Cryptocurrency Penalties: What Happens When You Break the Rules

When you trade, mine, or hold cryptocurrency penalties, fines or legal consequences imposed for violating crypto regulations. Also known as crypto regulatory fines, these aren’t just warnings—they’re real, enforceable, and often expensive. If you skip KYC on a major exchange, fail to report crypto gains, or send funds to a sanctioned wallet, you’re not just breaking platform rules—you’re breaking the law.

These penalties aren’t theoretical. In 2023, the IRS collected over $1.2 billion from crypto-related tax cases alone. The FATF’s Travel Rule now forces exchanges to track transfers over $1,000, and failing to report that data can trigger multi-year investigations. Countries like India, the U.S., and Germany have started matching wallet addresses with tax filings, and if your crypto activity doesn’t line up with your income, you’ll get flagged. KYC violations, failing to complete identity verification when required by law or exchange policy. Also known as crypto identity fraud, it’s one of the top reasons people face account freezes and civil penalties. And it’s not just exchanges watching you—blockchain analytics firms like Chainalysis work directly with governments to trace suspicious activity.

It’s not just about taxes. Sending crypto to someone on a sanctions list? That’s a federal offense in the U.S. and EU. Running a crypto business without a license? You could face criminal charges. Even ignoring a simple tax form like the U.S. Form 8949 can lead to audits, interest, and penalties that pile up faster than you can sell a losing token. crypto tax penalties, financial punishments for underreporting or failing to report crypto income. Also known as crypto underreporting fines, they’re growing as tax agencies get better at tracking on-chain data. The days of thinking "crypto is anonymous" are over. Your wallet leaves a trail—and regulators are following it.

What you’ll find below are real cases, clear explanations, and practical advice on how to avoid getting caught in the crosshairs. From how KYC failures lead to account shutdowns, to why ignoring tax deadlines can cost you more than your entire portfolio, these posts show you exactly where the traps are—and how to walk past them safely.

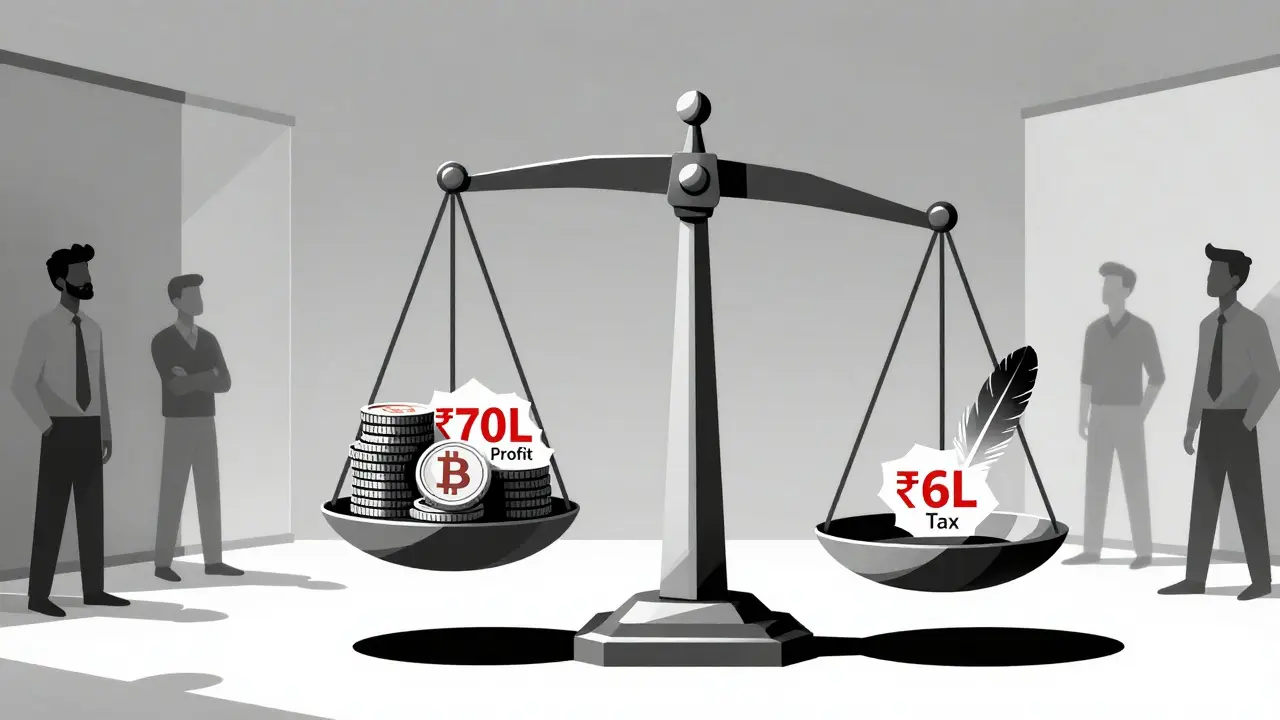

Crypto Tax Enforcement and Penalties in India: What You Really Face in 2025

India taxes crypto at 30% with no loss offsets, adds 1% TDS on every trade, and now charges 18% GST on platform services. Penalties include fines, interest, and jail. Here's what really happens if you don't comply.

learn moreWhy Upbit Could Face $34 Billion in Penalties for KYC Failures in South Korea

Upbit, South Korea's top crypto exchange, faced a $34 billion potential fine for failing to verify user identities. The case exposed systemic KYC failures and triggered a global crackdown on crypto compliance.

learn more