Crypto Tax Calculator for India

Calculate Your Tax Liability

Based on India's 30% tax rate, 1% TDS, and 18% GST effective from July 2025

Your Tax Summary

- Bank deposits trigger tax department scrutiny (Section 270A)

- Losses cannot be offset (Section 271F)

- Non-filing leads to penalties up to 200% of tax evaded

India doesn’t just tax cryptocurrency - it hunts it. Since April 2022, the government has treated crypto gains like lottery winnings: 30% tax, no deductions, no loss offsets, and no mercy. But here’s the real question: What happens if you don’t pay? And more importantly, how does the government even know?

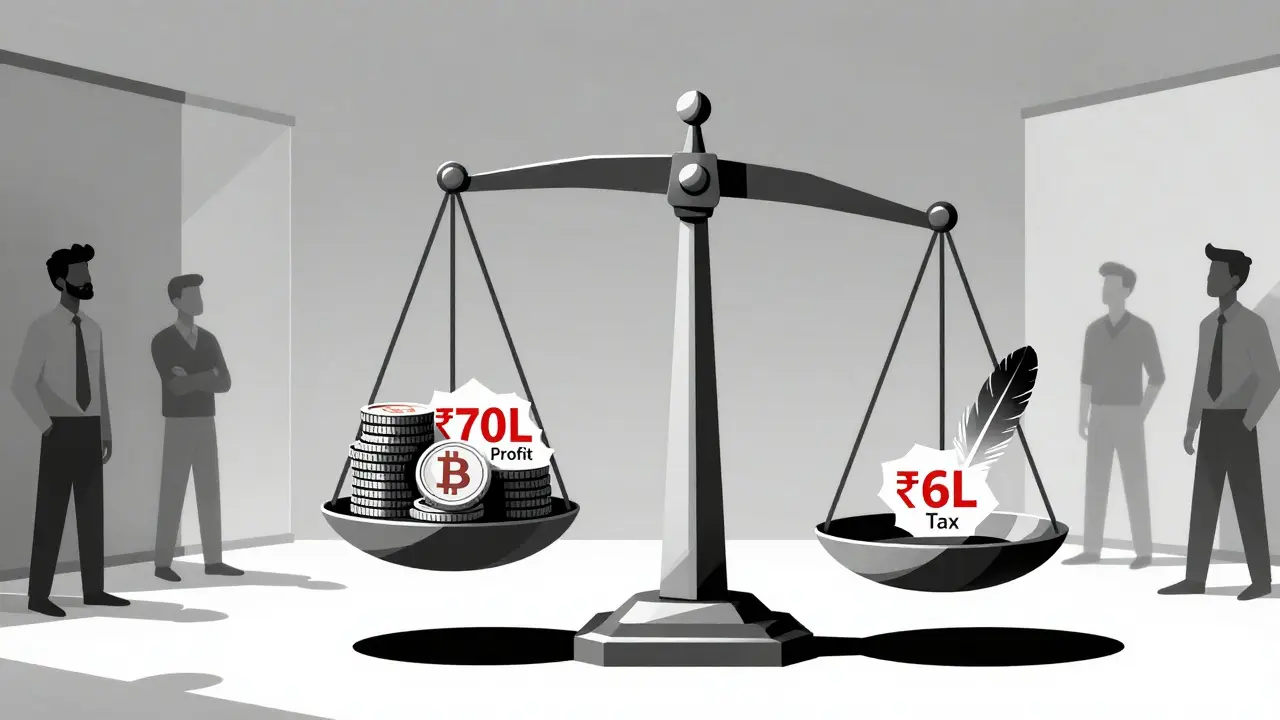

The 30% Tax That Doesn’t Care About Losses

If you bought Bitcoin at ₹50 lakh and sold it at ₹70 lakh, you owe ₹6 lakh in taxes. That’s 30% of your profit. Simple, right? But if you lost ₹10 lakh on Ethereum and made ₹15 lakh on Solana, you still pay 30% on the ₹15 lakh. No carrying forward losses. No offsetting against salary or property income. This isn’t how stocks or mutual funds are taxed. It’s how gambling winnings are taxed - and that’s intentional.The government didn’t design this to be fair. It was designed to discourage. The 30% rate is among the highest in the world. The U.S. taxes crypto gains at up to 37%, but only if you’re in the top bracket - and you can offset losses. India gives you nothing. Even if you’re underwater overall, you still pay tax on every single profitable trade.

The 1% TDS That’s Everywhere

Every time you sell crypto - even if you’re just swapping one coin for another - the buyer must deduct 1% as Tax Deducted at Source (TDS). This applies to every transaction on exchanges, peer-to-peer trades, and even gifts if they’re valued over ₹50,000. The buyer - whether it’s a friend, a platform, or a bot - has to collect and deposit this with the government.That means if you sell ₹1 lakh worth of Dogecoin, ₹1,000 gets pulled out before you even see your money. And it’s not optional. Exchanges like WazirX, CoinSwitch, and ZebPay automatically do this. If you’re trading on a decentralized exchange like Uniswap through a wallet, you’re still liable - but the government can’t track it easily. That’s the loophole.

Here’s the catch: TDS isn’t a final tax. It’s a prepayment. You still have to report your full gains in your income tax return. If you paid ₹1,000 in TDS but your total tax liability is ₹60,000, you owe ₹59,000 more. If you paid ₹1,000 but your net gain was zero? You can claim a refund - but only if you file.

The GST Trap (Yes, It’s Now Taxed Too)

From July 7, 2025, everything you pay to a crypto platform gets hit with 18% GST. That includes:- Trading fees

- Withdrawal charges

- Deposit fees

- Staking rewards processing

- Wallet management

- KYC verification costs

Even if you’re using an offshore platform like Binance or Kraken and you’re in India, you still pay GST. Why? Because the government classifies these platforms as “Online Information and Database Access or Retrieval (OIDAR)” services. That means they’re required to register for GST in India, regardless of how small they are.

Platforms now have to issue GST invoices for every service. That creates a digital paper trail - every fee, every deposit, every withdrawal. If you’re using a platform that doesn’t charge GST, you’re either dealing with a non-compliant service - or one that’s already shut down.

How the Government Tracks You (Even If You Think You’re Hidden)

You might think using a non-KYC wallet or a peer-to-peer app keeps you invisible. It doesn’t.The Income Tax Department has direct access to transaction data from all registered exchanges. They cross-check your ITR filings with exchange reports. If you reported ₹5 lakh in gains but your exchange shows ₹12 lakh, you’re flagged. No warning. No notice. Just a notice of demand.

Even if you trade on a decentralized exchange, the government can track you through your bank. If you deposit ₹8 lakh from a crypto sale into your savings account and you didn’t report it, the bank reports it under the Annual Information Return (AIR). The tax department gets that. They don’t need to know it’s crypto - they just need to know the money came from somewhere unexplained.

And don’t think mining or airdrops are safe. If you received 0.5 BTC as an airdrop and sold it later, the tax department expects you to value it at the market price on the day you received it - using Rule 11UA of the Income Tax Rules. That’s not guesswork. That’s a legal requirement. If you didn’t track it? You’re guessing wrong. And guessing wrong is still a violation.

What Happens If You Don’t File? Penalties You Can’t Ignore

There’s no official list of crypto-specific penalties. That’s because the government doesn’t need one. They use existing income tax laws.If you don’t file your ITR and you had crypto gains:

- Penalty under Section 271F: ₹10,000 if you miss the deadline (July 31). If you’re late and your income is over ₹5 lakh? ₹10,000 is the minimum - but it can go up to ₹1 lakh.

- Interest under Section 234A: 1% per month on unpaid tax from August 1 until you file.

- Penalty under Section 270A: 50% to 200% of the tax evaded if the department proves you deliberately hid income. For crypto, that’s easy - if you didn’t report, they assume intent.

- Prosecution under Section 276CC: Up to 7 years in jail if tax evasion exceeds ₹10 lakh.

There’s no “first-time offender” rule. No warning. No leniency. The system assumes you knew. And if you didn’t? That’s not an excuse - it’s negligence.

Real cases? They’re not public. But that’s because the government settles quietly. You get a notice. You pay the tax, penalty, and interest. You sign a form saying you won’t do it again. And you’re done. No headlines. No court. Just a quiet end to your crypto journey - and a permanent mark on your tax record.

Who’s Getting Caught? The Real Story

The government isn’t going after random people. They’re going after:- Traders who deposited over ₹10 lakh in crypto gains into their bank accounts without reporting

- Exchanges that didn’t deduct TDS or filed fake GST returns

- People who used offshore platforms but had Indian bank accounts linked

- Those who claimed crypto losses on paper but never actually traded

One case from early 2025 involved a software engineer in Bangalore who made ₹22 lakh in crypto gains over two years. He didn’t file. The tax department cross-checked his bank deposits with exchange data. He got a notice. He paid ₹6.6 lakh in tax, ₹1.3 lakh in interest, and ₹3.3 lakh in penalty. Total: ₹11.2 lakh. His crypto profit? Gone.

He wasn’t rich. He wasn’t a criminal. He just thought he could hide it. He was wrong.

The Big Shift: Is India Changing Its Mind?

In August 2025, the Central Board of Direct Taxes (CBDT) sent detailed questionnaires to 47 crypto exchanges. They asked:- Is the 1% TDS too high and killing trading volume?

- Does the 30% tax make India uncompetitive?

- Should offshore exchanges be treated differently?

- Should we allow loss offsets?

This isn’t just a review. It’s a sign of panic. The tax revenue from crypto is far below projections. Trading volumes dropped 68% since 2022. Over 200 crypto firms moved operations to Dubai, Singapore, or Portugal. The government is losing more in economic activity than it gains in tax.

They’re not going to remove the 30% tax. But they might allow loss offsets. They might lower TDS to 0.5%. They might create a separate category for crypto - not as a commodity, not as gambling, but as a new asset class.

Until then? The rules stay brutal.

What You Should Do Right Now

If you traded crypto in India between April 2022 and March 2025:- Log into every exchange you used and download your complete trade history.

- Calculate your gains and losses for each financial year (April 1 to March 31).

- Use ITR-2 or ITR-3 - and fill out Schedule VDA. No shortcuts.

- Report every TDS you paid. You’ll get credit.

- If you missed filing for 2022-23, 2023-24, or 2024-25 - file belated returns now. Penalties are lower if you act before they notice.

Don’t wait for a notice. Don’t hope it’ll go away. The system is watching. And it’s getting better at finding you.

Is crypto legal in India?

Yes, but not as legal tender. You can buy, sell, and hold crypto. But the government doesn’t recognize it as money. It’s treated as a virtual digital asset - and taxed like a speculative investment. The Supreme Court lifted the banking ban in 2020, but the government still warns about risks. Legality isn’t the issue - compliance is.

Can I avoid crypto tax by using offshore exchanges?

No. If you’re an Indian resident and you withdraw crypto profits into an Indian bank account, the tax department will know. Banks report large deposits under the Annual Information Return. Even if you use Binance or Kraken, your bank transaction is the trail. Plus, you still owe GST on platform services - and they’re now required to charge it if you’re in India.

Do I pay tax on crypto I received as a gift or airdrop?

Yes. If you received crypto as a gift over ₹50,000 in a year, it’s taxable as income. Airdrops? Taxed at fair market value on the day you received them. You must record the price using Rule 11UA. If you sell later, you pay 30% on the gain from that value. No exceptions.

What if I lost money on crypto? Can I claim it?

No. You can’t offset crypto losses against any other income - not salary, not property, not even other crypto gains. Losses can only be carried forward to offset future crypto gains - but only for 8 years, and only if you file your return on time. If you don’t file, your losses disappear.

Can the tax department freeze my crypto wallet?

Not directly. But they can freeze your bank account if they suspect tax evasion. And if your wallet is linked to a KYC exchange, they can demand transaction records. If you’re using a non-KYC wallet, they can’t access it - but they can still trace your bank deposits. Your wallet might be hidden, but your money isn’t.

Is there a chance the tax rules will change in 2026?

Possibly. The CBDT’s 2025 review suggests they’re reconsidering the 1% TDS and the lack of loss offsets. A new law could come in 2026 - but don’t expect lower taxes. More likely: better tracking, clearer rules, and stricter enforcement. The government wants control, not revenue. Don’t bet on relief.

Scot Sorenson

December 13, 2025 AT 09:29So India taxes crypto like it’s a lottery win but bans the fun of actually winning? Brilliant. If you lose money, you still pay tax. If you win, you pay even more. And if you’re dumb enough to trade on a decentralized exchange? They’ll still find you through your bank account. This isn’t regulation - it’s financial harassment with a spreadsheet.

Sarah Luttrell

December 14, 2025 AT 21:02OMG this is the most American thing I’ve ever seen 😭💀 India’s just like ‘you want to be rich? cool, here’s 30% of your dreams + 18% GST on your trading fees + jail if you sneeze wrong.’ At least in the US we let you lose money and still sleep at night. This is dictatorship with a tax form.

Sue Gallaher

December 16, 2025 AT 06:11Who even cares about crypto anymore I mean honestly why are we even talking about this when the real issue is inflation and rent and food prices why is the government wasting time on this nonsense

Stanley Machuki

December 16, 2025 AT 18:16Just file your ITR-2 with Schedule VDA and move on. No drama. No panic. Just do the thing. You’ll thank yourself later. Seriously. Do it today.

Rakesh Bhamu

December 18, 2025 AT 03:34As an Indian trader, I’ve been through this. The 1% TDS feels like a slap but honestly it’s the only thing keeping exchanges compliant. The real issue is the lack of loss offset - it’s punishing disciplined traders. I lost ₹8L on altcoins last year and still paid ₹3L on my one profitable trade. It’s broken. But filing on time? Non-negotiable. I’ve seen friends get notices. No second chances.

Ian Norton

December 19, 2025 AT 12:35Let’s be clear - the government isn’t targeting you. They’re targeting the ₹10L+ bank deposits. If you’re under that threshold, you’re probably fine. But if you’re depositing six figures from ‘unexplained sources’? You’re not hiding. You’re just delaying the audit. The system doesn’t care if you’re a student or a millionaire. It cares about the number in the account. And it’s already matched your wallet to your PAN.

Joey Cacace

December 21, 2025 AT 08:52Thank you so much for this incredibly thorough breakdown 🙏 I’ve been terrified of filing my crypto gains but now I feel so much more empowered to take action. The GST on trading fees was a total surprise - I had no idea! I’m downloading my trade history today and will file my belated return. You’ve truly helped me sleep better tonight 💛

Hari Sarasan

December 21, 2025 AT 15:08Per Section 115BBH of the Income Tax Act, 1961, the taxation of Virtual Digital Assets (VDAs) is codified under a quasi-speculative regime, wherein the absence of cost of acquisition adjustment, coupled with the non-allowability of set-off against other heads of income, constitutes a statutory disincentive mechanism designed to curb speculative capital flows. The 1% TDS under Section 194S further ensures real-time fiscal capture, rendering decentralized protocols functionally non-compliant unless interfaced via KYC-compliant on-ramps. The GST applicability under OIDAR framework, as per Notification No. 10/2025, renders even offshore platforms liable for reverse charge obligations if the recipient is an Indian resident. Non-filing triggers Section 270A penalties at 150% of evaded tax - a threshold easily met by any VDA transaction exceeding ₹5L in FY 2024-25. The system is not punitive. It is architecturally inevitable.

Lloyd Cooke

December 22, 2025 AT 11:13There’s a quiet horror in how efficiently the state has weaponized accounting. You don’t need to be a criminal to be guilty - just human. To have made a trade, to have felt hope in a coin’s rise, to have dared to believe in digital scarcity - and then be told: ‘This is not wealth. This is taxable gain. And we will track you through your bank, your phone, your breath.’ The irony? The very infrastructure that made crypto feel free - wallets, chains, decentralization - became the leash. They didn’t ban it. They taxed it into submission. And we, the users, became the unpaid auditors of our own dreams.

Jeremy Eugene

December 22, 2025 AT 22:47I appreciate the clarity of this post. It’s essential reading for anyone who traded crypto in India. The penalties are severe, but the legal framework is unambiguous. Ignorance is not a defense, and the tax department’s data integration is now state-of-the-art. If you have unreported gains, consult a chartered accountant immediately. Proactive compliance is the only safe path forward.