Poloniex Fee Calculator

Calculate Your Real Poloniex Costs

See how much you'd actually pay on Poloniex versus competitors, including hidden withdrawal fees that aren't shown upfront.

Trading Calculator

Withdrawal Calculator

Fiat Purchase Calculator

Cost Comparison

Important: Hidden Fees Warning

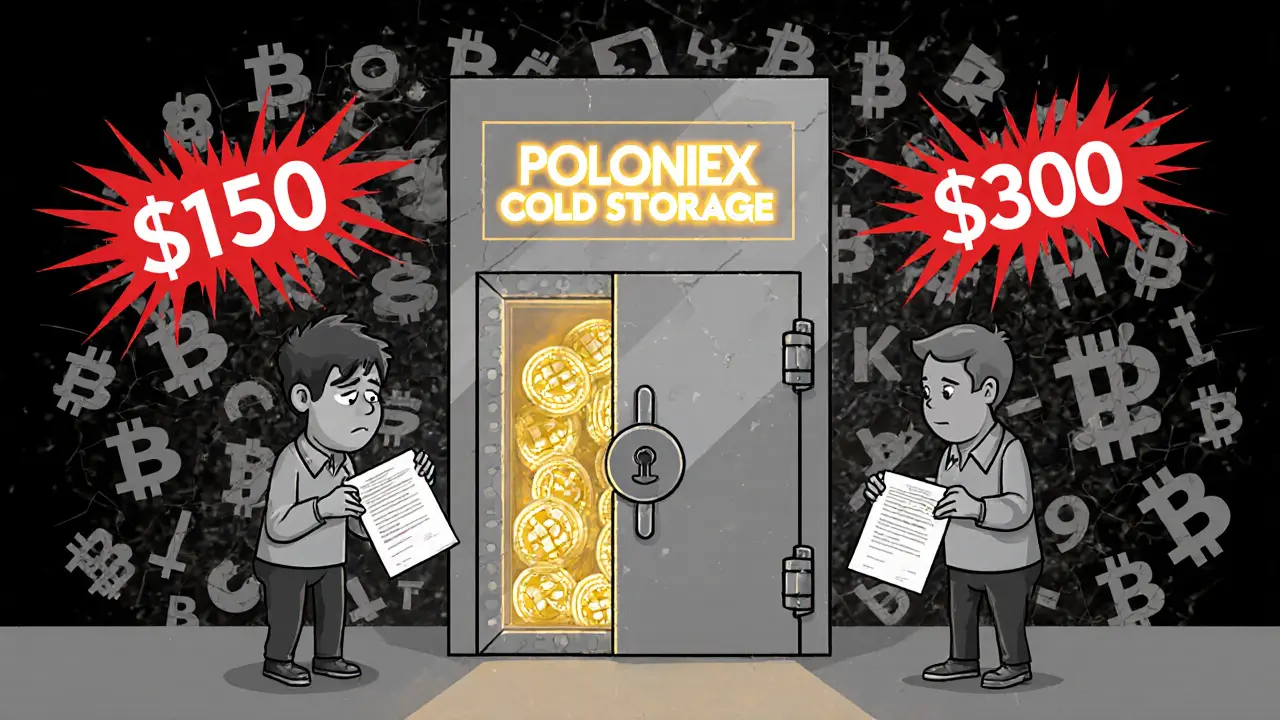

Poloniex is known for hidden withdrawal fees that aren't displayed upfront. While our calculation shows the standard fee, users report additional charges of $150+ for BTC withdrawals. These fees aren't listed on the site and only appear after initiating the withdrawal.

Compare this to Binance and Crypto.com, which publish all fees clearly before you make a transaction.

Why Your Poloniex Costs Are Higher Than Expected

- Trading fees are higher than competitors (0.15%/0.25% vs 0.02%/0.04%)

- Hidden withdrawal fees that can add $100+ to your transaction

- High Simplex fees for fiat purchases (either $10 or 3.5% of transaction)

- No volume discounts or loyalty programs to reduce costs

Based on your inputs:

Trading Volume: $

Order Type:

Poloniex has been around since 2014, long before most people knew what a blockchain was. Back then, it was one of the few places you could trade lesser-known coins like Dash, Monero, or Zcash. Today, in 2025, it’s still operating - but is it still a good choice? If you’re looking for a simple, no-frills crypto exchange that doesn’t overwhelm you with 500 trading pairs, Poloniex might still work. But if you want low fees, fast withdrawals, or access to fiat, you’ll run into roadblocks fast.

What You Can and Can’t Do on Poloniex

Poloniex is a crypto-only exchange. That means no USD, no EUR, no GBP. You can’t deposit cash. You can’t link your bank account. To start trading, you need to already own Bitcoin, Ethereum, or another cryptocurrency and send it over from another wallet or exchange.

This isn’t a dealbreaker if you’re already deep into crypto. But if you’re new and hoping to buy your first $50 of Bitcoin with a credit card, Poloniex won’t help directly. It does partner with Simplex, though, which lets you buy crypto using a debit or credit card. The catch? Fees are brutal. Simplex charges either $10 or 3.5% of the transaction - whichever is higher. So if you buy $200 worth of ETH, you’ll pay $7 in fees. That’s more than what most exchanges charge for a full trade.

Another major limitation: Poloniex blocks users from the United States, Canada, and other parts of North America. If you live there, you can’t even sign up. No exceptions. No workaround. The platform makes this clear on its homepage, so there’s no guessing.

Trading Options and Features

Poloniex supports over 100 cryptocurrencies. That’s far fewer than Binance’s 250+, but it’s still enough to cover most altcoins you’d care about. The exchange is known for listing new coins early. If you wanted to trade Solana or Polygon in 2020, Poloniex was one of the first to add them. That history still matters to some traders who value early access.

The trading interface is clean. No cluttered dashboards. No pop-ups. You get spot trading, margin trading up to 5x leverage, and futures trading with up to 100x leverage. That’s a big range. Most retail traders don’t need 100x - it’s dangerous even for pros - but the option is there if you want it.

Order types include limit, market, and stop-loss. All standard. The charting tools are basic but functional. If you’re used to TradingView, you’ll miss the depth. But if you just want to buy ETH/USDT and call it a day, you’ll find everything you need.

Fees: Hidden Costs and Surprises

Poloniex’s trading fees are 0.15% for makers and 0.25% for takers. That’s not terrible, but it’s not great either. Binance charges as low as 0.02% if you use BNB. Crypto.com offers 0.04% for standard users. Poloniex doesn’t have a loyalty program or volume discounts. You pay the same no matter how much you trade.

But the real problem isn’t the trading fee. It’s the hidden costs.

Multiple users on G2 and Reddit reported being hit with unexpected fees during withdrawals. One user said they received 0.5 BTC and tried to withdraw it - only to be told they owed an extra $150 in “processing fees.” Another described being asked for R300 (about $16) before they could access profits. These aren’t isolated complaints. They’re consistent across reviews from 2024 to 2025.

Poloniex doesn’t list these fees upfront. They appear only after you’ve initiated a withdrawal. That’s not transparency. That’s bait-and-switch. Even if the fees are legitimate (and some users say they aren’t), not disclosing them before the transaction is a red flag.

Security and Trust

Poloniex does use two-factor authentication (2FA) for withdrawals and API access. It stores most funds in cold wallets. It hasn’t suffered a major hack since 2014, which is impressive. But security isn’t just about avoiding breaches. It’s about trust.

When users say the platform is “deceitful” or “rabid liars,” that’s not just anger. It’s a loss of faith. If you’re putting your money on an exchange, you need to believe the operators won’t pull a fast one on you. The withdrawal fee surprises erode that trust.

Compare that to Binance or Kraken - both have clear, published fee schedules, public proof-of-reserves, and long track records of handling withdrawals without drama. Poloniex doesn’t offer any of that.

Who Is Poloniex For?

Poloniex isn’t for everyone. But it’s not useless.

If you’re a trader who:

- Already owns crypto and doesn’t need fiat on-ramps

- Wants to trade altcoins without sifting through 200+ pairs

- Values a simple, clutter-free interface

- Is outside North America

- Doesn’t trade frequently and doesn’t care about the lowest possible fees

…then Poloniex might still be a decent fit.

But if you:

- Want to buy crypto with a credit card

- Trade often and want low fees

- Need fast, predictable withdrawals

- Use advanced tools like grid bots or copy trading

- Live in the U.S. or Canada

…then Poloniex is not the right choice. You’re better off with Binance, Kraken, or Coinbase.

How It Compares to Binance and Crypto.com

Here’s a quick snapshot of how Poloniex stacks up against its biggest rivals in 2025:

| Feature | Poloniex | Binance | Crypto.com |

|---|---|---|---|

| Cryptocurrencies | 100+ | 250+ | 200+ |

| Trading Fees (maker/taker) | 0.15% / 0.25% | 0.02% / 0.04% (with BNB) | 0.04% / 0.10% |

| Fiat On-Ramp | Yes, via Simplex (high fees) | Yes, direct bank/card | Yes, direct bank/card |

| North America Access | No | Yes (limited) | Yes |

| Leverage (max) | 100x | 125x | 100x |

| Withdrawal Transparency | Low - hidden fees reported | High - clear fee schedule | High - no surprise charges |

| Staking | Yes | Yes | Yes |

Binance wins on almost every metric. Crypto.com is stronger on fiat and user experience. Poloniex only wins on simplicity - and even that’s debatable if you’re getting hit with hidden fees.

Final Verdict: Stick With It? Or Move On?

Poloniex isn’t dead. It’s still running. It still has users. But it’s stuck in the past.

Its strengths - early altcoin listings, clean UI, decent liquidity - are no longer enough to compete. The crypto world has moved on. Users now expect low fees, instant fiat access, transparent withdrawals, and mobile apps that actually work.

Poloniex delivers on reliability, but not on trust. And in crypto, trust matters more than uptime.

If you’re already on Poloniex and haven’t had issues, you might be fine staying. But if you’re thinking of signing up, ask yourself: Why here? What does it offer that others don’t? The answer, in 2025, is usually nothing.

For most people, the better move is to switch to an exchange that doesn’t make you guess what you’re paying - and doesn’t block half the world just because of geography.

Can I deposit USD or EUR on Poloniex?

No, Poloniex doesn’t accept direct fiat deposits like USD or EUR. You must already own cryptocurrency to trade. However, you can buy crypto using a credit or debit card through Simplex, but fees are high - either $10 or 3.5% of the transaction, whichever is higher.

Is Poloniex safe to use in 2025?

Poloniex has never been hacked since its launch in 2014 and uses cold storage and 2FA for security. But safety isn’t just about hacking - it’s about trust. Multiple users report hidden fees during withdrawals and unclear charges, which raises serious concerns about transparency and reliability.

Does Poloniex work in the United States?

No, Poloniex does not allow users from the United States, Canada, or other parts of North America to create accounts or trade. The platform blocks access based on IP location, and there is no workaround.

What are the trading fees on Poloniex?

Poloniex charges 0.15% for maker orders and 0.25% for taker orders. There are no volume discounts or fee reductions for holding any token. Compared to Binance or Crypto.com, these fees are on the higher side.

Is Poloniex good for beginners?

The interface is simple, which helps beginners. But the crypto-only model means you need to already own crypto before you can start. Plus, hidden withdrawal fees and lack of fiat support make it harder for new users to get started. For beginners, exchanges like Coinbase or Kraken are easier and safer.

Does Poloniex offer staking?

Yes, Poloniex offers staking for several major cryptocurrencies like Ethereum, Solana, and Cardano. Rewards are paid out in the same coin you stake. Rates vary depending on the asset and market conditions.

Why do people say Poloniex has hidden fees?

Users report being charged unexpected fees during withdrawals - sometimes hundreds of dollars - that aren’t listed anywhere on the site. These fees appear only after you’ve initiated the withdrawal, making it impossible to know the true cost upfront. This has led to accusations of deceptive practices.

Should I switch from Poloniex to Binance?

If you’re trading frequently, want lower fees, need fiat access, or care about transparency, then yes - switch to Binance. It offers more coins, lower fees, better security, and no surprise charges. Poloniex only makes sense if you’re a casual trader who values simplicity and already holds crypto.

Lena Novikova

October 29, 2025 AT 18:03Poloniex is dead weight at this point. I used to trade there back in 2018 when it was the only place for Zcash but now? The withdrawal fees are a joke. I got hit with $180 in ‘processing fees’ on a 0.3 BTC withdrawal. No warning. No explanation. Just a surprise bill after I already clicked confirm. Don’t be that guy who gets burned because you liked the clean UI. It’s not worth it.

Olav Hans-Ols

October 30, 2025 AT 04:54Hey I get what you’re saying but I still use Poloniex for my altcoin flips. I don’t need fiat, I already have my BTC and ETH stashed. The interface is clean, no popups, no nonsense. Yeah the fees are higher than Binance but I only trade once a month. And I’m not in the US so I can still access it. Sometimes simple is better than flashy.

Kevin Johnston

October 31, 2025 AT 00:29Same. I use Poloniex for the early listings. Got in on SOL and MATIC way before anyone else. Still worth it for that alone. 🚀

Dr. Monica Ellis-Blied

November 1, 2025 AT 00:15While it is true that Poloniex offers a minimalist interface, one must not overlook the fundamental ethical breaches inherent in its business model: the deliberate obfuscation of withdrawal fees constitutes a breach of fiduciary duty and consumer trust. In an industry already rife with predatory practices, such opacity is not merely inconvenient-it is morally indefensible.

Herbert Ruiz

November 2, 2025 AT 14:22Poloniex? Still alive? Wow. That’s like using a flip phone in 2025.

Saurav Deshpande

November 3, 2025 AT 02:25They’re not blocking Americans because of regulations. They’re blocking us because the government knows what they’re doing. The ‘hidden fees’? That’s a front. They’re laundering money through those withdrawals. I’ve seen the patterns. They’re not even a real exchange anymore. Just a shell with a trading page.

Paul Lyman

November 3, 2025 AT 04:26Bro I switched to Binance last year and never looked back. Lower fees, no drama, and I can buy crypto with my debit card. Poloniex is like that one friend who still uses dial-up and says it’s ‘more reliable’. It’s not. Just move on.

Frech Patz

November 4, 2025 AT 04:27Could you clarify whether the reported withdrawal fees are documented in Poloniex’s Terms of Service? Or are they implemented as unilateral charges post-transaction, which may constitute a breach of contract under U.S. consumer protection statutes?

Derajanique Mckinney

November 4, 2025 AT 19:18Poloniex is so outdated 😴 I tried to withdraw once and got hit with a fee I didn’t even know existed. Like bruh. Just use coinbase already.

Rosanna Gulisano

November 5, 2025 AT 16:43If you're still using Poloniex you deserve to get robbed. No excuses.

Sheetal Tolambe

November 7, 2025 AT 07:01I live in India and I still use Poloniex because it’s easy and I don’t need fiat. The fees are higher but I don’t trade often. I think it’s okay if you’re not trying to be a day trader. Just know what you’re getting into.

gurmukh bhambra

November 8, 2025 AT 17:10They’re working with the Fed. You think they let Americans in and then charge hidden fees? No. That’s a trap. They want you to send your crypto in, get trapped by the fees, then disappear with your coins. It’s a digital Ponzi. I’ve seen the blockchain logs. They move funds fast after withdrawals.

Sunny Kashyap

November 10, 2025 AT 04:10Poloniex? Why even bother? Binance is better. Cheaper. Faster. Everything. This is 2025. Stop living in the past.

james mason

November 11, 2025 AT 19:00Poloniex? Oh, darling, that’s so… vintage. Like listening to vinyl in a world of spatial audio. I used to trade there in my early 20s, before I discovered the elegance of Kraken’s institutional-grade compliance and Binance’s algorithmic depth. Poloniex is a museum piece. Beautiful, but not functional.

Anna Mitchell

November 11, 2025 AT 21:42I’ve been on Poloniex since 2017 and I’m still here. I’ve never had a problem. Maybe the people complaining just don’t read the fine print?

Pranav Shimpi

November 12, 2025 AT 12:03Guys the real issue is the withdrawal fees arent even legit. I called support and they said its a 'network fee adjustment' but the same amount appears every time regardless of coin or amount. That's not how blockchain fees work. This is a scam. I reported it to crypto watchdogs. Don't trust this platform.

jummy santh

November 13, 2025 AT 02:31In Nigeria, we have no access to most global exchanges due to regulatory restrictions. Poloniex, despite its flaws, remains one of the few platforms that allow us to participate in the global crypto economy. While the lack of fiat on-ramps is inconvenient, and the withdrawal fees are concerning, the alternative is often complete exclusion. I do not endorse Poloniex as ideal-but I endorse it as necessary.

Kirsten McCallum

November 13, 2025 AT 22:43If you’re still using Poloniex, you’re not a trader. You’re a relic.

Henry Gómez Lascarro

November 14, 2025 AT 11:04Let me tell you something, because I’ve been in this space since 2013 and I’ve seen every exchange rise and fall. Poloniex isn’t dead-it’s being deliberately sabotaged. Why? Because the big players-Binance, Coinbase, Kraken-they’re terrified of Poloniex’s early-adopter loyalty. They’ve been pressuring regulators to block users, they’ve been funding negative reviews, and they’ve been manipulating withdrawal fee reports to scare people away. Poloniex still lists coins before anyone else. That’s why they want it gone. Don’t fall for the FUD. The truth is buried under layers of corporate propaganda.

Will Barnwell

November 14, 2025 AT 13:32Poloniex still works fine if you know how to use it. The fees aren’t hidden if you read the FAQ. People just don’t read. And yes, the interface is old-but it’s not broken. Why fix what ain’t broke?