Monero Regulation: What’s Allowed, Blocked, and Why It Matters

When you hear Monero, a privacy-focused cryptocurrency designed to hide transaction details like sender, receiver, and amount. Also known as XMR, it’s one of the few coins built from the ground up to be untraceable. Unlike Bitcoin, where every transaction is public, Monero uses ring signatures, stealth addresses, and confidential transactions to make tracking nearly impossible. That’s why governments and financial regulators see it as a red flag — not because it’s illegal, but because it’s hard to control.

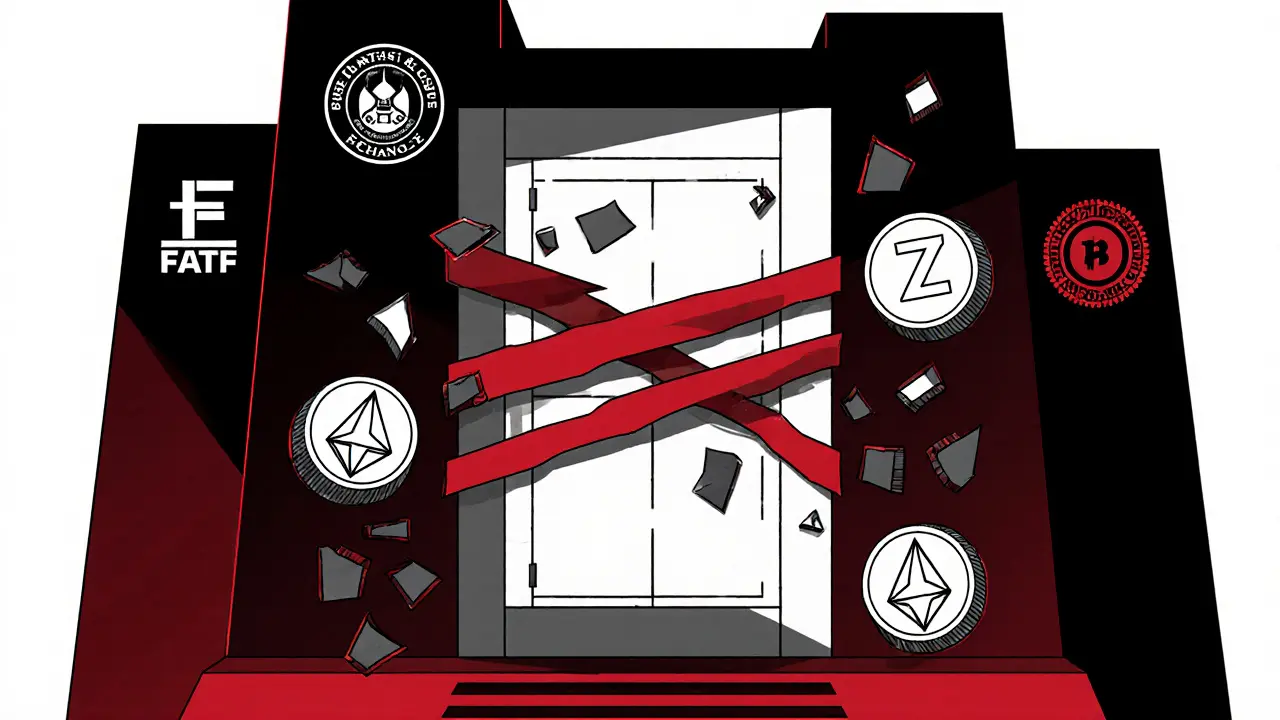

Privacy coin regulation, the growing legal push to restrict or ban cryptocurrencies that obscure transaction data is now a top priority for the FATF, the EU, and the U.S. Treasury. Countries like South Korea and Japan have already forced exchanges to delist Monero. In 2024, Switzerland banned Monero trading on licensed platforms. Even in places where crypto is legal, banks often refuse to process Monero deposits. The issue isn’t theft or fraud — it’s opacity. Regulators don’t trust what they can’t see. Meanwhile, Monero mining restrictions, efforts to limit the hardware and energy use tied to privacy coin mining are rising too, especially in Europe. Sweden’s energy rules and France’s grid caps hit Monero miners harder than Bitcoin miners because Monero’s algorithm favors CPUs, which are more widely available and harder to monitor.

What you won’t find in official reports is how many ordinary people still use Monero — not for crime, but for privacy. Journalists in authoritarian states, activists in sanctioned countries, and even small business owners avoiding corporate surveillance rely on it. The same tools that scare regulators are the ones that protect people without access to secure banking. That’s the real tension: Monero isn’t about breaking laws — it’s about forcing a choice between control and freedom. The posts below show exactly how this plays out: from exchange delistings in Taiwan to underground trading in Nepal, from legal threats in Bolivia to the quiet collapse of fake Monero airdrops. You’ll see who’s banning it, who’s still using it, and why no law has ever stopped someone who truly wants to stay private.

Privacy Coins Regulations: Monero and Zcash Restrictions in 2025

Monero and Zcash face growing restrictions in 2025 as global regulators crack down on anonymous crypto. Exchanges delist them, P2P trading rises, and privacy vs. compliance becomes the defining battle for the future of cryptocurrency.

learn more