Crypto Regulation 2025: What’s Banned, What’s Legal, and Who’s Enforcing It

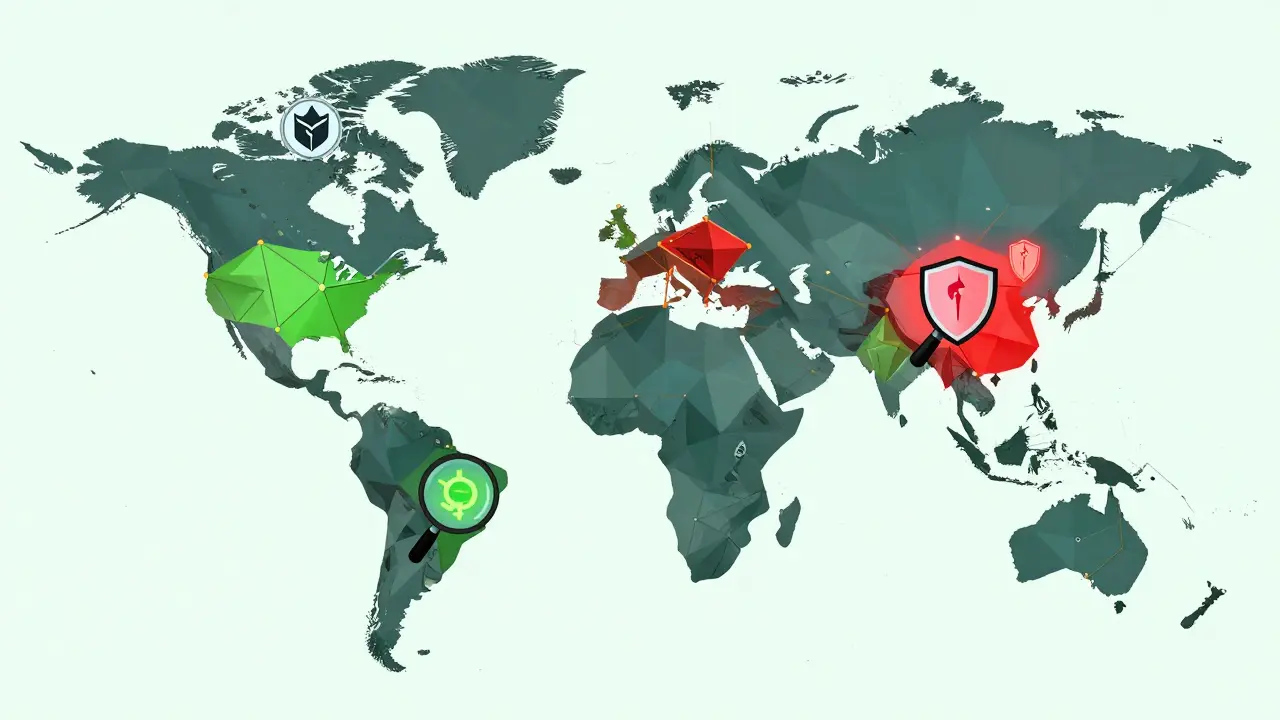

When we talk about crypto regulation 2025, the global rules and enforcement actions shaping how cryptocurrency is used, traded, and taxed by governments and financial institutions. Also known as digital asset regulation, it’s no longer about if crypto will be controlled—it’s about how hard and how fast. By 2025, the world isn’t debating whether to regulate crypto. It’s already done it—differently in every country.

Some places, like China, a nation that banned all crypto trading, mining, and ownership in 2021 and enforces it with prison sentences, treat crypto like a financial crime. Others, like the EU under MiCA, the Markets in Crypto-Assets regulation that requires exchanges to verify users, disclose risks, and keep reserves, treat it like a financial product. Then there’s the U.S., where the SEC, the agency that treats most tokens as unregistered securities unless proven otherwise is suing major exchanges and labeling DeFi protocols as illegal. The rules aren’t just changing—they’re splitting the world in two.

What’s Getting Banned—and Who’s Still Finding Ways Around It

Privacy coins like Monero and Zcash are being quietly removed from exchanges worldwide because regulators say they can’t track them. That’s not a rumor—it’s happening. Banks in the U.S. and Europe are cutting off services to crypto firms that support these coins. Meanwhile, countries like Bangladesh and Russia are locking down crypto access through banking bans, but people are still trading. How? P2P networks, offshore wallets, and stablecoins. In Russia, traders use USDT to bypass cash withdrawal limits. In Bangladesh, people trade Bitcoin through local sellers who accept cash. The laws are strict, but the workarounds are creative—and growing.

Security tokens, on the other hand, are being built to comply from the start. These aren’t meme coins. They’re tokenized stocks, real estate, or bonds with built-in KYC and transfer restrictions coded into the blockchain. That’s why they’re legal in places like Singapore and the EU. The difference? One side fights the rules. The other designs around them.

And then there’s the quiet war on anonymity. No-KYC exchanges like Unnamed.Exchange are getting flagged, labeled unsafe, and pushed out of visibility. Meanwhile, regulators are pushing the FATF Travel Rule—requiring exchanges to share sender and receiver data for every transaction over $1,000. That’s not coming in 2026. It’s already active in 40+ countries.

What you’ll find below isn’t a list of opinions. It’s a collection of real cases: how China’s ban actually works, why Bangladesh jails crypto traders, how Russia’s banking limits are being beaten, and why privacy coins are vanishing from exchanges. You’ll see what happens when a government says no—and how people still find a way. Whether you’re trying to stay legal, avoid scams, or just understand where crypto stands today, these stories show the real state of crypto regulation in 2025—not the hype, not the promises. Just the facts.

2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

2024-2025 crypto enforcement stats show fraud dropping but sophisticated crime rising. TRON's crime fell after a landmark crackdown, while DeFi and stablecoins become new targets. Global rules are improving - but enforcement still lags.

learn more