Crypto Fraud: How Scams Work and How to Avoid Them

When you hear crypto fraud, the deliberate deception of individuals to steal cryptocurrency through fake projects, phishing, or manipulated markets. Also known as crypto scams, it’s not just risky—it’s everywhere. You don’t need to be a tech expert to get caught. A simple click on a fake airdrop site, a misleading tweet, or a "guaranteed returns" Discord group can empty your wallet before you realize what happened.

Most fake airdrops, fraudulent token distributions that trick users into connecting wallets or paying gas fees look real. They copy official logos, use fake Twitter accounts, and even mimic the language of legit projects. Look at HAI token or NAMA Protocol—both were falsely advertised as having airdrops when they didn’t. People lost money thinking they were getting free tokens. Then there’s the rug pull, when developers abandon a project after draining liquidity, leaving investors with worthless tokens. Projects like MINU 2.0, Kryptomon, and BlockVault Token all had tiny communities and zero trading volume before vanishing. No updates. No team. Just silence.

Phishing is another big one. Fake websites that look like Unnamed.Exchange or KibbleSwap trick you into entering your seed phrase. Once you do, your coins are gone—no recovery, no help. Even privacy coins, cryptocurrencies designed for anonymity like Monero and Zcash, aren’t safe from scams. Criminals use them to hide stolen funds, which is why exchanges delist them. But that doesn’t mean you’re protected. If you’re chasing high returns on a token with no audits, no team, and no real use case, you’re already in danger.

It’s not about being smart. It’s about being skeptical. If it sounds too good to be true—free NFTs, 1000% returns, exclusive access—it’s a trap. Check the contract. Look at the holder count. See if anyone’s actually trading it. Most scams have fewer than 200 holders and zero volume. The people behind them don’t care about you. They care about your private key.

Below, you’ll find real breakdowns of scams that happened, how they worked, and how to spot the next one before it’s too late. No fluff. No hype. Just facts from people who’ve been burned—and learned the hard way.

Cryptocurrency Phishing Scams Explained: How They Work and How to Stop Them

Cryptocurrency phishing scams trick users into giving up private keys or sending crypto to fake sites. Learn how they work, the most common types, and how to protect yourself from losing your digital assets forever.

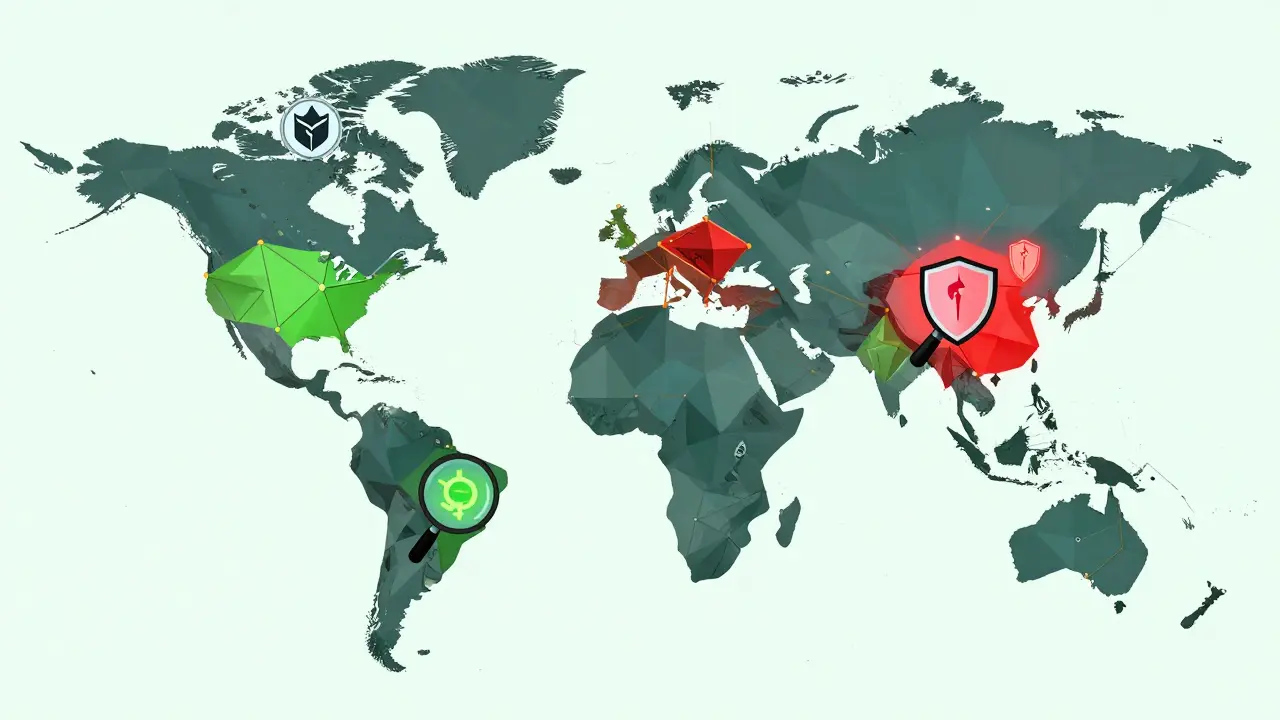

learn more2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

2024-2025 crypto enforcement stats show fraud dropping but sophisticated crime rising. TRON's crime fell after a landmark crackdown, while DeFi and stablecoins become new targets. Global rules are improving - but enforcement still lags.

learn more