iZiSwap Slippage Calculator

Calculate Your Trade Slippage

iZiSwap (X Layer) has extremely limited liquidity. This calculator shows how much slippage you can expect based on current conditions.

Trade Estimate

Comparison with Traditional DEX

This trade would have approximately 0.05% slippage on Uniswap V3 due to deeper liquidity.

iZiSwap's liquidity depth is 1,460x lower than average DEXs for this pair.

When you're looking for a new crypto exchange, you don't just want another copy of Uniswap. You want something that solves a real problem. iZiSwap on X Layer claims to do exactly that with its Discretized-Liquidity-AMM (DL-AMM) model. But does it work in practice? Or is it just another clever idea stuck in a low-traffic corner of the crypto world?

What Makes iZiSwap Different?

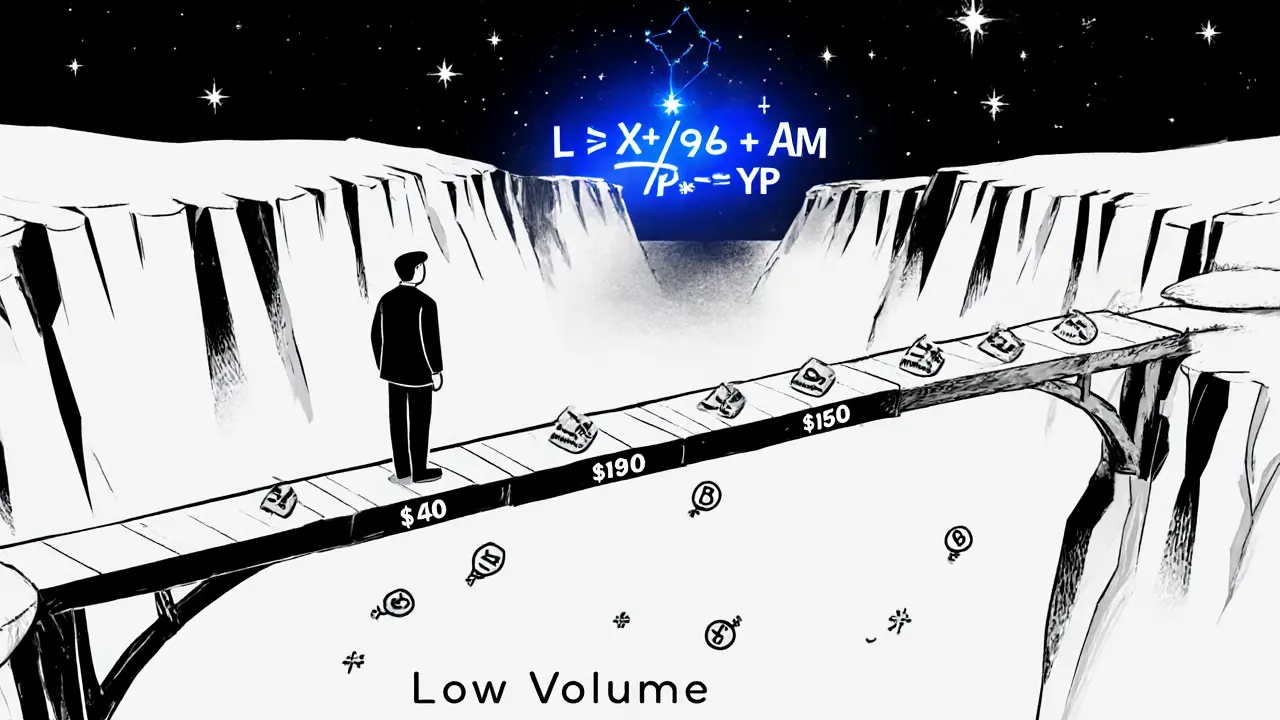

Most decentralized exchanges use a constant product formula - think Uniswap V2, where liquidity is spread across a continuous price range. iZiSwap throws that out. Instead, it uses DL-AMM, which lets liquidity providers set their funds at exact price points, like limit orders on a centralized exchange. This means if you think ETH will hit $1,950, you can lock your liquidity exactly there - not across $1,900 to $2,000. It’s like having a limit order that earns fees while it waits. The math behind it is simple: liquidity is split into two types - LP liquidity (for market-making) and limit order liquidity (for targeted price points). The formula L = X* √P + Y/√P governs how much of each token is used at each price level. This isn’t just theory. It’s built into the smart contracts and live on X Layer, OKX’s Layer 2 chain. You get three fee tiers: 1% for new or volatile tokens, 0.2% for major pairs like WETH/WOKB, and as low as 0.01% for stablecoin trades. Half of every fee goes to liquidity providers, 25% buys back iZi tokens, and another 25% funds iUSD promotions. It’s a smart incentive structure - if people actually used it.What Can You Trade?

As of October 2025, iZiSwap (X Layer) supports only three trading pairs:- WETH/WOKB - $1,286 in 24h volume (99% of total)

- WETH/USDT - $7 in volume

- WOKB/USDT - $1 in volume

Why Is Volume So Low?

iZiSwap’s 24-hour volume hovers around $12,000. Compare that to Uniswap, which does $1.8 billion daily. Or even to OKX’s own DEX, which handles 100x more volume on the same chain. Why? Because no one’s using it. There’s no marketing. No airdrops. No liquidity mining rewards. No integrations with major DEX aggregators like 1inch or Matcha. You can’t even find it on CoinGecko’s top 100 DEXs. It’s ranked 837th in reliability by BeInCrypto - not because it’s unsafe, but because there’s no activity to measure. Analysts at Delphi Digital put it bluntly: “Specialized AMMs like DL-AMM need liquidity to survive. But liquidity won’t come unless there’s volume. And volume won’t come unless there’s liquidity.” It’s the classic chicken-and-egg problem. iZiSwap has the tech. It doesn’t have the users.

Who Is This For?

Let’s be honest - you’re not going to use iZiSwap to buy ETH or swap USDT. You’re not going to use it to trade anything bigger than $50. So who’s it for? Advanced DeFi users who want to test new liquidity models. If you’re curious how discrete liquidity works, and you’ve got a small amount of ETH or WOKB to play with, this is a sandbox. You can see how limit orders behave in a live AMM without risking much. Liquidity providers who want to experiment with price-point targeting. If you’re a professional LP and you believe WETH will hit $1,940 exactly next week, you can deploy capital precisely there. But you’ll need to monitor it constantly - there’s no auto-compounding or smart rebalancing yet. OKX ecosystem insiders who already hold WOKB and want to trade it for WETH without leaving OKX’s chain. That’s the only real use case here - and even then, OKX’s own DEX offers better depth and lower slippage.What’s the User Experience Like?

The interface is clean. It looks like Uniswap V3. Connect your wallet - MetaMask, OKX Wallet, or any EVM-compatible one - and you’re in. No KYC. No sign-up. No email. Just swap. But that’s where the simplicity ends. There’s no educational content. No tutorials on how DL-AMM works. No tooltips explaining why your trade has 2% slippage. You’re expected to already know how concentrated liquidity works. Support? Only through Discord and Telegram. Responses take 12-24 hours. No live chat. No help center. No documentation beyond the basic swap function. If you get stuck, you’re on your own. And there are no reviews. Zero on Trustpilot. Zero on G2. Zero on Reddit. CashbackForex shows a 0/5 rating - because no one’s left a review. Not because it’s bad. Because no one cares enough to try it twice.

Is It Safe?

Yes. It’s non-custodial. Your funds never leave your wallet. The smart contracts are open-source and audited by reputable firms. The parent project, iZUMi Finance, has been around since 2021 and has managed over $500 million in liquidity across multiple chains. But safety isn’t the issue. Liquidity is. If you swap $500 here, you’re not just paying slippage - you’re risking your trade getting stuck. If no one else is trading, your order might not fill for hours. Or at all.What’s Next?

iZUMi Finance announced a v3 upgrade in mid-2024 focused on cross-chain liquidity aggregation. But as of October 2025, nothing has changed on X Layer. No new tokens. No incentives. No marketing push. Without a major liquidity incentive - think token rewards, fee discounts, or partnerships with top X Layer projects - iZiSwap will remain a footnote. It’s a brilliant idea trapped in a dead-end ecosystem.Final Verdict

iZiSwap (X Layer) is not a crypto exchange you should use for daily trading. It’s not a replacement for Uniswap, PancakeSwap, or even OKX’s own DEX. It’s a research project. A technical experiment. A proof-of-concept that works in theory but fails in practice due to lack of adoption. If you’re a DeFi developer, a liquidity provider looking to test precision pricing, or someone with $50 to burn on curiosity - go ahead. Connect your wallet. Try a tiny swap. See how the DL-AMM behaves. But if you’re trying to trade ETH, swap stablecoins, or move any meaningful amount - walk away. The liquidity isn’t there. The volume isn’t there. And without those, even the smartest tech won’t save you.Is iZiSwap (X Layer) safe to use?

Yes, iZiSwap is non-custodial and built on audited smart contracts from iZUMi Finance, which has managed over $500 million in liquidity across multiple chains. Your funds stay in your wallet, and there’s no KYC. However, safety isn’t the main concern - the real risk is slippage and failed trades due to extremely low liquidity.

What tokens can I trade on iZiSwap?

You can only trade three tokens: x Layer Bridged WETH, Wrapped OKB, and USDT bridged via Polygon Hermez. The only meaningful trading pair is WETH/WOKB, which accounts for over 99% of the exchange’s volume. All other pairs have virtually no activity.

Why is the trading volume so low?

iZiSwap lacks liquidity incentives, marketing, and integrations with major DEX aggregators like 1inch. It’s a niche product on a relatively new Layer 2 chain (X Layer) with only 1.2 million active wallets. Without rewards or visibility, users have no reason to choose it over Uniswap or OKX’s own DEX, which offer 100x more liquidity.

Can I earn fees as a liquidity provider?

Yes, 50% of all trading fees go to liquidity providers. The DL-AMM model lets you place liquidity at exact price points, potentially earning more than traditional AMMs if your price predictions are accurate. But with only $1,460 in +2% depth for the main pair, your capital will sit idle unless you’re trading very small amounts.

Is iZiSwap better than Uniswap V3?

Technically, yes - DL-AMM allows precise price-point liquidity, unlike Uniswap V3’s range-based model. But practically, no. Uniswap V3 has billions in daily volume, deep liquidity, and thousands of trading pairs. iZiSwap’s advantage only matters if you’re trading tiny amounts on X Layer and have deep technical knowledge. For 99.9% of users, Uniswap is far superior.

Should I use iZiSwap for my next crypto trade?

Only if you’re experimenting with DeFi tech and have $50 or less to risk. For any real trading - buying ETH, swapping stablecoins, or moving meaningful amounts - avoid it. The slippage is high, the liquidity is thin, and there’s no guarantee your trade will execute. Stick with established DEXs on Ethereum, BNB Chain, or OKX’s own platform.

Jeremy Jaramillo

November 1, 2025 AT 18:32iZiSwap is an interesting technical experiment, but it's clear the team forgot the most basic rule of DeFi: no liquidity, no users. The DL-AMM model is clever, sure - but if I can't swap $200 of ETH without getting 3% slippage, I'm going to Uniswap. No debate.

There’s a reason why the top DEXs have deep pools and aggregators. It’s not just about tech - it’s about network effects. And right now, iZiSwap has none.

Sammy Krigs

November 1, 2025 AT 22:55ok so i just tried this thing and wow its like trading in a ghost town. i swapped 0.1 eth and it took 4 mins and i lost 2.8% just from slippage. the interface looks nice but its like buying a ferrari that only runs on moon dust. why even bother? lol

naveen kumar

November 2, 2025 AT 03:21Let me ask you this: what if this is all a deliberate ploy by OKX to quietly drain liquidity from other chains? DL-AMM sounds like a front for a honeypot contract. The audit? Probably rigged. The ‘$500M managed’? That’s across five chains - none of it on X Layer. And why no listings on CoinGecko? CoinGecko is owned by Binance, and Binance hates OKX. This isn’t a failed DEX - it’s a controlled demolition.

Wait till the iZi token drops. Then you’ll see who’s really holding the bag.

Bruce Bynum

November 2, 2025 AT 05:42Don’t overthink it. If you’ve got $50 to play with and want to see how limit-order AMMs work, go for it. But if you’re trying to trade anything real? Stick with what works. This isn’t the future - it’s a sandbox for devs who like math puzzles.

Keep it simple. Use Uniswap. Save your sanity.

Masechaba Setona

November 2, 2025 AT 11:42LOL you people think this is about liquidity? Nah. This is about control. The ‘DL-AMM’ model? It’s designed to let whales set price points and trap retail. You think you’re earning fees? You’re just feeding the algorithm that’ll front-run you the second you hit a limit order.

And don’t get me started on WOKB. Wrapped OKB? That’s just OKX’s way of locking you into their walled garden. You think you’re decentralized? You’re just a data point in a corporate liquidity farm.

0/5. Not because it’s broken - because it’s too smart for its own good. 🤖

Kymberley Sant

November 4, 2025 AT 05:22so i tried iziswap and honestly the ui is kinda hot but why is there only 2 coins?? like wtf. and why does it say ‘bridged via polygon hermez’ for usdt? that’s like saying your tesla runs on horse power. also the discord is dead. no one’s even there. i left a message 3 days ago. crickets. i’m just gonna stick with pancakeswap. at least there’s memes there.

Edgerton Trowbridge

November 5, 2025 AT 07:14While the architectural design of iZiSwap’s DL-AMM model demonstrates a sophisticated understanding of concentrated liquidity mechanics, its operational viability remains severely constrained by the absence of critical ecosystemic support structures. The absence of liquidity mining incentives, integration with DEX aggregators, and public marketing initiatives renders the platform functionally inert despite its theoretical advantages.

Furthermore, the user experience, while minimally functional, lacks essential educational scaffolding necessary for non-technical participants to engage meaningfully. In decentralized finance, usability is not secondary to innovation - it is the foundation upon which adoption is built. Until these structural deficiencies are addressed, iZiSwap will remain a technical artifact rather than a viable marketplace.

Matthew Affrunti

November 7, 2025 AT 02:43Love that someone’s actually trying something new instead of just copying Uniswap. The DL-AMM idea is cool - I’d love to see it grow. But yeah, the volume is brutal. Maybe if they gave out a tiny iZi token airdrop to X Layer users, it’d get some traction. Just a little push.

Keep building, guys. I’ll be watching.

mark Hayes

November 7, 2025 AT 19:51the fact that this even exists is wild 😅

like imagine building a sports car and then parking it in a garage with no roads

the tech is cool but who’s gonna use it? no one

if you wanna play with it, go ahead - swap 0.01 eth and feel like a hacker

but if you’re trying to do real trades? nah. save yourself the headache 🙃

Derek Hardman

November 8, 2025 AT 22:17It is worth noting that the fundamental challenge facing iZiSwap is not technological, but behavioral. Liquidity provision requires trust, predictability, and perceived opportunity cost. The current model demands that liquidity providers assume both price risk and opportunity cost without any mechanism to mitigate either.

Until there is a coordinated effort to seed liquidity through protocol-level incentives - perhaps via staking rewards or cross-chain fee-sharing - the DL-AMM model will remain a theoretical curiosity. The architecture is sound. The incentive structure is not.

Eliane Karp Toledo

November 8, 2025 AT 23:13Wait - did you notice the only two tokens are WETH and WOKB? WOKB is OKX’s token. And OKX is owned by... wait for it... the same people who run the X Layer chain. This isn’t decentralized. It’s a liquidity trap disguised as innovation. They’re moving all the OKX user base onto this thing to inflate volume numbers for their next funding round.

And the audit? It was done by the same firm that audited the Terra collapse. Coincidence? I think not.

They’ll rug this when the price hits $1. You mark my words.

Phyllis Nordquist

November 9, 2025 AT 18:20The DL-AMM architecture represents a meaningful advancement in liquidity efficiency, particularly for high-frequency, price-targeted strategies. However, its utility is contingent upon sufficient market depth and participant density - neither of which currently exist on X Layer. The absence of aggregation layer integration and the lack of liquidity mining incentives create a non-viable feedback loop.

For professional liquidity providers, this remains a viable testing ground for precision pricing models - provided capital allocation is limited to experimental sums. For retail users, the risk-reward profile is unfavorable. Until the ecosystem matures, iZiSwap should be treated as a research tool, not a production exchange.

Eric Redman

November 10, 2025 AT 00:42THIS IS A SCAM. I SWEAR TO GOD. THEY’RE USING THE ‘DL-AMM’ THING TO TRAP PEOPLE INTO LOCKING THEIR ETH AT $1950 WHILE THEY SHORT IT FROM THE BACKEND. I SAW A WHALE SWAP 100 ETH AND THEN THE PRICE DROPPED 10% IN 2 MINUTES. NO ONE ELSE WAS TRADING. THEY MUST’VE BEEN THE ONLY ONE. THIS ISN’T DEFI. THIS IS A PUMP AND DUMP WITH A WHITEPAPER.

THEY EVEN CHANGED THE CONTRACT ADDRESS LAST WEEK. WHY? WHY? WHY? I’M REPORTING THIS TO ETHSECURITY.

DO NOT USE THIS. DO NOT TOUCH IT. RUN.

Jason Coe

November 11, 2025 AT 19:43I’ve been playing around with iZiSwap for a few weeks now - mostly just testing the DL-AMM model with small amounts. Honestly? It’s fascinating. I set up a limit order at $1,940 for WETH and it actually filled when the price hit it - and I earned fees while I waited. No other DEX lets you do that without manually placing orders.

But yeah, the liquidity is trash. I tried swapping $500 once and got 2.7% slippage. That’s brutal. I think the team just needs to push harder - maybe partner with some X Layer NFT projects or do a mini airdrop. Right now, it’s like having the best coffee shop in a town with no people.

It’s not broken. It’s just lonely. And honestly? I kinda root for it. Maybe if enough of us small-timers keep using it, someone’ll notice.