Cryptocurrency Anonymity: How Private Transactions Really Work

When people talk about cryptocurrency anonymity, the ability to conduct digital transactions without revealing identity or transaction history. Also known as financial privacy, it's not about being secret—it's about having control over who sees your money moves. Most crypto users think Bitcoin is anonymous. It’s not. Every Bitcoin transaction is public, traceable, and permanently stored on a global ledger. If someone links your wallet to your real name—through an exchange, an IP address, or a spent coin—you’re exposed. True anonymity doesn’t come from using Bitcoin. It comes from tools built to break that chain of visibility.

That’s where Monero, a privacy-focused cryptocurrency that hides sender, receiver, and amount by default comes in. Unlike Bitcoin, Monero uses ring signatures and stealth addresses to make every transaction look like it came from a group of possible senders. Even experts can’t trace where the money went. Then there’s Zcash, a coin that lets users choose between transparent and shielded transactions. Shielded transactions hide details using zero-knowledge proofs—a math trick that proves a payment happened without showing who sent it or how much. These aren’t gimmicks. They’re engineered solutions for people who need privacy: activists in repressive regimes, businesses avoiding competitors’ surveillance, or just regular users tired of being tracked.

But anonymity doesn’t exist in a vacuum. It’s shaped by regulation, technology, and user behavior. Exchanges like HTX and Coinlim don’t allow anonymous deposits—you need ID. That’s why people turn to P2P trading, peer-to-peer platforms where buyers and sellers exchange crypto directly, often with cash or gift cards to bypass KYC. In countries like Nepal and Bangladesh, where crypto is banned or risky, P2P and mixers are the only way to stay off the radar. Even then, mixing services can be scams. Some take your coins and disappear. Others log your transactions, selling the data later. Real anonymity requires both the right tool and the right habits.

And here’s the hard truth: if you’re using crypto for anything other than speculation, anonymity matters more than you think. Your spending habits, income sources, and financial relationships are all visible if you’re not careful. A single leaked address can expose years of activity. That’s why blockchain analysis firms like Chainalysis exist—they turn public data into profit maps. But the same tools that track you can also protect you. Understanding how cryptocurrency anonymity works means knowing what to avoid, what to use, and when to walk away from a platform that promises privacy but delivers nothing but exposure.

Below, you’ll find real cases of what worked, what failed, and what scams pretend to be privacy tools. No fluff. No hype. Just what actually happens when people try to move crypto without leaving a trail.

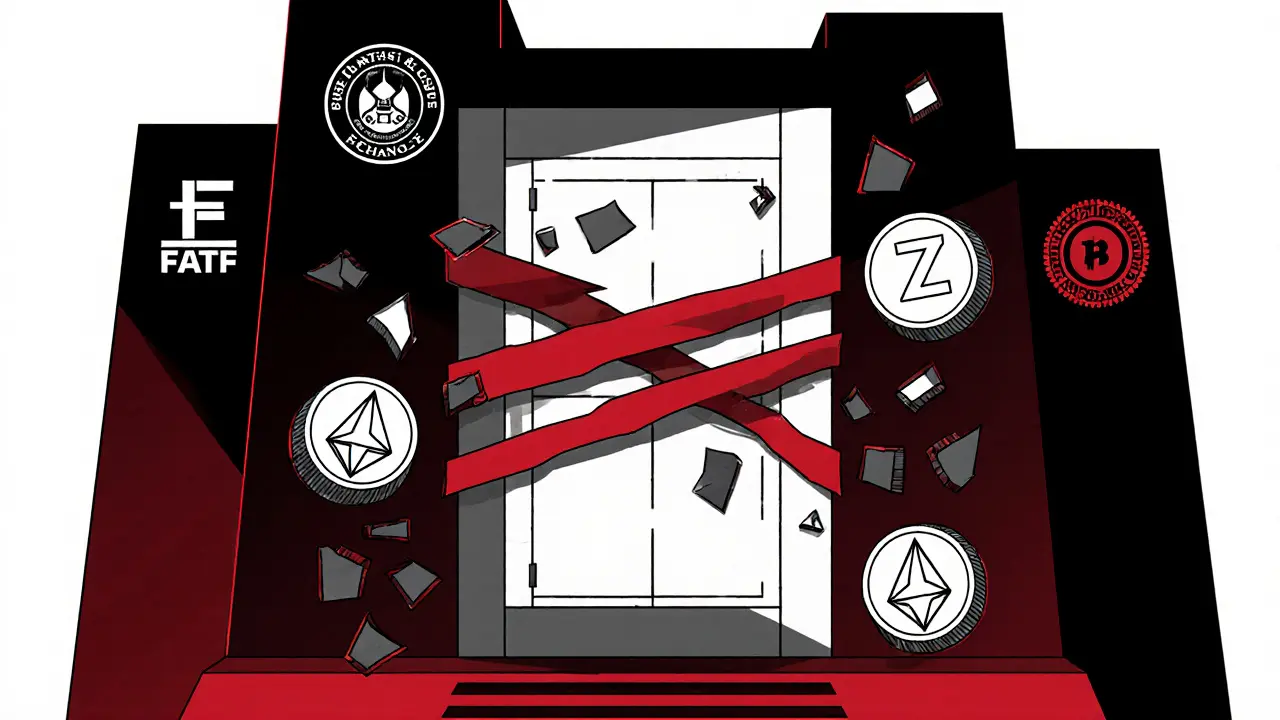

Privacy Coins Regulations: Monero and Zcash Restrictions in 2025

Monero and Zcash face growing restrictions in 2025 as global regulators crack down on anonymous crypto. Exchanges delist them, P2P trading rises, and privacy vs. compliance becomes the defining battle for the future of cryptocurrency.

learn more