Georgia Crypto Mining Profit Calculator

Your Mining Setup

Business Structure

Market Data

Daily Profitability

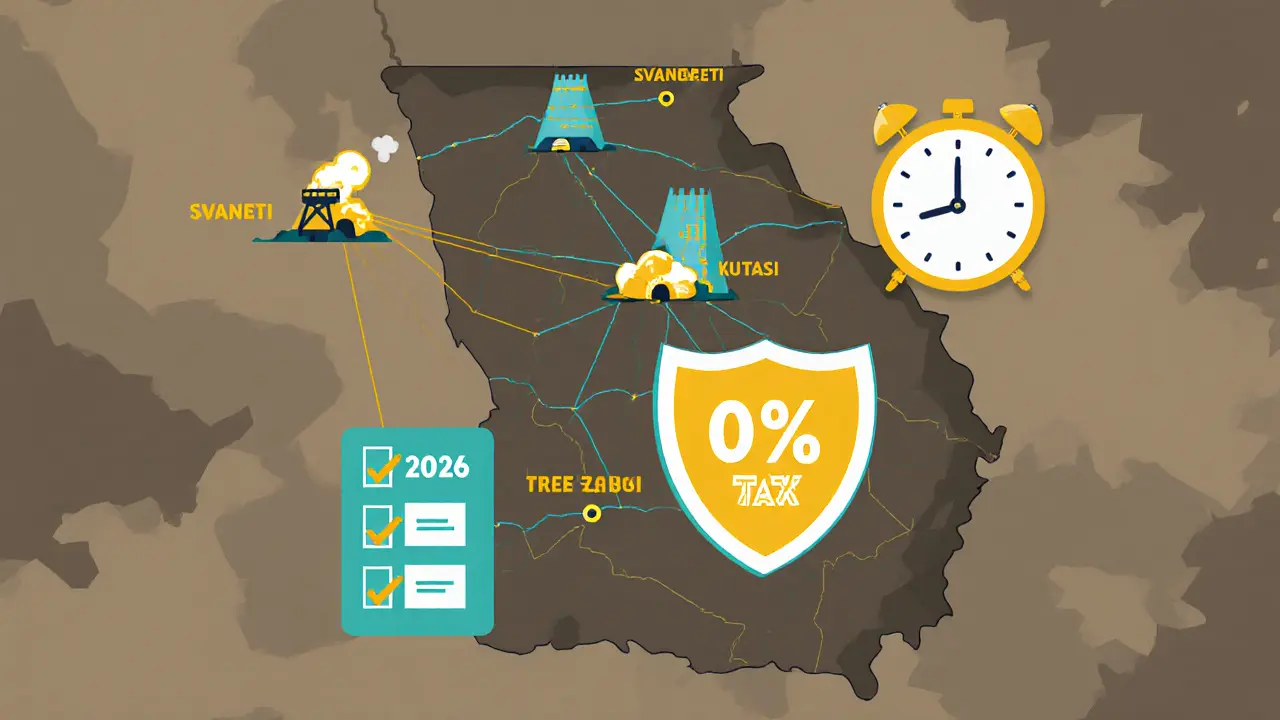

Georgia has become one of the most unexpected hotspots for cryptocurrency mining in the world. While countries like the U.S. and China have cracked down or imposed heavy restrictions, Georgia opened its doors wide - and now, as of 2025, it hosts about 5% of global crypto mining activity. That’s up from less than 1% in 2019. The reason isn’t just cheap power or cold mountains. It’s the clear, business-friendly rules that make it possible to mine legally without fear of sudden shutdowns or surprise taxes.

Is crypto mining legal in Georgia?

Yes. Completely. There’s no ban. No gray area. Individuals and companies can mine Bitcoin, Ethereum, or any other coin without breaking any law. The government doesn’t treat crypto as money - it treats it as property. That’s a big deal. It means when you mine a Bitcoin, you’re not earning income in the traditional sense. You’re acquiring an asset. And for individual miners, that translates to zero taxes on mining profits. No income tax. No capital gains tax. Nothing. That’s rare anywhere in the world.Who regulates crypto mining in Georgia?

The National Bank of Georgia (NBG) is the main authority. It doesn’t regulate mining itself directly, but it controls the broader ecosystem through the Virtual Asset Service Provider (VASP) law. This law, passed in July 2023 and fully rolling out by 2026, requires any business that handles crypto transactions - exchanges, wallets, custody services - to register and comply with strict AML/CFT rules. But here’s the catch: if you’re just mining and not selling, trading, or holding crypto for others, you don’t need a VASP license.What’s the difference between individual and commercial mining?

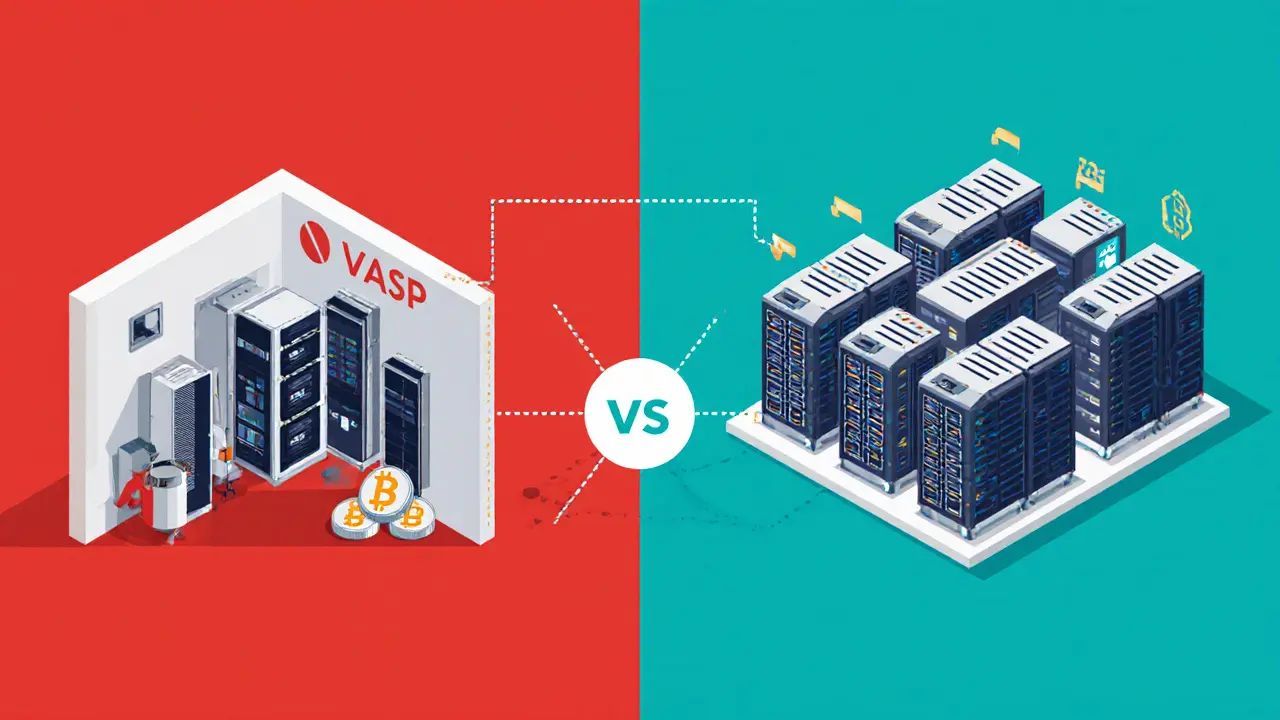

This is where things get practical. If you’re running a few rigs in your garage or a small warehouse, you’re an individual miner. You pay no taxes. You don’t need to register with the NBG. You just plug in, mine, and keep the coins. No paperwork. No fees. But if you’re setting up a 10-megawatt data center in Kutaisi with 5,000 ASICs, you’re a commercial operator. You still don’t need a mining-specific license. But you do need to register your company under Georgia’s standard business laws. You’ll need a business ID, a bank account, and you’ll have to follow general corporate reporting rules. If your company also trades, sells, or manages crypto for clients - even if it’s just converting mined coins to fiat - then you fall under the VASP law and must apply for a license.The two paths to legal operation: VASP vs. Tbilisi Free Zone

Georgia gives businesses two choices to operate legally - and they’re very different. The first is the mainland VASP license. This is for companies that want to operate under full Georgian jurisdiction. It requires:- Company registration in Georgia

- AML/CFT compliance program

- Employee training on anti-fraud rules

- Security audits

- Monthly reporting to the Financial Monitoring Service (FMS)

- 0% corporate tax

- 0% VAT on crypto services

- No currency controls

- Faster registration (under 30 days)

- No requirement to hire local staff

Energy costs and infrastructure

Georgia’s real advantage isn’t just rules - it’s electricity. The country generates most of its power from hydroelectric dams, especially in the mountainous regions. In winter, when water flow drops, the grid has surplus capacity. Mining companies take advantage of that. Many set up in places like Svaneti or Racha, where electricity is nearly free - sometimes even subsidized for industrial users. Crypto mining uses about 2% of Georgia’s total electricity. That’s low compared to countries like Kazakhstan or the U.S., where mining can hit 5-8%. Why? Because Georgian miners use modern, energy-efficient ASICs. They also benefit from naturally cool mountain air, which cuts cooling costs by 30-50%. That means lower operational expenses and higher profit margins.Compliance and risks

Even though the rules are clear, you can’t ignore compliance. The Financial Monitoring Service (FMS) watches for suspicious activity. If your company moves large amounts of crypto without proper KYC records, you could be flagged. The NBG and FMS work closely with the IMF, which pushed Georgia to strengthen its AML rules in March 2024. You must:- Keep records of all mining transactions

- Report any unusual activity

- Verify the identity of clients if you’re a VASP

- Update your compliance system as regulations evolve

Why Georgia beats other mining destinations

Compare Georgia to other popular mining countries:- USA: High electricity costs, state-by-state bans, environmental scrutiny.

- Kazakhstan: Power shortages, sudden tax hikes, political instability.

- Russia: Legal uncertainty, sanctions, banking restrictions.

- China: Complete ban since 2021.

What you need to start mining in Georgia

If you’re an individual:- Buy ASIC miners (e.g., Antminer S21, Whatsminer M50S)

- Find a location with low electricity (mountain areas or industrial zones)

- Connect to the grid (no special permits needed for small-scale)

- Set up a crypto wallet (preferably cold storage)

- Keep records of your mining output for personal accounting

- Decide: mainland VASP or Tbilisi Free Zone?

- Register your business (online via Georgia’s e-Government portal)

- Open a corporate bank account (choose a bank that supports crypto, like TBC Bank or Bank of Georgia)

- Apply for VASP license (if you’re trading or holding crypto for clients)

- Install compliance software for transaction monitoring

- Begin mining and report as required

Future outlook

Georgia isn’t slowing down. The government is building new data centers in Tbilisi and Kutaisi with direct access to renewable energy. It’s negotiating with blockchain firms to host their regional headquarters. The National Bank is exploring a digital lari - a central bank digital currency - which could further integrate crypto into the financial system. Industry experts say Georgia will remain a top-five mining hub through 2030. Why? Because it’s one of the few countries that got the balance right: no bans, low taxes, clear rules, and enough oversight to keep criminals away.Frequently Asked Questions

Do I need a license to mine crypto as an individual in Georgia?

No. Individual miners do not need any license or registration. As long as you’re not running a business or trading crypto for others, you can mine without filing paperwork or paying taxes.

Is crypto mining taxed in Georgia?

For individuals: No. Mining profits are treated as personal property, not income, so there’s no tax. For companies: If you’re registered as a business and sell mined crypto, you may owe corporate tax - unless you’re in the Tbilisi Free Zone, where corporate tax is 0%.

What’s the difference between VASP and Tbilisi Free Zone licenses?

The VASP license is for companies operating under Georgia’s main financial regulations - it requires full AML/CFT compliance and reporting. The Tbilisi Free Zone license is an offshore option with no corporate tax, lighter reporting, and faster setup. Most large mining farms use the FIZ route.

Can I use my home electricity to mine crypto in Georgia?

Yes. Many people start with home mining. There’s no legal limit on how much power you use for mining. However, if your electricity bill spikes dramatically, your utility might ask for an explanation - but that’s rare. Most residential users are not targeted.

How long does it take to get a crypto license in Georgia?

For a Tbilisi Free Zone license: 2-4 weeks. For a mainland VASP license: 3-6 months, depending on how quickly you submit documents and pass audits. The FIZ route is much faster and cheaper for foreign operators.

Eric Redman

November 2, 2025 AT 17:02Jason Coe

November 3, 2025 AT 14:19Brett Benton

November 4, 2025 AT 22:04David Roberts

November 5, 2025 AT 14:35Monty Tran

November 7, 2025 AT 14:33Beth Devine

November 8, 2025 AT 16:44Brian McElfresh

November 9, 2025 AT 22:33Hanna Kruizinga

November 10, 2025 AT 03:55David James

November 10, 2025 AT 14:50Shaunn Graves

November 12, 2025 AT 08:15Jessica Hulst

November 12, 2025 AT 13:16Kaela Coren

November 12, 2025 AT 14:25Nabil ben Salah Nasri

November 13, 2025 AT 06:53alvin Bachtiar

November 14, 2025 AT 14:21Bhavna Suri

November 15, 2025 AT 11:03Eli PINEDA

November 16, 2025 AT 00:26Debby Ananda

November 17, 2025 AT 03:00Vicki Fletcher

November 18, 2025 AT 11:07