DL-AMM: What It Is and How It Powers Decentralized Trading

When you trade crypto without a middleman, you’re likely using something called DL-AMM, a Distributed Ledger Automated Market Maker that enables trustless trading by using smart contracts and algorithmic pricing. Also known as automated market maker, it replaces traditional order books with mathematical formulas that keep liquidity flowing—no brokers, no delays, just code. This isn’t theory. It’s what powers Uniswap, SushiSwap, and dozens of other DeFi platforms you’ve heard about.

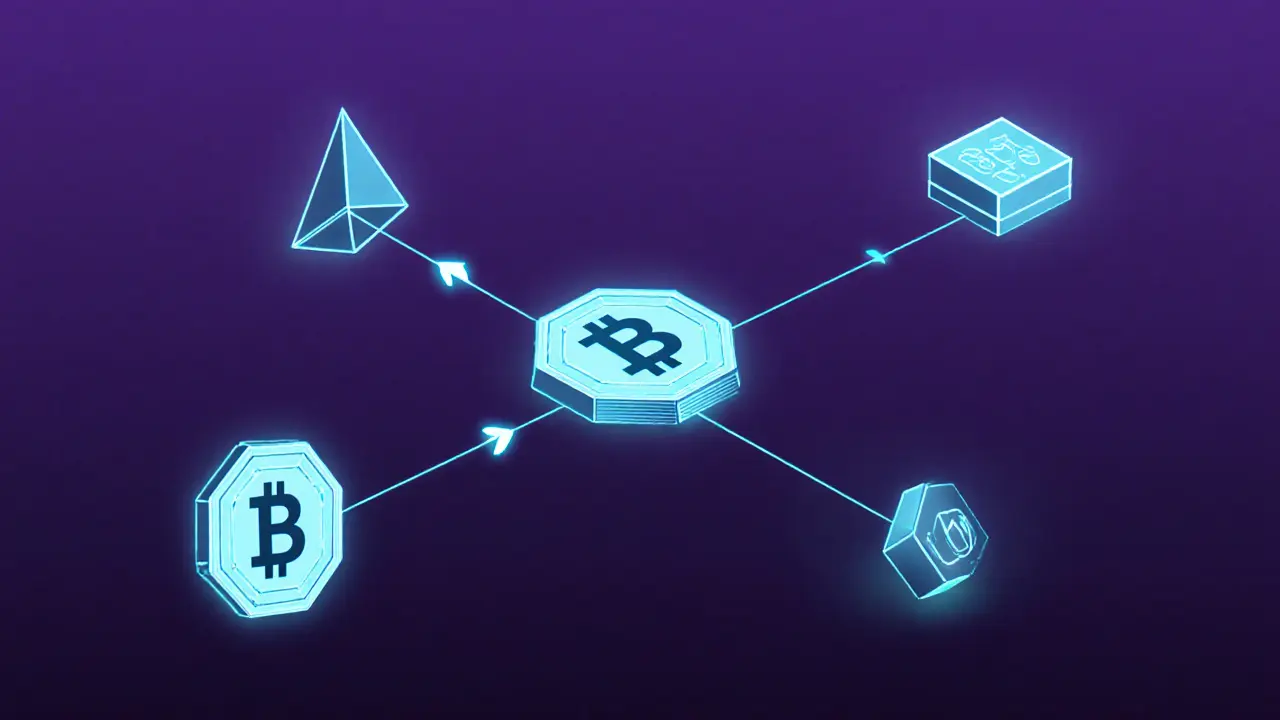

DL-AMM doesn’t work alone. It relies on three key pieces: decentralized exchange, a platform where users trade directly from their wallets without surrendering control, crypto liquidity, the pool of tokens locked in smart contracts to enable instant trades, and blockchain trading, the process of executing trades on a public, immutable ledger. These aren’t just buzzwords—they’re the bones of modern crypto finance. Without liquidity pools, there’s no trade. Without smart contracts, there’s no trust. Without a distributed ledger, there’s no transparency.

Look at the posts below. You’ll see how DL-AMM shows up in real projects—like JPool’s JSOL, where staking SOL happens through automated pools. Or Superp’s 10,000x leverage trades, built on BNB Chain using AMM logic. Even the scam alerts make sense here: fake airdrops often pretend to be part of a DeFi ecosystem, but they’re not connected to any real AMM. If a project claims to be decentralized but doesn’t mention liquidity pools or smart contracts, it’s probably not using DL-AMM at all.

This page collects real-world examples of how DL-AMM works—both the good and the dangerous. You’ll find deep dives into how liquidity providers earn fees, how price slippage can eat your profits, and why some tokens like GBL or CDONK are red flags because they have no underlying AMM structure. Whether you’re new to DeFi or you’re checking if a new platform is legit, understanding DL-AMM helps you cut through the noise.

iZiSwap (X Layer) Crypto Exchange Review: Is This Niche DEX Worth Using?

iZiSwap on X Layer offers a unique DL-AMM model for precise liquidity placement, but with only $12k daily volume and razor-thin liquidity, it's not viable for real trading - only for DeFi experimenters.

learn more