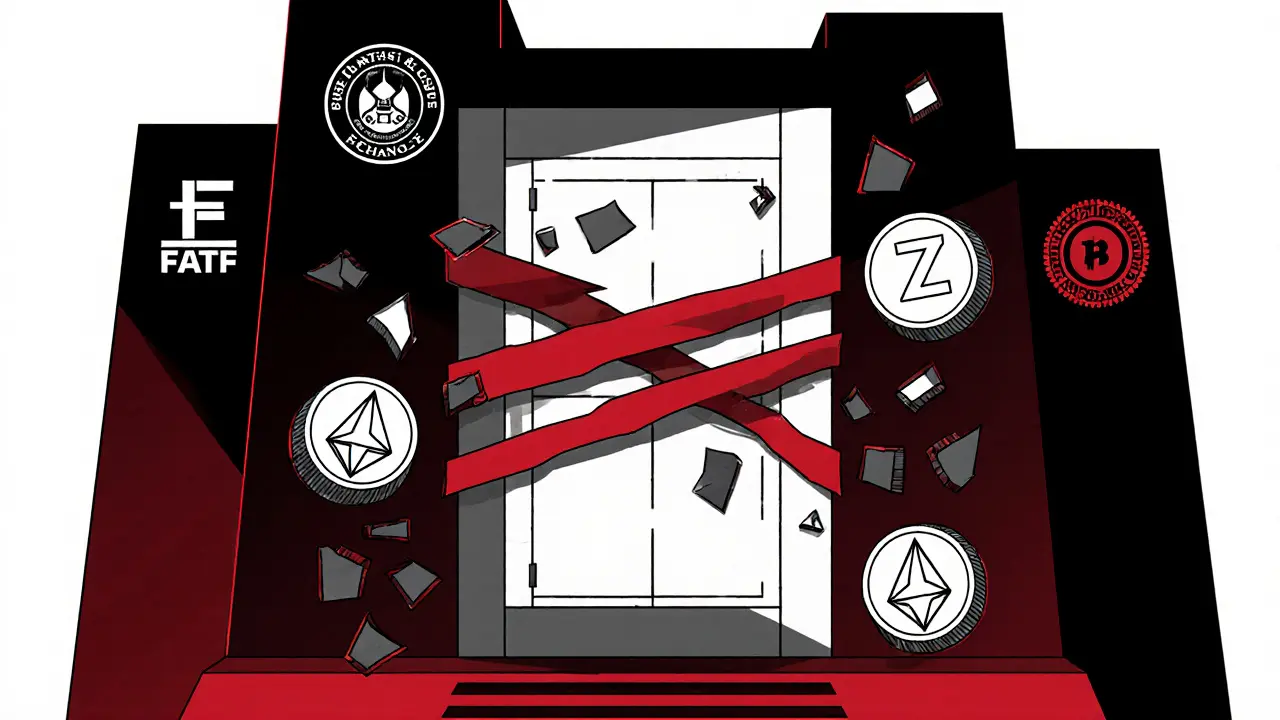

Privacy Coins Ban: What It Means and How It Affects Crypto Users

When people talk about a privacy coins ban, a regulatory effort to restrict cryptocurrencies designed to hide transaction details. Also known as anonymous coin restrictions, it’s not about banning crypto altogether—it’s about stopping the kind that can’t be traced by law enforcement. This isn’t theoretical. Countries like South Korea, Japan, and parts of the EU have moved to block exchanges from listing coins like Monero, a blockchain that obscures sender, receiver, and amount by default and Zcash, a coin that lets users choose between transparent and shielded transactions. These aren’t just niche projects—they’re among the most private digital assets ever built.

Why the crackdown? Governments say it’s about stopping money laundering, ransomware, and darknet markets. But here’s the catch: most illegal crypto activity still happens on Bitcoin and Ethereum, not Monero. The real target isn’t crime—it’s control. Privacy coins make it hard for regulators to track every dollar. That’s why exchanges like Binance and Kraken quietly delisted them, even when users kept asking for them. The ban isn’t always law—it’s often policy. And once an exchange drops a coin, it becomes nearly impossible to trade legally in many countries.

But people still use them. In places like Russia, Iran, and Venezuela, where financial systems are unstable or under sanctions, privacy coins are a lifeline. You won’t find them on major apps, but they’re traded over P2P networks, Telegram groups, and decentralized exchanges. The tech hasn’t disappeared—it just went underground. And that’s why the privacy coins ban is more symbolic than effective. You can’t ban what’s already decentralized.

What’s next? More countries will try to follow suit. But enforcement is expensive, and privacy tech keeps evolving. Projects like Namada and Tornado Cash show that anonymity tools aren’t going away—they’re getting smarter. If you care about financial privacy, you need to understand the risks, not just the headlines. Below, you’ll find real cases of how these bans played out, what scams followed, and how users adapted when the doors closed.

Privacy Coins Regulations: Monero and Zcash Restrictions in 2025

Monero and Zcash face growing restrictions in 2025 as global regulators crack down on anonymous crypto. Exchanges delist them, P2P trading rises, and privacy vs. compliance becomes the defining battle for the future of cryptocurrency.

learn more