The Philippines just froze $150 million in cryptocurrency assets - not because of a hack, not because of a scam, but because the government said these platforms weren’t allowed to operate. This isn’t a story about theft. It’s a story about rules. And it’s changing how millions of Filipinos think about crypto.

What Exactly Got Frozen?

In early 2025, the Philippine Securities and Exchange Commission (SEC) took action against 20 unlicensed cryptocurrency exchanges. These weren’t foreign platforms trying to sneak in. These were services actively marketing to Filipinos - offering trading, staking, lending - all without permission. The SEC didn’t just shut them down. It froze every dollar, every Bitcoin, every USDT sitting in user accounts on those platforms. That’s $150 million locked up overnight. Most of that money? Stablecoins. About 68% was tied to USDT and USDC. Another 22% was Bitcoin. The rest? Lesser-known altcoins. The funds were spread across Ethereum, Binance Smart Chain, and Tron - the same blockchains most everyday users interact with daily. This wasn’t random. The SEC had laid out clear rules in January 2025. Any platform offering crypto services - buying, selling, storing - had to register as a Crypto-Asset Service Provider (CASP). No registration? No operating. No exceptions.Why Now? The Regulatory Turning Point

The Philippines has been one of the most crypto-enthusiastic countries in the world. By early 2025, the total value of crypto held by Filipinos hit ₱6 trillion - roughly $107 billion. That’s more than half the country’s annual government budget. And most of it? Held by regular people, not investors. For years, the central bank, the Bangko Sentral ng Pilipinas (BSP), had a moratorium on issuing licenses to crypto firms. That rule, set in 2022, was supposed to expire in September 2025. But the SEC didn’t wait. They saw a mess: dozens of platforms promising high returns, offering “free crypto” sign-ups, and running ads on TikTok and Facebook. Some were clean. Many weren’t. The freeze was a signal: “We’re not waiting for the moratorium to end. We’re cleaning house before the gates open.” This wasn’t just about catching fraudsters. It was about building trust. Before the BSP starts handing out licenses, they needed to prove they could protect users.Who Lost Money - And Why?

The biggest surprise? Most people who lost access weren’t criminals. They were teachers, drivers, gig workers - people who used crypto because it was easier than banks. Many had no idea the platform they used wasn’t licensed. They trusted the app. They trusted the customer service. They trusted the reviews. Reddit threads exploded. One user wrote: “My $15k is frozen in Bitget PH. No email. No phone. Just a message saying ‘compliance reasons.’” That post got over 1,200 upvotes. Thousands more chimed in. Trustpilot ratings for the blacklisted platforms crashed from 4.2 stars to 1.3 in just two months. The top complaints? “No warning.” “No way to get my money back.” “They blocked the app, but didn’t tell me how to recover.” The Philippine Consumer Welfare Association received over 3,200 formal complaints. The average loss? $4,670. For many, that was their entire savings.

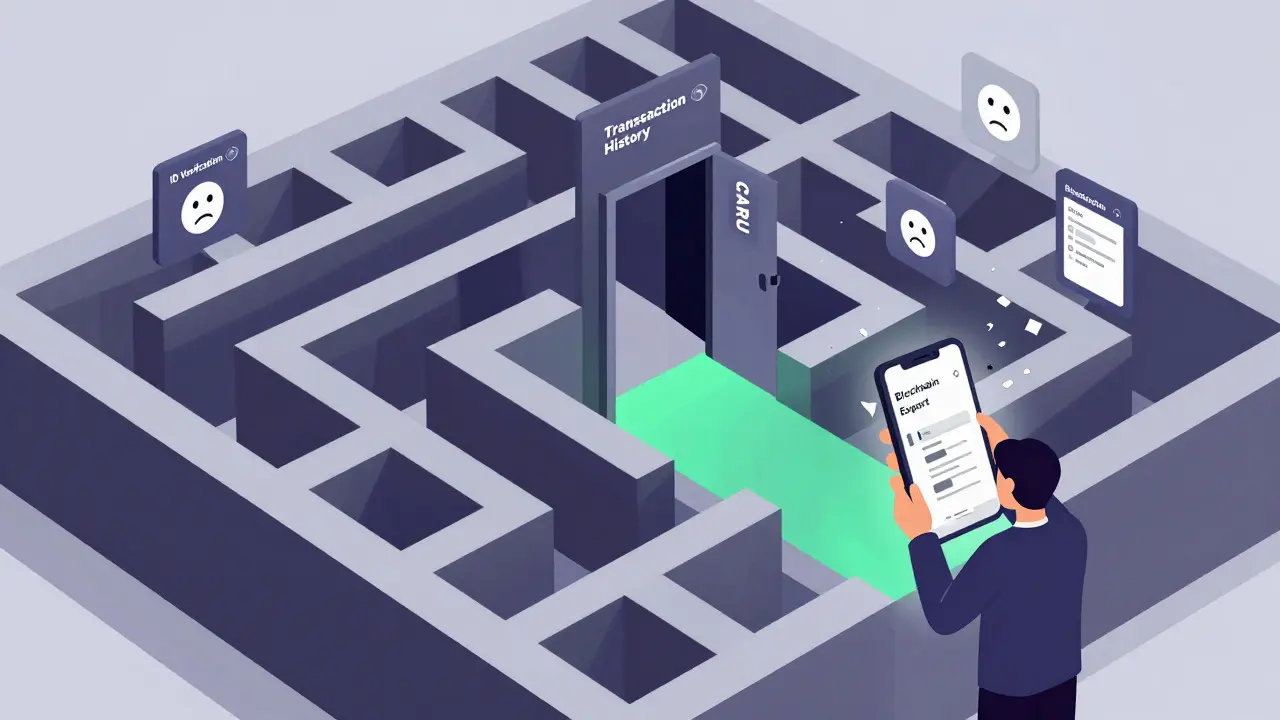

The Recovery Process - And Why It’s So Hard

The SEC set up a Crypto Asset Recovery Unit (CARU). Sounds official. Sounds helpful. But the process? It’s a maze. To get even a chance at recovering your funds, you need to:- Prove you’re who you say you are (government ID, facial recognition)

- Submit full transaction history from the frozen platform

- Prove your crypto wasn’t from illegal activity

- Use the SEC’s online portal - which doesn’t work well on older phones

What Do Filipinos Think?

A survey by the Association of Cryptocurrency Enthusiasts of the Philippines found something surprising: 62% of users supported the freeze. They were tired of scams. Tired of platforms disappearing overnight. Tired of hearing about friends who lost everything. But 78% had no idea what licensing rules even existed. They didn’t know the SEC had issued new rules in January. They didn’t know what a CASP was. So the support? It was based on frustration - not understanding. One Facebook comment summed it up: “Better to freeze suspicious funds than let scammers operate freely.” That sentiment was shared by 27% of respondents. The other 73%? They just wanted their money back.

What’s Next? The Road to Licensing

The BSP’s three-year freeze on issuing licenses ends on September 1, 2025. And the SEC is already preparing. On July 5, 2025, they announced a “Regulatory Sandbox” - a trial program where 10 vetted platforms can operate under temporary licenses while the full system is built. The first applications open September 15. The goal? To bring transparency, accountability, and safety to the market. But the $150 million in frozen assets? That’s still hanging. The SEC says they’ll start releasing verified funds in November 2025. But legal battles are already brewing. Blacklisted exchanges like Bitget and Bybit are challenging the freeze in court. If they win, the entire process could unravel. Meanwhile, users are stuck. Some are selling their remaining crypto at huge losses just to pay bills. Others are waiting - hoping the system works. A few have given up entirely.The Bigger Picture

This isn’t just a Philippine story. It’s a preview of what’s coming everywhere. Countries like the U.S. and Singapore have frozen crypto before - but usually targeting criminals or sanctioned entities. The Philippines did something different. They froze money from regular people because the platforms they used broke the rules. No warning. No grace period. Just a freeze. It’s harsh. But it’s also honest. If you want to play in crypto, you have to play by the rules. And right now, the rules are being written in real time. The Philippines didn’t kill crypto. It forced it to grow up. The question now is: Can the system recover the money? Can it protect users without crushing trust? And can it make sure the next wave of platforms - the licensed ones - actually deliver on their promises? Because if they fail? Millions more will lose faith. And this time, there won’t be another $150 million to freeze.Why were $150 million in crypto assets frozen in the Philippines?

The Philippine Securities and Exchange Commission (SEC) froze $150 million in crypto assets because 20 unlicensed cryptocurrency exchanges were operating illegally. These platforms failed to register as Crypto-Asset Service Providers (CASP) under new rules issued in January 2025. The freeze targeted platforms offering trading, staking, or lending services without proper authorization, regardless of whether they were involved in fraud.

What types of crypto were frozen?

The frozen assets were mostly stablecoins - 68% were USDT and USDC. Bitcoin made up 22%, and altcoins accounted for the remaining 10%. The funds were spread across Ethereum (45%), Binance Smart Chain (30%), and Tron (15%), which are the most commonly used blockchains by retail users in the Philippines.

How can users recover their frozen funds?

Users must submit a formal application through the SEC’s Crypto Asset Recovery Unit (CARU). Required documents include government-issued ID, full transaction history from the frozen platform, and proof that funds weren’t from illegal activity. Only 12% of applicants had completed the process by July 2025, with an average processing time of 47 days. Many were rejected due to incomplete paperwork or lack of digital literacy.

Did the freeze target criminals or everyday users?

The freeze targeted unlicensed platforms - not individual users. But since most users didn’t know the platforms were unlicensed, the vast majority of those affected were regular Filipinos - teachers, drivers, gig workers - who lost access to their savings. Only a small fraction of the frozen funds were linked to criminal activity.

What happens after September 1, 2025?

The Bangko Sentral ng Pilipinas (BSP) will lift its three-year moratorium on issuing licenses to crypto firms on September 1, 2025. The SEC will begin accepting applications for full licenses on September 15, 2025. A temporary “Regulatory Sandbox” will allow 10 pre-vetted platforms to operate while the final rules are finalized. The fate of the frozen assets will depend on whether users successfully complete the recovery process and whether legal challenges from exchanges succeed.