Blockchain Compliance: What It Means and Why It Matters for Crypto Users

When you hear blockchain compliance, the set of legal and operational rules that crypto projects and exchanges must follow to operate legally. Also known as crypto regulation, it's not just about government control—it's about keeping your funds safe from fraudsters and rogue platforms. Without it, platforms like NUT MONEY or Digiassetindo can vanish overnight with your money. Compliance isn’t a buzzword—it’s the difference between a working exchange and a ghost site with zero withdrawals.

Blockchain compliance ties directly to crypto exchanges, platforms that handle buying, selling, and storing digital assets under legal oversight. Also known as VASPs, they’re required to verify users with KYC crypto, the process of confirming a user’s real identity before allowing trading. This is why Nigeria’s new crypto laws now force exchanges to get SEC licenses, and why Switzerland tracks your crypto holdings for annual wealth tax. It’s not about spying—it’s about tracing stolen funds and stopping money laundering. And when it comes to AML crypto, anti-money laundering rules that require exchanges to flag suspicious transactions. Also known as crypto anti-fraud, it’s why you can’t just send $50,000 in crypto to a random wallet without the platform asking questions. The Taliban didn’t ban crypto in Afghanistan because they hated tech—they feared untraceable payments. China doesn’t jail traders because they’re anti-innovation—they’re protecting their digital yuan from being undermined. Compliance doesn’t kill innovation. It kills scams.

You’ll see this play out in every post below: from the fake CDONK airdrop that pretends to be CoinMarketCap, to the ghost token GBL with zero supply, to the unlicensed Tsunami.cash that drains wallets. These aren’t just bad projects—they’re violations of basic blockchain compliance. Meanwhile, platforms like BlueBit and JPool follow rules, get audited, and stay online. The difference isn’t luck. It’s structure. Whether you’re checking a new airdrop, trading on a DEX, or holding crypto in Switzerland, compliance is the invisible hand keeping your assets from disappearing. Below, you’ll find real cases, real warnings, and real lessons from the front lines of crypto regulation—no theory, no fluff, just what’s happening now.

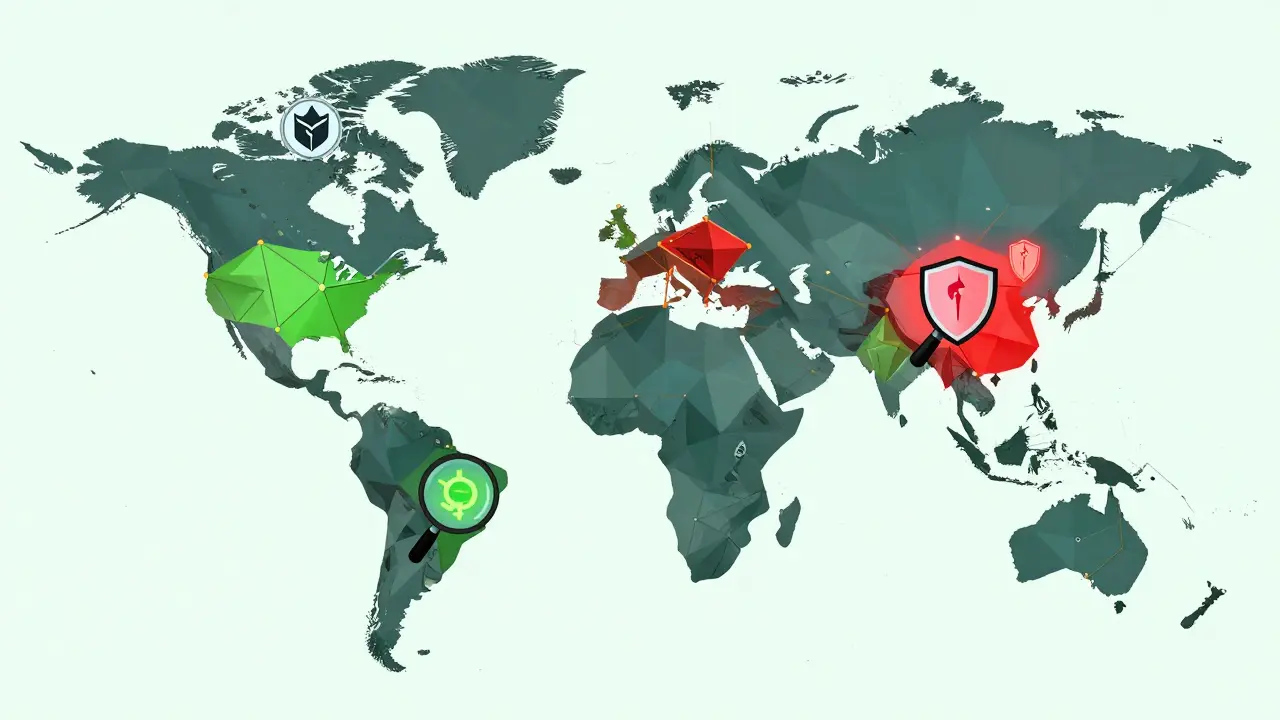

2024-2025 Crypto Enforcement Statistics Worldwide: What’s Really Happening

2024-2025 crypto enforcement stats show fraud dropping but sophisticated crime rising. TRON's crime fell after a landmark crackdown, while DeFi and stablecoins become new targets. Global rules are improving - but enforcement still lags.

learn moreCross-chain Crypto Transaction Monitoring: How to Track Funds Across Blockchains

Cross-chain crypto transaction monitoring tracks funds moving between blockchains like Bitcoin and Ethereum. Essential for compliance, it helps detect money laundering, flag suspicious bridges, and meet global AML rules. Without it, crypto businesses risk fines and shutdowns.

learn more