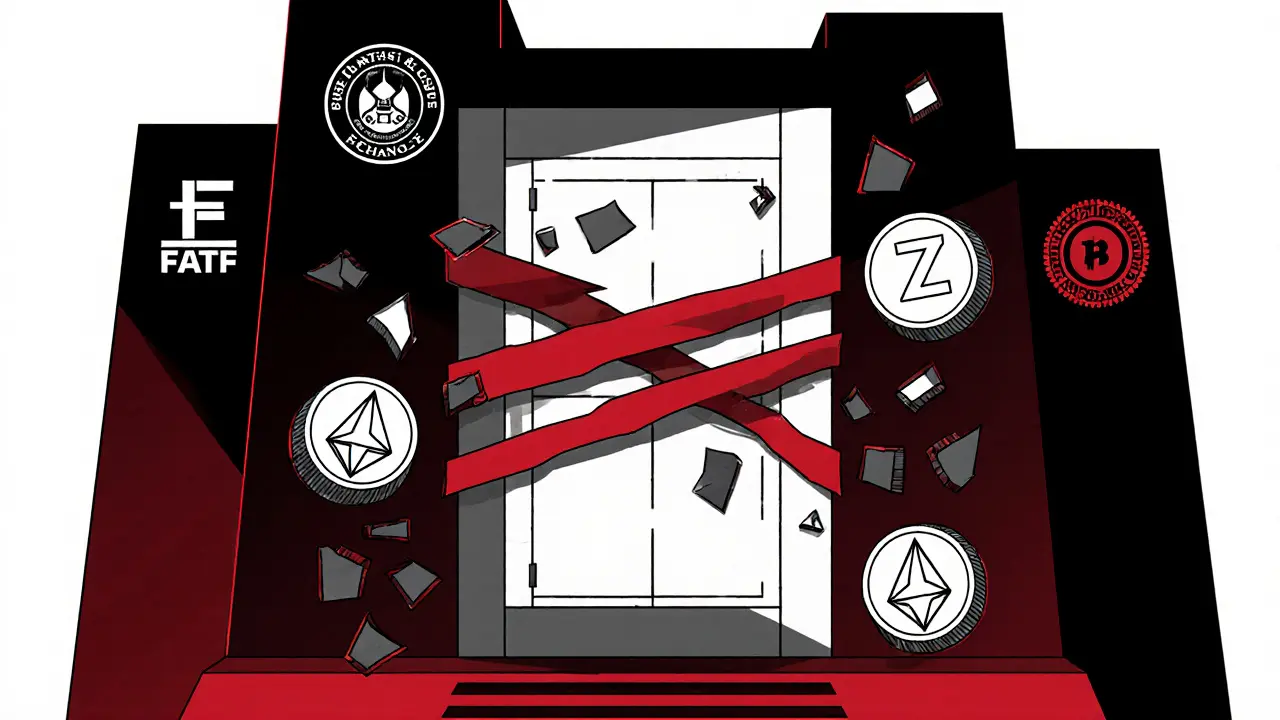

FATF Travel Rule: What It Means for Crypto Exchanges and Users

When you send crypto from one exchange to another, the FATF travel rule, a global standard requiring financial institutions to share sender and receiver info on transactions over $1,000. Also known as Recommendation 16, it was created to stop money laundering and terrorist financing by making crypto transactions as traceable as bank transfers. This isn’t about banning crypto—it’s about forcing exchanges to collect and pass along basic user data, just like banks do with wire transfers.

The rule targets VASP, Virtual Asset Service Providers like Binance, Coinbase, or HTX that handle crypto transfers for users. If you trade on one of these platforms, they must verify your identity and share your name, account number, and address when you send crypto above the $1,000 threshold. The receiver VASP must also check that info. This creates a paper trail, even for digital assets. But it’s not just exchanges—wallet providers, DeFi platforms, and even some P2P services are being pulled into this net as regulators tighten definitions.

What about users who prefer privacy? The rule doesn’t ban self-custody, but it makes it harder to move crypto between exchanges without triggering identity checks. If you send from your personal wallet to an exchange, that exchange may freeze the deposit until you verify your identity. If you send from one exchange to another, both sides must match your data—or the transaction gets blocked. That’s why some users now use mixers or privacy coins, but those tools are increasingly flagged as high-risk by regulators. Countries like South Korea, Taiwan, and the EU have already enforced this rule strictly, while others are still catching up. The result? Crypto is becoming more regulated, not less.

You’ll find posts here that cut through the noise: how Taiwan’s FSC enforces the rule, why some exchanges like Coinlim don’t accept fiat to avoid compliance headaches, and how users in sanctioned countries bypass restrictions using decentralized tools. We also cover what happens when exchanges ignore the rule—like Russia’s Garantex being shut down—or when scams pretend to be compliant, like fake airdrops that steal your data under the guise of "KYC verification." This isn’t theory. It’s happening right now, and it’s changing how you move money in crypto.

Privacy Coins Regulations: Monero and Zcash Restrictions in 2025

Monero and Zcash face growing restrictions in 2025 as global regulators crack down on anonymous crypto. Exchanges delist them, P2P trading rises, and privacy vs. compliance becomes the defining battle for the future of cryptocurrency.

learn more