Privacy Coin Compliance Checker

Check Your Privacy Coin Compliance

Based on 2025 regulatory landscape. This tool helps assess whether Monero or Zcash transactions would comply with current regulations in your jurisdiction.

Compliance Assessment

Monero

Zcash

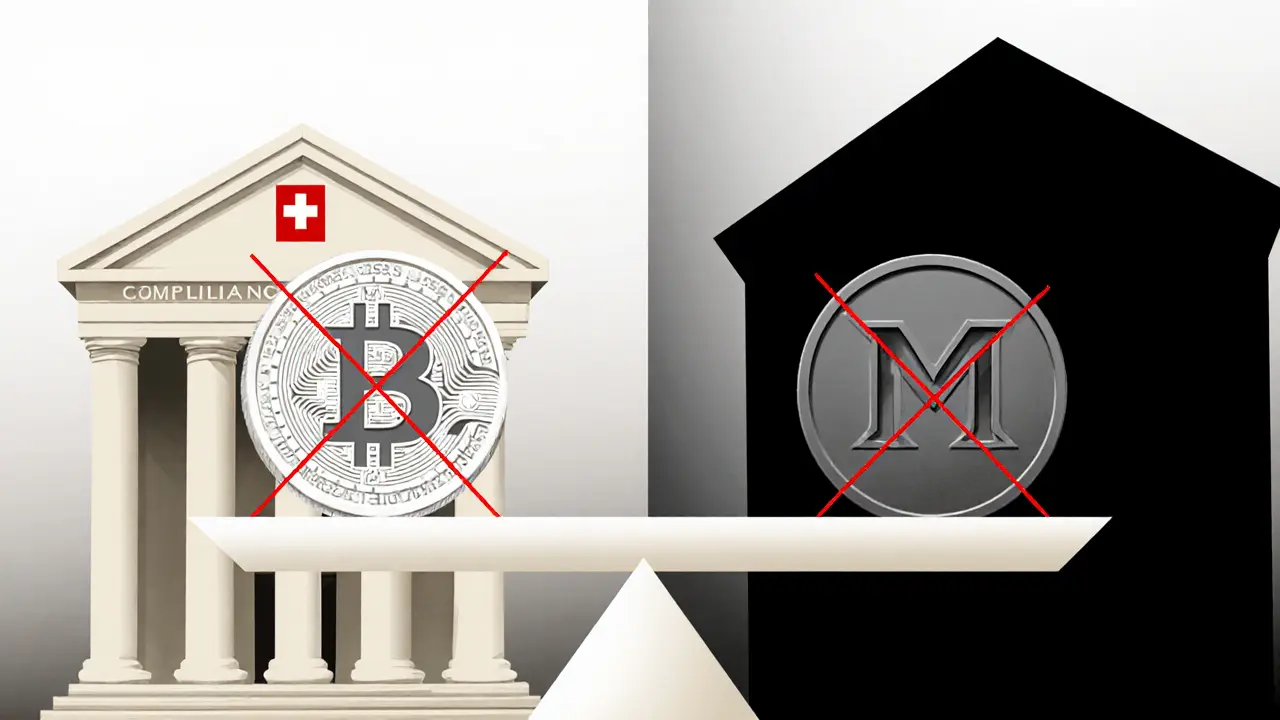

By 2025, if you're still using Monero or Zcash on a major exchange, you're probably one of the few left. The era of unchecked privacy in cryptocurrency is over. Governments didn't just raise eyebrows-they shut doors. And it wasn't because they hated privacy. It was because they couldn't track where the money went.

Why Monero and Zcash Got Targeted

Monero and Zcash were built to hide. Not to obscure, not to make things harder-to hide. Monero doesn't give you a choice. Every transaction uses ring signatures, stealth addresses, and RingCT by default. There's no "public mode." Even if you wanted to be transparent, the protocol won't let you. That’s the point. It’s like a bank that refuses to show who sent money to whom-even to the police. Zcash is different. It lets you pick. You can send a shielded transaction using zk-SNARKs-zero-knowledge proofs that prove you have the money without revealing how much or where it came from. Or you can send a regular, public one, just like Bitcoin. Sounds fair, right? But here’s the catch: most people use the public option. And that’s why Zcash’s privacy is weakening. If only 8% of addresses are shielded, then every shielded transaction stands out like a flashlight in a dark room. Regulators don’t need to break the crypto-they just need to watch the outliers.What Changed in 2025

The big shift came from the Financial Action Task Force (FATF). In early 2025, they expanded their Travel Rule to cover all privacy coins. That meant exchanges had to collect and share sender and receiver data for every Monero or Zcash trade. No exceptions. No "privacy by design" loophole. If you couldn’t comply, you got delisted. Binance and Kraken pulled Monero and Zcash off their platforms in March 2025. Not because they wanted to. But because their banking partners threatened to cut them off. Banks don’t want to touch anything that can’t be traced. And with 97 countries now enforcing stricter crypto rules, exchanges had no choice. The result? A 19% jump in peer-to-peer (P2P) trading. People moved to LocalMonero, Bisq, and other decentralized platforms-especially in places like Nigeria, Argentina, and Ukraine, where inflation is high and trust in banks is low. The European Union’s MiCA regulation made things worse. It forced exchanges to prove they could monitor all transactions. Privacy coins? Impossible. So EU-based exchanges dropped them. Some even stopped supporting Zcash’s shielded addresses entirely. That’s not a technical decision-it’s a legal one. If you can’t prove compliance, you’re not allowed to operate.

Where Privacy Coins Still Survive

Not everywhere is shutting them down. Singapore and Switzerland are quietly building sandboxes. These aren’t free-for-alls. They’re controlled environments where developers can test privacy tech under watchful eyes. Regulators get to see how it works. Developers get to keep building. It’s a compromise: privacy, but with oversight. In places like Switzerland, you can still trade Monero on licensed platforms-but only if you’ve passed KYC. Your identity is known. The transaction isn’t. That’s the new model: know your customer, but not your transaction. It’s a weird middle ground, but it’s working-for now. Meanwhile, darknet markets still rely on Monero. Fentanyl vendors on Abacus Market use it because it’s the only coin that can’t be traced back to a wallet. Law enforcement has tried to track the flow, but without public addresses or transaction history, they hit dead ends. That’s why regulators are pushing for new tools-like blockchain analysis firms claiming they can now "de-anonymize" Monero with AI patterns. Some experts say it’s hype. Others say they’ve found cracks in the ring signature mixing.Why Zcash Is Struggling More Than Monero

Zcash has a branding problem. It’s marketed as a privacy coin, but most users treat it like Bitcoin. That’s not because the tech is bad-it’s because people don’t understand it. Shielded transactions require more computing power. They’re slower. They’re clunkier. And exchanges don’t promote them. On top of that, Zcash’s team has been trying to add compliance features. They’ve been testing selective disclosure-where a user can prove to a regulator that a transaction is clean without revealing the full details. Think of it like showing a cop your license without handing over your entire wallet history. It’s technically possible. But no regulator has agreed to accept it. So Zcash is stuck in limbo: too private for banks, too public for privacy purists. Monero, by contrast, doesn’t care. It doesn’t try to please regulators. It doesn’t offer a public option. That’s why it’s still alive on P2P networks. It’s not popular-it’s stubborn. And stubbornness works when the system is rigged against you.

The Future: Can Privacy and Compliance Coexist?

Some developers are trying to build a bridge. Zero-knowledge proofs are getting better. New protocols like Lelantus Spark (used by Firo) and Zcash’s upcoming upgrades aim to make shielded transactions faster and cheaper. The goal? Make privacy so easy that even normal users pick it. But the real question isn’t technical-it’s political. Can a government allow a system where money moves without a paper trail? The answer right now is no. And until that changes, privacy coins will keep shrinking on exchanges, growing on the margins. The next big move might come from central banks. If digital currencies (CBDCs) become widespread, they’ll demand full traceability. That could make privacy coins even more attractive to those who fear state surveillance. But it could also make them targets for outright bans-like China did with Bitcoin mining.What You Can Do Now

If you still hold Monero or Zcash:- Don’t keep them on an exchange. Move them to a wallet you control.

- Use a VPN or Tor if you’re trading P2P-your IP address is the new weak point.

- Learn how to send shielded Zcash transactions. Most wallets have a toggle-use it.

- Don’t assume privacy is guaranteed. Tools are improving. So are tracking methods.

Are Monero and Zcash illegal?

No, they’re not illegal in most countries. But they’re banned or heavily restricted on regulated exchanges in the EU, U.S., UK, Canada, Australia, and Japan. You can still own them, but trading them legally is getting harder. Using them for illegal activity is always illegal-regardless of the coin.

Why did Binance and Kraken delist Monero and Zcash?

Because their banking partners refused to process fiat deposits or withdrawals tied to privacy coins. Under the 2025 FATF Travel Rule, exchanges must track sender and receiver info for every transaction. Monero can’t do that by design. Zcash can, but most users don’t use its shielded feature, making compliance unreliable. So exchanges chose to cut losses and avoid regulatory fines.

Can I still buy Monero or Zcash in 2025?

Yes, but not easily. You can buy them on peer-to-peer platforms like LocalMonero, Bisq, or Paxful. Some smaller exchanges in Switzerland, Singapore, and parts of Latin America still list them. But if you’re using a major platform like Coinbase or Kraken, you won’t find them. You’ll need to trade Bitcoin or Ethereum first, then swap for privacy coins on a decentralized exchange.

Is Zcash’s privacy actually broken?

Not broken, but weakened. Zcash’s shielded transactions are still cryptographically secure. But because only 8% of users use them, those transactions stand out. Analysts can guess which ones are private just by rarity. It’s like wearing a black coat in a crowd of white ones-you’re still hidden, but you’re also the only one people notice.

What’s the difference between Monero and Zcash privacy?

Monero hides everything by default-sender, receiver, amount. Zcash lets you choose: public (like Bitcoin) or shielded (private). Monero’s privacy is all-or-nothing. Zcash’s is optional. That’s why Monero is favored by privacy purists, and Zcash is used more as a hybrid coin-often for compliance testing or institutional experiments.

Will privacy coins be banned outright?

Not yet. But some countries are moving in that direction. South Korea and India have proposed full bans. The U.S. hasn’t banned them, but the Treasury Department has labeled them as "Anonymity-Enhanced Cryptocurrencies"-a regulatory label that triggers extra scrutiny. A full ban is possible, but unlikely in the U.S. or EU. More likely: they’ll be forced off exchanges, taxed heavily, or made unusable through technical barriers.

Leisa Mason

November 21, 2025 AT 14:33This is peak crypto irony: we built decentralized money to escape surveillance, and now the only people still using privacy coins are the ones who can’t afford to pay taxes or are laundering drug money. The market corrected itself. Privacy isn’t a feature-it’s a bug in a regulated economy.

Rob Sutherland

November 23, 2025 AT 01:37It’s not about legality. It’s about power. Governments don’t hate privacy-they hate losing control. Monero doesn’t care if you’re a criminal or a whistleblower. It just protects the right to be unseen. That’s why it survives. Not because it’s perfect, but because it’s honest.

Frank Verhelst

November 23, 2025 AT 20:59People keep saying 'privacy coins are dead'... but have you seen the P2P volume in Nigeria? 🚀 The real users aren't on Binance. They're on LocalMonero with a VPN and a prayer. This isn't the end-it's the beginning of the underground economy. 💪

Jennifer Corley

November 24, 2025 AT 09:23Let’s be real-Zcash’s 8% shielded usage isn’t a technical flaw, it’s a moral one. Most users don’t care about privacy. They just want to pretend they do. That’s why it’s failing. Monero doesn’t give you a choice because it knows most people will choose the easy, trackable path. And that’s exactly why it’s right.

Melina Lane

November 25, 2025 AT 23:08I moved my XMR to a hardware wallet last week. Felt like I was smuggling something. But honestly? It’s the only coin that makes me feel like I still have control. If the system wants to track everything, then I’m going to hide in plain sight. 🤫

Roshan Varghese

November 27, 2025 AT 07:14they say the govt banned monero but they still let the banks print money out of thin air?? lol. this is a scam. they dont want privacy they want you to be broke and dependent. CBDCs are coming and theyll track your coffee buys. #freemoney

Natalie Reichstein

November 28, 2025 AT 00:50If you’re still holding Monero in 2025, you’re either a libertarian idealist or someone who bought in at $50 and refuses to accept reality. Privacy isn’t a right-it’s a luxury for people who don’t pay their taxes. Wake up.

Kris Young

November 28, 2025 AT 14:29Regulators aren't against privacy. They're against untraceable transactions. That's a difference. Zcash could work if users actually used shielded addresses. But they don't. So the problem isn't the tech-it's the people. Simple as that.

Lara Ross

November 30, 2025 AT 10:14As someone who works in financial compliance, I can tell you this: exchanges didn’t delist these coins because they were evil. They did it because their auditors, lawyers, and bank partners threatened to shut them down. This isn’t ideological-it’s operational. No bank wants to be fined $50 million because someone used a privacy coin to move $2 million in untraceable funds. It’s not about ethics. It’s about liability.

Tim Lynch

December 1, 2025 AT 05:01Monero is the last true anarchist project left in crypto. It doesn’t beg for approval. It doesn’t offer compliance APIs. It doesn’t care if you understand it. It just exists-quiet, stubborn, unyielding. That’s why it’s still alive. Not because it’s better. But because it refuses to compromise. And in a world that rewards conformity, that’s the most radical thing left.

Lani Manalansan

December 2, 2025 AT 10:09People in Ukraine and Argentina aren’t using Monero because they’re criminals. They’re using it because their banks froze accounts, their currencies collapsed, and their governments can’t be trusted. Privacy isn’t a luxury for the rich-it’s survival for the vulnerable. If you think this is just about drug dealers, you’re not looking at the real world.

Kaitlyn Boone

December 2, 2025 AT 18:36the whole 'only 8% of zcash is shielded' argument is such a strawman. if you make privacy hard to use, of course people won't use it. it's like giving someone a lock and then blaming them for not locking their door because the key is buried under 3 inches of dirt. zcash's design is a failure of UX, not ethics.

andrew casey

December 4, 2025 AT 18:34It is imperative to note that the FATF Travel Rule, as codified under international financial standards, explicitly mandates the transmission of originator and beneficiary data for all virtual asset transfers. Privacy coins, by their cryptographic architecture, are structurally incompatible with this requirement. The delisting is not arbitrary-it is a legal necessity. To suggest otherwise is to misunderstand the foundation of modern financial regulation.

James Edwin

December 5, 2025 AT 06:55What nobody talks about is the real innovation: Zcash’s selective disclosure. It’s not perfect, but it’s the only path forward. Imagine proving to a regulator you didn’t launder money without showing them your whole wallet. That’s not backdoor access-that’s privacy with accountability. We need more of this, not less.

Dexter Guarujá

December 5, 2025 AT 14:22Let me get this straight-you're defending a coin used by fentanyl dealers because you 'believe in privacy'? America built this country on transparency and rule of law. If you want to hide your money, go live in a dictatorship. We don't need crypto anarchists undermining our financial system.