Zcash Restrictions: What’s Banned, Why, and Where It’s Still Allowed

When you hear about Zcash, a privacy-focused cryptocurrency that hides transaction amounts and sender/receiver details. Also known as ZEC, it was designed to give users true financial privacy—something most blockchains don’t offer. But that same privacy is why governments and regulators see it as a risk. Unlike Bitcoin, where every transaction is public, Zcash uses zero-knowledge proofs to make transactions untraceable. That’s great for protecting your data—but also perfect for money laundering, tax evasion, and darknet markets. So countries with strict financial oversight are stepping in.

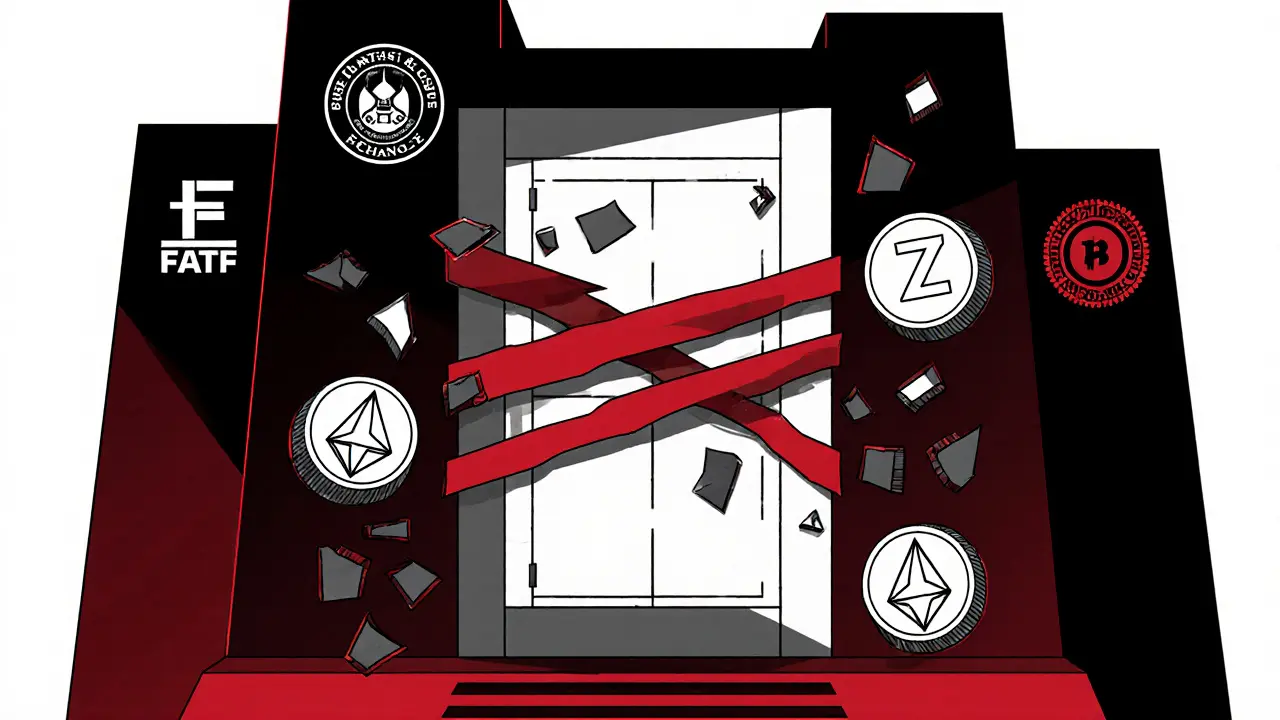

Some places, like South Korea, a country with some of the strictest crypto rules in the world, have outright blocked Zcash on licensed exchanges. Others, like Japan, a market that once welcomed privacy coins but tightened rules after regulatory pressure, require exchanges to disable Zcash trading unless they can prove they’re monitoring for illegal use. Even the Financial Action Task Force (FATF), the global body that sets anti-money laundering standards, has flagged privacy coins as high-risk. That’s why exchanges like Binance and Kraken quietly removed Zcash from some regions—not because it’s illegal everywhere, but because complying with local laws is easier than fighting them.

But Zcash isn’t banned everywhere. In the U.S., it’s still legal to hold and trade Zcash, though exchanges must follow KYC rules. In places like Taiwan, where crypto exchanges must register and report transactions, Zcash is allowed but tracked. And in countries where financial access is limited—like Nepal, where crypto is banned but still traded underground—Zcash’s privacy features make it a top choice for those avoiding government oversight. The truth? Zcash isn’t the problem. The problem is that regulators don’t trust technology they can’t see into. That’s why so many posts here dig into the real stories behind crypto bans: from Sweden limiting mining due to energy use, to Bangladesh’s misunderstood prison threats, to China’s total mining shutdown. Zcash fits right into that pattern—privacy is powerful, but power attracts scrutiny.

What you’ll find below aren’t just news snippets. These are deep dives into how Zcash restrictions play out in the real world—why exchanges drop it, how miners get shut down, and what alternatives users turn to when Zcash disappears from their favorite platform. No fluff. No hype. Just the facts behind the crackdowns.

Privacy Coins Regulations: Monero and Zcash Restrictions in 2025

Monero and Zcash face growing restrictions in 2025 as global regulators crack down on anonymous crypto. Exchanges delist them, P2P trading rises, and privacy vs. compliance becomes the defining battle for the future of cryptocurrency.

learn more