Cryptocurrency: Real Coins, Scams, and What Actually Works

When you hear cryptocurrency, a digital asset built on blockchain technology that can be traded, stored, or used to access services. Also known as crypto, it’s not just Bitcoin or Ethereum anymore—it’s a wild mix of working tools, abandoned tokens, and outright scams. Most people think crypto means quick money. But the truth? Out of every ten coins you hear about, eight have no real users, no exchange listings, and no future.

Take crypto token, a type of digital asset issued on an existing blockchain, often representing utility, ownership, or access. Some, like security token, a blockchain-based asset that represents legal ownership in a real-world asset like equity or real estate, are tied to actual companies—with paperwork, audits, and regulations. Others, like memecoins or AI training tokens, are built on hype, with no team, no liquidity, and no plan. Then there’s crypto exchange, a platform where you buy, sell, or trade digital assets. Some are legit, like RabbitX on Starknet, offering zero fees and 50x leverage. Others, like Greenhouse or Lifinity, are just tokens with a fancy name, designed to trick you into thinking they’re real platforms.

Airdrops used to be a way to distribute new tokens fairly. Now? They’re mostly gone—or turned into scams. The BAKE airdrop in 2022 was real. The SMAK one? A $20,000 party with zero lasting value. And if you see a "new" airdrop today for a coin that hasn’t traded in three years, it’s not a gift—it’s a trap.

This collection doesn’t sell you dreams. It shows you what’s real, what’s dead, and what’s dangerous. You’ll find deep dives into coins that actually do something—like τemplar paying users to train AI—and others that vanished years ago, like Zayedcoin. You’ll learn why RabbitX works for experienced traders, why Greenhouse isn’t an exchange at all, and why most "crypto launchpads" are just empty wallets waiting to be forgotten. No fluff. No hype. Just the facts you need to avoid losing money on something that doesn’t exist.

Bitcoin.com.au Local Crypto Exchange Review: Is It Right for Australian Beginners?

Bitcoin.com.au is a simple, secure Australian crypto exchange for beginners. It offers AUD-only trading, 15 cryptocurrencies, and strong local compliance - but charges a 1% fee and lacks advanced features. Ideal for first-time buyers, not active traders.

learn moreIbitt Crypto Exchange Review: What You Need to Know Before Using It

Ibitt crypto exchange has no verified presence online. This review explains why it's likely a scam and what to look for in a legitimate crypto exchange to protect your funds.

learn moreWhat is Doomer (DOOMER) crypto coin? A breakdown of the meme token and its variants

Doomer (DOOMER) isn't one crypto coin-it's multiple fragmented meme tokens across Solana, Base, and other chains. With no team, no utility, and declining prices, it's a cautionary tale in the meme coin space.

learn moreWhat is Terrace (TRC) Crypto Coin? The All-in-One Trading Token Explained

Terrace (TRC) is a crypto trading terminal and ecosystem token that aggregates liquidity across 40+ exchanges and 13+ blockchains. TRC powers fee discounts, gas-free trading, and future governance - making it essential for serious traders.

learn moreHTX Crypto Exchange Review: Features, Fees, and Real User Experience in 2026

HTX is a powerful crypto exchange with 700+ coins, 200x leverage, and staking rewards - but slow verification and hidden fees make it tricky for beginners. Ideal for experienced traders outside the U.S.

learn moreWavelength Crypto Exchange Review: Is It Real or a Scam?

Wavelength Crypto Exchange is not a real platform. It's a scam designed to steal crypto deposits. Learn how to spot fake exchanges and which real platforms to trust instead.

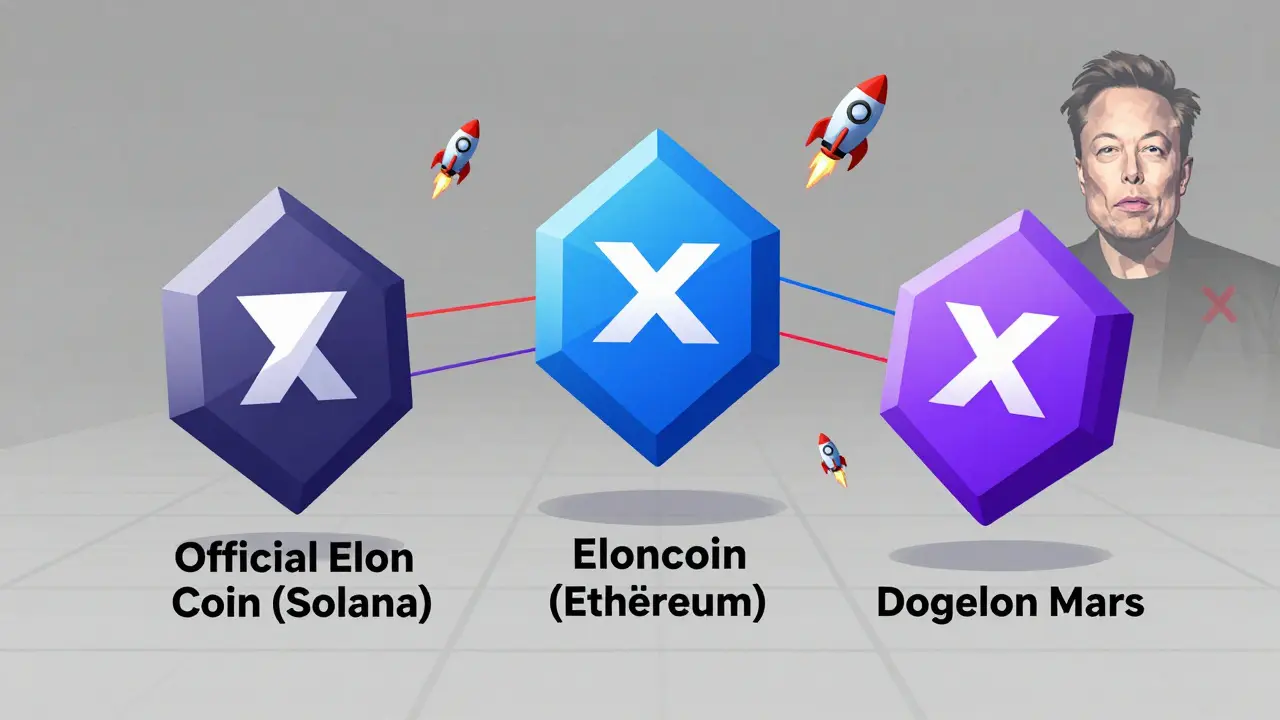

learn moreWhat is Eloncoin (ELON) crypto coin? The truth about Solana, Ethereum, and Dogelon Mars versions

Eloncoin (ELON) isn't one coin - it's three separate memecoins with no connection to Elon Musk. Learn the truth about Official Elon Coin on Solana, the Ethereum version, and Dogelon Mars.

learn moreWhat Is Cryptocurrency Volatility? Understanding Price Swings in Digital Assets

Cryptocurrency volatility refers to the extreme price swings in digital assets like Bitcoin and Ethereum. It's driven by small market size, retail trading, and regulatory uncertainty - making crypto riskier but potentially more rewarding than traditional assets.

learn moreRACA x BSC Metamon Game Airdrop: How It Worked and What You Missed

The RACA x BSC Metamon Game airdrop rewarded NFT holders with tokens and gameplay items, but strict rules disqualified many. Learn how it worked, who got paid, and why the Potion NFT mattered more than the tokens.

learn moreWhat is Snibbu (SNIBBU) crypto coin? The crab market meme token on Solana explained

Snibbu (SNIBBU) is a Solana-based meme token representing sideways crypto markets - known as the 'crab market.' With a $41k market cap and zero utility, it’s a cultural symbol for traders, not an investment.

learn moreADAPad IDO Launch and Airdrop Details: What We Know and What to Expect

ADAPad (ADAPAD) has no verified IDO or airdrop. Despite claims online, there's no official team, whitepaper, or smart contract. Beware of scams asking for wallet connections. Price is falling with no fundamentals.

learn moreWhat is DogeSquatch (SQUOGE)? A Beginner's Guide to the Meme Coin in 2026

DogeSquatch (SQUOGE) is a meme coin on Base chain with minimal market presence. It has a fixed supply of 42 million tokens, but trades at near-zero volume. Experts warn it's highly risky due to low liquidity and lack of utility. Learn why most investors avoid this token in 2026.

learn more