Stryke Options Profit Calculator

Options Trading Calculator

Stryke (SYK) isn't just another cryptocurrency. It’s a specialized DeFi protocol built for trading crypto options - a financial tool that lets you bet on whether a coin’s price will go up or down by a certain date. Unlike Bitcoin or Ethereum, SYK doesn’t aim to be digital money. Instead, it powers a platform where users can buy and sell options on assets like WBTC, WETH, and ARB, all without needing a centralized exchange. If you’ve ever wondered how regular traders can access advanced derivatives in DeFi, Stryke is one of the few protocols making it possible.

How Stryke Works: Options Trading Made Decentralized

Stryke operates as a decentralized options exchange. That means users can create or buy options contracts directly on the blockchain. An options contract gives you the right - but not the obligation - to buy or sell an asset at a set price before a specific date. For example, you could buy an option to purchase 1 WBTC at $60,000 in 7 days. If WBTC hits $65,000, you profit. If it stays below, you only lose the premium you paid.

What makes Stryke different is its Concentrated Liquidity Automated Market Maker (CLAMM). This system combines ideas from Uniswap v3 - where liquidity providers concentrate their funds around specific price ranges - with options trading. Instead of spreading liquidity thinly across all prices, Stryke lets users lock funds in tight ranges where options are most likely to be exercised. This boosts capital efficiency and increases yields for liquidity providers.

Users can either buy options (betting on price moves) or sell them (earning premium income). Selling options is especially popular because it generates steady income, similar to collecting rent on a property. But it comes with risk - if the market moves sharply against you, you could owe more than the premium you earned. Stryke’s interface helps manage this by letting you sell your position early to another buyer, reducing your exposure.

The SYK Token: Purpose and Tokenomics

The SYK token is the native currency of the Stryke protocol. It’s used for paying trading fees, earning rewards, and participating in governance. In mid-2024, Stryke replaced its old dual-token system (DPX and rDPX) with a single token: SYK. The conversion was straightforward: 1 DPX became 100 SYK, and 1 rDPX became 13.333 SYK. This simplified the system and improved cross-chain compatibility.

There’s a maximum supply of 100 million SYK tokens. As of late 2025, between 38.5 million and 69 million SYK are in circulation, depending on the data source. That’s a wide range, and it reflects uncertainty around how many tokens are locked in staking or liquidity pools. The token distribution breaks down like this:

- 12.2 million SYK allocated to the Protocol Treasury (for operational costs and future development)

- 40 million SYK reserved for future emissions (incentives, liquidity mining, partnerships)

- The rest is circulating among traders, liquidity providers, and early adopters

Annual inflation is capped at around 3%, meaning new SYK tokens are slowly added to reward participants. This keeps supply growth predictable and avoids sudden dumps that could crash the price.

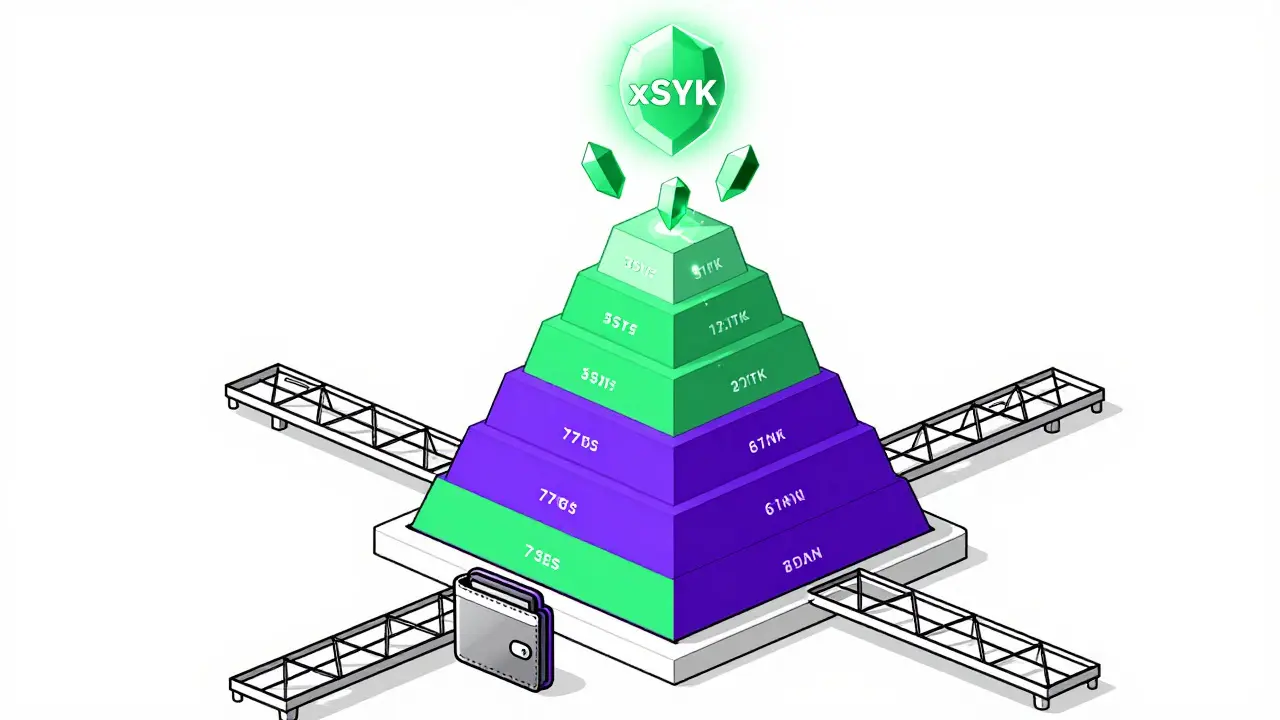

xSYK: The Governance Token

SYK isn’t the only token you’ll interact with. There’s also xSYK, which is used for voting on protocol upgrades, fee structures, and new asset listings. To get xSYK, you lock up SYK for a set period. This process is called vesting.

The vesting system has two key features:

- You can lock SYK for as little as 7 days or as long as 6 months

- If you lock for 7 days, you get back 50% of your SYK after the period ends

- If you lock for 6 months, you get back 100% of your SYK

This design encourages long-term commitment. The longer you lock your SYK, the more governance power you gain - and the more SYK you get back. It’s a clever way to align user incentives with the protocol’s long-term health. xSYK doesn’t have a separate supply limit - it’s just a staked version of SYK.

Where Stryke Runs: Arbitrum and Polygon

Stryke is built on Arbitrum One, a Layer 2 solution for Ethereum that cuts transaction costs and speeds up trades. It also supports Polygon for cross-chain access. This means you can trade options on assets like WBTC or stETH without paying Ethereum mainnet gas fees - which can sometimes hit $50 or more.

The protocol supports a growing list of trading pairs, including:

- WBTC

- WETH

- stETH

- ARB

- SYK

- xSYK

- GMX

- CRV

- CVX

- MATIC

- BOOP

These are mostly high-liquidity assets already popular in DeFi. Stryke doesn’t list obscure tokens - it sticks to what traders actually use. That keeps the platform focused and reduces risk.

How Stryke Compares to Other DeFi Options Platforms

There are other DeFi options protocols out there, like Dopex and Lyra. But Stryke stands out in a few key ways:

| Feature | Stryke (SYK) | dYdX | Dopex |

|---|---|---|---|

| Primary Product | Options (weekly/monthly) | Perpetual futures | Options with capital-efficient pools |

| Blockchain | Arbitrum, Polygon | dYdX Chain (proprietary) | Ethereum, Arbitrum |

| Liquidity Model | CLAMM (concentrated liquidity) | Order book | Rebasing options pools |

| Token Utility | SYK for fees, xSYK for governance | DYDX for fees and governance | DPX for governance and rewards |

| Target Users | Retail traders, yield seekers | Active futures traders | Options traders seeking capital efficiency |

Unlike dYdX, which focuses on perpetual futures (a different kind of derivative), Stryke is laser-focused on options. That makes it simpler for users who want to hedge or speculate without complex leverage. Dopex offers similar features, but Stryke’s CLAMM model gives liquidity providers higher yields by concentrating capital where it’s most needed.

Current Price and Market Data (Late 2025)

As of November 2025, SYK trades between $0.03 and $0.05. Different exchanges report slightly different numbers:

- Bybit: $0.04187374 (market cap ~$1.61M)

- CoinGecko: $0.0242 (market cap ~$1.67M)

- LBank: $0.0305 (market cap ~$2.1M)

The wide range in price and market cap shows low liquidity. Trading volume is minimal - some exchanges even show $-- for 24-hour volume. That means if you try to buy or sell a large amount of SYK, you’ll likely get a bad price due to slippage.

Price forecasts vary. Wallet Investor predicts SYK could reach $0.037 by 2026 and $0.052 by 2030. LiteFinance estimates an average price of $0.0326 in 2025. These are speculative and based on historical trends, not fundamental analysis. No major institutions or analysts have published official reports on Stryke.

Who Should Use Stryke?

Stryke isn’t for beginners. If you don’t know what a liquidity pool is or how to connect a wallet like MetaMask to Arbitrum, you’ll struggle. The interface assumes you already understand DeFi basics.

But if you’re an experienced DeFi user looking to:

- Earn yield by selling options on your crypto holdings

- Protect your portfolio against sudden price drops

- Trade options without KYC or centralized intermediaries

Then Stryke is one of the few tools that can help. It’s especially useful if you’re already active on Arbitrum or Polygon. You can use it to generate income on assets you already own - like stETH or WBTC - without selling them.

Risks and Challenges

There are serious downsides to consider:

- Low liquidity - You might not be able to exit your position quickly

- Complexity - Options trading is inherently risky and hard to master

- Smart contract risk - Bugs or exploits could lead to lost funds

- Regulatory uncertainty - Options are often classified as securities. If regulators target Stryke, the protocol could be forced to shut down or restrict access

- Competition - Established platforms like Dopex and Lyra have more users and funding

Also, the lack of user reviews or community discussion suggests Stryke has a very small user base. That’s not necessarily bad - it can mean less volatility - but it also means fewer eyes on the code and slower development.

Final Thoughts: Is Stryke Worth It?

Stryke (SYK) is a niche product for a niche audience. It’s not going to make you rich overnight. It won’t be on Coinbase anytime soon. But if you’re serious about DeFi and want to explore options trading without relying on centralized exchanges, it’s one of the most technically interesting platforms out there.

The CLAMM model is genuinely innovative. The tokenomics are thoughtful. And the focus on retail traders gives it a different vibe from the institutional-heavy derivatives platforms.

But with low volume, minimal adoption, and no institutional backing, it’s a high-risk, high-reward play. Only invest what you can afford to lose. And if you do, make sure you understand how options work - because in DeFi, there’s no customer support when things go wrong.

What is Stryke (SYK) used for?

Stryke (SYK) is the native token of a decentralized options exchange. It’s used to pay trading fees, earn rewards from liquidity provision, and participate in governance through its staked version, xSYK. The protocol allows users to buy and sell crypto options on assets like WBTC and WETH without needing a centralized exchange.

How do I buy SYK tokens?

You can buy SYK on decentralized exchanges like Uniswap or SushiSwap on the Arbitrum network. First, connect a Web3 wallet like MetaMask, bridge ETH or stablecoins to Arbitrum, then swap for SYK using the token contract address. Avoid centralized exchanges unless they list it - most don’t.

Is SYK a good investment?

SYK is not a traditional investment. It’s a speculative asset tied to the success of a niche DeFi protocol. With low trading volume, minimal adoption, and no institutional backing, it carries high risk. Price predictions are theoretical and not guaranteed. Only consider it if you understand options trading and can afford to lose your entire stake.

What’s the difference between SYK and xSYK?

SYK is the main utility token used for fees and rewards. xSYK is a staked version used for governance. To get xSYK, you lock SYK for a period (7 days to 6 months). The longer you lock, the more governance power you gain and the more SYK you get back when you unlock. xSYK cannot be traded - it’s purely for voting.

Can I lose money trading on Stryke?

Yes, you can lose money in multiple ways. If you buy options and the asset doesn’t move as expected, you lose your premium. If you sell options and the price moves sharply against you, you may owe more than your premium. Liquidity providers can also face impermanent loss. There’s no safety net - all risks are on you.

Why is Stryke’s trading volume so low?

Stryke’s low volume comes from its niche focus. Options trading is complex, and most retail traders stick to spot trading or perpetual futures. Stryke also lacks marketing, listings on major exchanges, and institutional interest. Without volume, liquidity dries up, making it harder for new users to enter or exit positions - a cycle that’s hard to break.

Cheyenne Cotter

December 16, 2025 AT 13:39Stryke's CLAMM model is actually pretty clever - it’s like Uniswap v3 but for options, which means liquidity providers aren’t just wasting capital across a 100x price range. They’re stacking it where the action is. That’s why yields are higher than Dopex’s rebasing pools, even if volume’s trash. Most people don’t get that liquidity concentration isn’t just about efficiency - it’s about reducing impermanent loss in volatile markets. And yeah, the tokenomics are cleaner now that they dumped the DPX/rDPX mess. One token, one system. Simple. Elegant.

But honestly? The real bottleneck isn’t the tech. It’s the user base. Nobody’s gonna trade options on Arbitrum if they don’t even know what a strike price is. And Stryke’s interface doesn’t hold your hand. No tutorials, no tooltips, just a wall of numbers. That’s fine for pros, but it kills adoption. You can’t expect retail to jump in when the onboarding feels like debugging smart contracts.

Also, low volume isn’t just a ‘niche’ problem - it’s a death spiral. No liquidity → big slippage → traders leave → liquidity dries up more. It’s not sustainable unless someone dumps millions into a liquidity mining program. And no one’s gonna do that until there’s traction. Which brings us back to marketing. Or lack thereof.

I’ve watched this play out with 3 other DeFi options protocols. Two died. One got acquired. Stryke’s not dead yet, but it’s in the ICU with the machines beeping slow.

Still… if you’re already on Arbitrum and holding WBTC? Selling weekly options on it via Stryke is the quietest yield farm out there. Just don’t go all-in. And always leave a little buffer for margin calls.

Also, xSYK vesting is genius. Locking for 6 months to get 100% back? That’s not governance - that’s loyalty testing. And it works. The voters are the ones who actually care.

Low volume doesn’t mean low potential. It just means you’re early. And early means risky. But if you believe in decentralized derivatives? This is one of the few places that’s actually building something real, not just rebranding yield farming as DeFi 3.0.

Jesse Messiah

December 17, 2025 AT 06:34Man, I just tried Stryke last week and honestly? I was scared at first - options sound like something Wall Street brokers use to trick people. But once I got past the jargon, it was kinda like renting out your crypto. You give someone the right to buy your WBTC at $60k in a week, they pay you a little fee, and if it doesn’t hit that price? You keep the fee AND your WBTC. Win-win, right?

Only thing I lost was $0.12 in gas, but I made $0.47 in premiums. Not bad for 10 minutes of clicking. I’m gonna do it again next week. Maybe even lock some SYK for xSYK. Gotta vote on stuff, ya know? This stuff matters.

Also, big shoutout to whoever built the UI. It’s not pretty, but it doesn’t crash. That’s a win in DeFi.

Sally Valdez

December 17, 2025 AT 06:42Oh wow, another ‘decentralized finance’ scam pretending to be innovation. Let me guess - next they’ll tell us the SYK token is ‘backed by real assets’ like gold or something? Nah. It’s just another memecoin with fancy charts and a whitepaper written by a grad student who failed econ.

And don’t even get me started on ‘CLAMM’ - that’s just Uniswap with a thesaurus. You think the average person cares about ‘concentrated liquidity’? No. They care about not losing their life savings to a smart contract bug.

And don’t tell me about ‘governance’ - the only thing being governed here is how fast this project gets abandoned. Look at the volume. $1.6M market cap? On a protocol that’s supposed to be the future of DeFi? LOL. This isn’t finance. It’s a casino run by people who think ‘Arbitrum’ is a new iPhone.

Meanwhile, real people are using Coinbase. Real people are making money. Real people don’t need 12 different tokens to buy a damn option.

Wake up. This is the same snake oil they sold in 2021. Just with a new logo.

Sammy Tam

December 18, 2025 AT 13:38Okay but can we talk about how wild it is that Stryke lets you sell options on BOOP? Who even is BOOP? Is that a meme coin? A bot? A glitch in the matrix?

Anyway, I’ve been using Stryke for 3 weeks now and I’ve made more in premiums than I did in 6 months of staking ETH. Not because I’m smart - because the market’s weird and people are desperate to hedge. I sell 1-week WBTC puts every Monday. It’s like a side hustle. Low effort. High reward.

Also, the xSYK vesting thing? I locked mine for 6 months. Not because I believe in governance - but because I want to be the guy who gets to vote when they add SOL options. I’m not noble. I’m greedy. And that’s fine.

Low volume? Yeah. But that’s why it’s quiet. No whales dumping. No drama. Just me, my MetaMask, and a bunch of bots trading options on stETH. It’s weird. But it’s working.

Also, whoever designed the UI - I love you. It’s ugly as sin, but it doesn’t freeze. That’s more than I can say for most DeFi apps.

Emma Sherwood

December 19, 2025 AT 10:38For anyone new to this - don’t be intimidated. Options sound scary, but they’re just insurance for your crypto. If you own WBTC and you’re worried it might drop next week? Sell a put. You get paid. If it drops? You buy more at a discount. If it doesn’t? You keep the cash. It’s that simple.

And Stryke? It’s one of the few places that lets you do this without KYC. No bank. No middleman. Just you and the blockchain. That’s powerful.

I’ve helped 5 friends set up their first options trade on Stryke. All of them were nervous. All of them made a little money. All of them are now hooked. It’s not about getting rich. It’s about taking control. DeFi isn’t just tech - it’s freedom.

And yes, the volume is low. But that’s okay. We don’t need millions. We need people who understand what they’re doing. And that’s what Stryke attracts.

Also - if you’re reading this and thinking ‘this is too complicated’ - start with $5. Just $5. Try selling a 1-day option on 0.001 WBTC. See how it feels. Then decide.

You’ve got nothing to lose. And maybe, just maybe, you’ll learn something real.

Chevy Guy

December 21, 2025 AT 01:59SYK is a honeypot. The whole thing is rigged. You think the devs are selling options? Nah. They’re buying them up with their own wallets. Then they pump the price with fake volume on LBank. Then they dump on Bybit. Watch the price. It always dips right after a big xSYK lock-up period ends. Coincidence? I think not.

Also - why is there a token called BOOP? Who approved that? Who’s the idiot who said ‘yeah let’s list BOOP’? That’s not a crypto asset. That’s a glitch in the code.

And don’t tell me about ‘governance’. The only votes that matter are the ones the devs already decided. The rest is theater. You lock SYK? Cool. You get to vote on whether the logo changes from blue to green.

Low volume? Of course. Nobody’s stupid enough to trade this except the bots and the insiders.

They’re not building a protocol. They’re building a exit scam with a whitepaper.

Kelsey Stephens

December 22, 2025 AT 23:14Just wanted to say - if you’re thinking about trying Stryke, start small. Like, really small. Maybe $10 worth of SYK. Test the waters. Don’t go all-in. DeFi doesn’t forgive mistakes.

But if you do try it - and you make a mistake? That’s okay. Everyone does. I lost $18 on my first trade. I cried. Then I read the docs. Then I tried again. Now I make a few bucks a week. It’s not life-changing. But it’s mine.

Also, the community is tiny, but it’s kind. People actually answer questions. No one laughs. No one calls you dumb. That’s rare.

Just be patient. Be careful. And don’t let the noise of the crypto Twitter trolls scare you off. This isn’t a get-rich-quick scheme. It’s a learning curve. And it’s worth climbing.

Tom Joyner

December 23, 2025 AT 22:26CLAMM is an overhyped rebrand of liquidity concentration. The entire protocol is a derivative of Uniswap v3 with a thin veneer of options theory. The tokenomics are structurally unsound - 40M tokens reserved for future emissions without clear vesting schedules? That’s inflationary overreach disguised as ‘incentives.’

Furthermore, the reliance on Arbitrum is a strategic vulnerability. Should Ethereum L1 fees spike again, or Arbitrum face a critical upgrade failure, Stryke’s entire value proposition collapses. No resilience.

And xSYK? A performative governance token. No real power. No binding votes. Just a placebo for retail users who believe they have agency.

This is not innovation. It’s engineering theater. A well-designed façade for a protocol destined to be absorbed by a larger entity - or abandoned.

Abby Daguindal

December 24, 2025 AT 10:53People who think this is ‘niche’ are delusional. This is a dumpster fire with a whitepaper. Low volume? That’s because no one with sense touches it. You’re not ‘early’ - you’re the last one holding the bag when the devs rug. And don’t even get me started on BOOP. What is BOOP? A bot? A typo? A joke? Either way, listing it proves they have zero standards.

And ‘xSYK governance’? You think locking SYK gives you power? You’re the puppet. They control the strings. You vote on whether to change the color of the button. That’s not governance. That’s gaslighting.

Don’t waste your time. Go trade on Coinbase. At least they’ll refund you when you mess up.

SeTSUnA Kevin

December 25, 2025 AT 11:22Stryke’s CLAMM is the only viable decentralized options model. All others rely on inefficient capital allocation. SYK’s tokenomics are sound: capped supply, controlled inflation, vesting-aligned governance. Volume is low because options are inherently illiquid. This is not a flaw - it’s a feature of the domain.

BOOP is a legitimate LP token from a defunct protocol. It’s listed for historical continuity. Not a joke.

Regulatory risk exists. But so does opportunity. This is the most technically rigorous options protocol on-chain. The rest are derivatives. This is the original.

Not for everyone. But for those who understand - it’s essential.