Crypto Crime Statistics: What Really Happens When Crypto Goes Wrong

When we talk about crypto crime statistics, measurable data on illegal activities involving cryptocurrency, including fraud, theft, and money laundering. Also known as cryptocurrency crime data, it’s not just numbers—it’s real people losing life savings, exchanges getting hacked, and governments scrambling to catch up. The truth? Crypto isn’t inherently criminal, but its design makes it a magnet for bad actors who exploit anonymity, speed, and weak enforcement.

One of the biggest drivers behind crypto fraud, deceptive schemes designed to trick users into sending crypto, often through fake airdrops, phishing sites, or impersonated teams is hype. Look at the NFT airdrops that vanished overnight—YOOSHI SHIB ARMY, FEAR Play2Earn, even the fake NAMA Protocol drop. These aren’t glitches. They’re engineered scams that prey on FOMO. Then there’s money laundering crypto, the process of disguising illegally obtained crypto through mixing services, cross-chain swaps, or P2P trades to evade tracking. Countries like Bangladesh and Russia don’t ban crypto because they hate tech—they’re fighting criminal networks using it to move cash without banks. That’s why enforcement is getting harsher: jail time for trading, bank account freezes, and exchanges being forced to block certain wallets.

It’s not all chaos, though. Behind the headlines, regulators are building tools to fight back. The crypto regulation, legal frameworks designed to control how crypto is used, traded, and taxed to prevent abuse is evolving fast. MiCA in Europe, SEC crackdowns in the U.S., and FATF’s travel rule are forcing exchanges to collect user data—even the "no-KYC" ones like Unnamed.Exchange are getting squeezed. Privacy coins like Monero and Zcash are being delisted not because they’re evil, but because they’re too hard to trace. And when a project like HAI gets hacked and millions of fake tokens are minted, the market doesn’t just crash—it learns. Scams leave fingerprints: zero trading volume, ghost holders, fake team profiles. The crypto crime statistics show a pattern: the riskiest coins are the ones with no transparency, no audits, and no real users.

If you’ve ever wondered why some crypto projects disappear overnight or why your friend lost money on a "free" airdrop, the answer is in the data. The posts below don’t just list scams—they show you how they work, who gets hurt, and how to spot the next one before it’s too late. From China’s underground crypto traders to Russia’s workarounds for withdrawal limits, these stories aren’t theoretical. They’re happening right now. And if you’re holding crypto, you need to know what’s really going on behind the scenes.

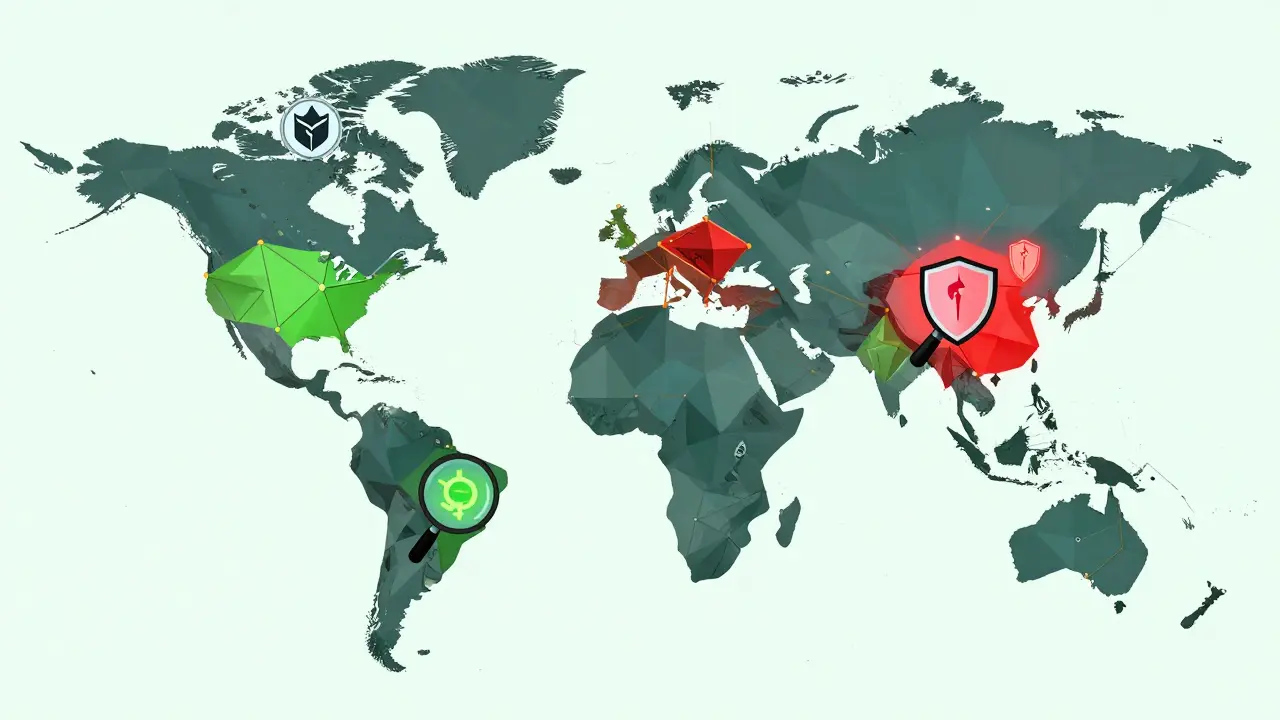

2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

2024-2025 crypto enforcement stats show fraud dropping but sophisticated crime rising. TRON's crime fell after a landmark crackdown, while DeFi and stablecoins become new targets. Global rules are improving - but enforcement still lags.

learn more