When you sign up for a crypto exchange like Coinbase or Binance, you’re asked to upload a photo of your ID, take a selfie, and confirm your address. It feels like a hassle-especially if you’re used to the anonymity Bitcoin promised. But this process isn’t just bureaucracy. It’s KYC-Know Your Customer-and it’s now built into almost every major crypto platform. Without it, you can’t buy Bitcoin with your bank account, cash out to your debit card, or trade large amounts. So what exactly is KYC in cryptocurrency, and why does it matter?

Where Did KYC Come From?

KYC didn’t start with Bitcoin. It began in 1970 with the U.S. Bank Secrecy Act, designed to stop criminals from using banks to hide illegal money. After 9/11, the USA PATRIOT Act made it even stricter, forcing banks to verify who their customers really were. This became known as Customer Identification Programs (CIP). By the 2010s, as crypto exchanges started handling real money-dollars, euros, yen-regulators asked: if you’re moving money, you’re a financial institution. And that means you need KYC.In 2013, the U.S. Treasury’s FinCEN officially said crypto exchanges are money transmitters. That changed everything. Suddenly, platforms like Coinbase had to follow the same rules as banks. By 2019, the Financial Action Task Force (FATF), a global watchdog, made it clear: any company dealing with crypto must verify users’ identities. Today, 98% of the top 50 crypto exchanges require KYC. If you’re using a big platform, you’re already in the system.

What Information Do You Need to Provide?

It’s not just a name and email. KYC in crypto asks for real, government-backed proof of who you are. Here’s what most exchanges require:- Your full legal name (exactly as it appears on your ID)

- Your date of birth

- Your current residential address

- A government-issued photo ID (passport, driver’s license, or national ID card)

- A live selfie or video confirming you’re physically present

- Proof of address (a recent utility bill or bank statement)

Some exchanges, especially for larger transactions, will also ask for more:

- Where your money came from (pay stubs, bank statements, tax returns)

- Proof of employment or business ownership

- Details about anyone who owns 25% or more of a company account (called Ultimate Beneficial Owner or UBO)

These aren’t random requests. They’re part of the 5th EU Money Laundering Directive and similar rules in the U.S. and Singapore. The goal? To make sure you’re not laundering drug money, hiding from tax authorities, or funding terrorism.

How Does the Verification Process Work?

It’s not just uploading a photo and waiting. Modern KYC uses technology to catch fraud before it happens:- Identification: You enter your details and upload your ID.

- Document Verification: AI checks your ID for signs of tampering-blurry text, fake holograms, altered photos. It can recognize over 1,200 document types from 200+ countries.

- Liveness Check: You take a selfie or video. The system uses 3D depth sensing to make sure it’s a real person, not a photo or mask.

- Address Verification: Your utility bill or bank statement is cross-checked with public records to confirm you live where you say you do.

- Risk Scoring: Based on your location, transaction history, and ID type, the system assigns you a risk level. High-risk users get asked for more proof.

Most platforms have tiered verification. Basic accounts might let you trade up to $1,000 per day with just a photo ID. Fully verified accounts-those with address proof and source of funds-can trade $50,000 or more. If you’re a serious trader, you’ll need the higher tier.

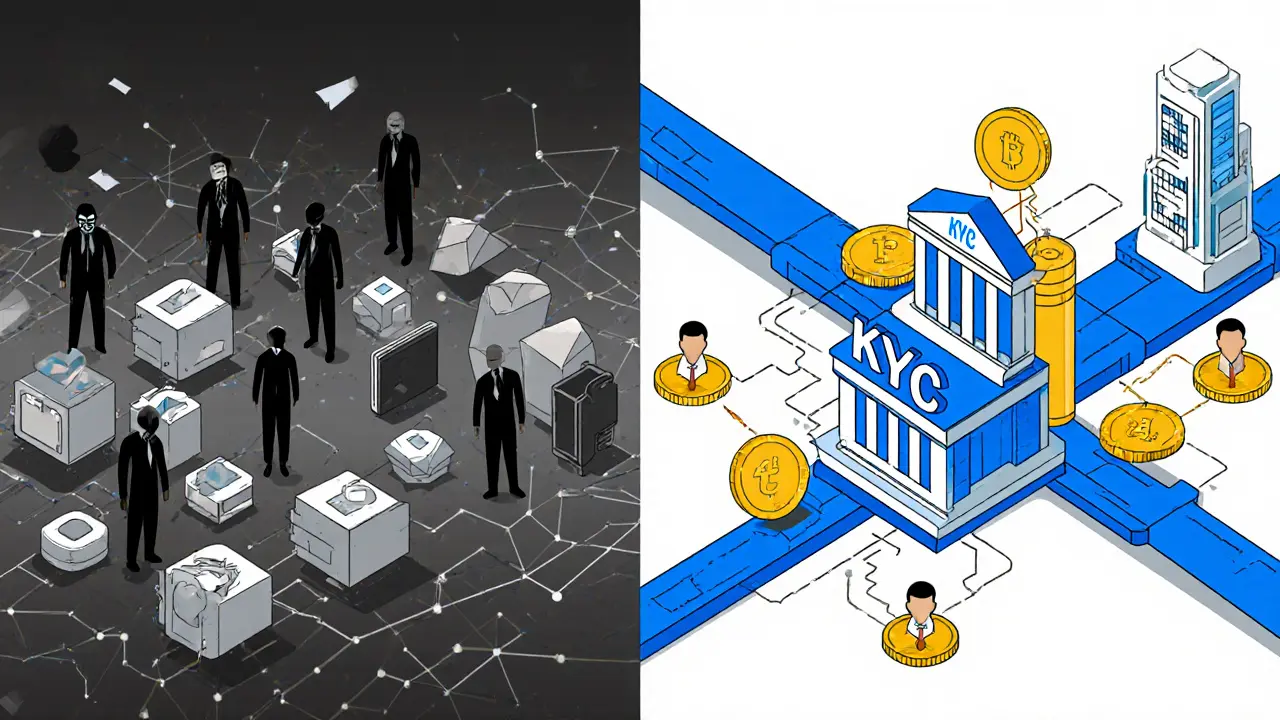

KYC vs. No-KYC: What’s the Real Difference?

You’ve probably heard of decentralized exchanges like Uniswap or PancakeSwap. They don’t ask for ID. You connect your wallet and trade. Sounds great, right? But here’s the catch:- KYC exchanges: Let you buy crypto with your bank account, cash out to your debit card, and access insurance or customer support. 92% of all crypto-to-fiat trades happen here.

- No-KYC platforms: Only let you trade crypto for crypto. You can’t deposit dollars. You can’t withdraw to your bank. And if your wallet gets hacked? No one’s coming to help.

Bitcoin ATMs are another example. About 70% of U.S. ATMs don’t require KYC for transactions under $900. But if you try to buy $1,000 worth of Bitcoin, you’ll be asked to show ID. And even those ATMs are disappearing-regulators are cracking down.

Since 2020, the number of viable no-KYC on-ramps has dropped by 45%. Why? Because governments are making it illegal to operate anonymous crypto services. The EU’s 6th Money Laundering Directive and U.S. rules on mixing services shut down many anonymous platforms. If you want to buy crypto with real money, KYC is your only legal option.

Why Do People Hate KYC?

It’s not just slow-it’s invasive. A 2023 CoinLedger survey found 68% of crypto users worry about handing over their personal data. Reddit threads are full of complaints:- “My ID got rejected because of a shadow on my passport.”

- “Took 72 hours to verify. I just wanted to buy Bitcoin.”

- “I don’t trust them to keep my data safe.”

And it’s not paranoia. In 2022, a major exchange suffered a breach that exposed 300,000 users’ IDs. KYC creates a goldmine of personal data-and hackers know it.

But here’s the flip side: KYC saved one user $12,000 after his Kraken account was hacked. Because his identity was verified, Kraken could prove it was fraud and reverse the transaction. For many, that peace of mind is worth the hassle.

What Are the Biggest Problems With KYC?

Even with all the tech, KYC still has flaws:- Rejected documents: 34% of failed verifications are due to glare, shadows, or expired IDs. Use your phone’s camera in good light. Hold the ID flat. No sunglasses.

- Slow processing: During busy times, verification can take 24-72 hours. Some platforms offer 24/7 chat support (Coinbase does). Others? Email only-wait 2-3 days.

- False security: Harvard researcher Marion Laboure found 72% of illicit funds still pass through KYC exchanges using fake IDs or stolen documents. KYC catches the obvious, but not the clever.

- Global inconsistency: What’s required in the U.S. isn’t the same as in Japan or Brazil. That’s why the FATF is pushing for global standards by 2025.

And then there’s the big question: is KYC even effective? Former FinCEN Director James H. Freis says yes-83% of transactions linked to sanctioned entities were caught because of KYC. But Dr. David L. Shrier argues KYC alone isn’t enough. You need real-time transaction monitoring too.

What’s Next for KYC in Crypto?

The future isn’t about removing KYC-it’s about making it better:- Decentralized identity: Projects like Microsoft’s ION and W3C’s Verifiable Credentials let you prove who you are without handing over your data to a company. You control the info. Only share what’s needed. 23 pilot programs are already running in Europe.

- IRS 1099-DA reporting (2026): If you’re a U.S. taxpayer, you’ll need full KYC to report crypto gains. No KYC? No tax compliance. That could end most anonymous trading for Americans.

- MiCA regulations (EU, 2024): All crypto platforms operating in Europe must now meet strict KYC rules. No exceptions.

- Enterprise adoption: 87% of institutional investors only use KYC exchanges. Banks won’t touch crypto without it.

Deloitte predicts 89% of regulators will expand KYC rules over the next five years-not shrink them. The trend is clear: crypto is becoming part of the financial system. And the system requires identity.

How to Pass KYC Without the Headache

If you’re doing KYC for the first time, here’s how to get it right on the first try:- Use your phone’s camera, not a scanner or desktop webcam. Better lighting = fewer rejections.

- Make sure your ID is current (less than 5 years old) and not damaged.

- Match your name exactly-no nicknames, no typos. If your license says “Robert James Smith,” don’t enter “Rob Smith.”

- For address proof, use a recent bill (under 3 months old) with your full name and address.

- Do the liveness check in a well-lit room. No hats, no masks, no sunglasses.

- If you’re rejected, don’t resubmit the same photo. Take a new one. Glare or shadows are the #1 reason for failure.

Most exchanges let you retry. But if you keep failing, contact support. Coinbase and Kraken offer live chat. Smaller exchanges? Email only. Be patient. It’s worth it.

Is KYC Here to Stay?

Yes. And it’s not going away. Crypto was born with the idea of anonymity. But as it grew into a $3.1 trillion industry, regulators demanded accountability. KYC isn’t perfect. It’s slow. It’s invasive. It can be hacked. But right now, it’s the only way to connect crypto to the real financial world.If you want to buy Bitcoin with your bank account, cash out to your credit card, or trade large amounts safely-you need KYC. If you want privacy? You can still use decentralized exchanges. But you’ll be stuck in a closed loop, unable to move money in or out without going through a KYC platform anyway.

KYC isn’t about trust. It’s about rules. And in the world of money, rules matter. The question isn’t whether KYC should exist. It’s how we make it faster, safer, and more private-without giving up security.

Is KYC mandatory for all cryptocurrency exchanges?

No, but nearly all major exchanges require it. Decentralized exchanges like Uniswap and PancakeSwap don’t require KYC because they don’t hold your funds or handle fiat currency. However, 98% of top exchanges by trading volume enforce KYC, and most countries now legally require it for platforms that convert crypto to real money. If you want to deposit dollars or withdraw to your bank, KYC is unavoidable.

What happens if I don’t complete KYC?

You’ll be limited to small trades or crypto-only transactions. Most exchanges block deposits, withdrawals, and higher trading limits until KYC is complete. Some may freeze your account entirely. In regulated regions like the U.S. or EU, exchanges are required to suspend accounts that don’t verify users. You won’t be able to cash out or use fiat on-ramps.

Can I use crypto without giving my ID to anyone?

Yes, but only in limited ways. You can use decentralized exchanges (DEXs) to trade crypto for crypto, or Bitcoin ATMs for small amounts under $900 in the U.S. But you can’t buy crypto with a credit card, deposit USD, or withdraw to your bank without going through a KYC platform. Also, no-KYC options are shrinking fast due to global regulations.

Why do some KYC verifications take so long?

High traffic, document quality, and manual reviews cause delays. During market spikes or new regulatory deadlines, exchanges get flooded with submissions. If your ID is blurry, expired, or has glare, it gets flagged for manual review-which can take 24-72 hours. Using the exchange’s mobile app with good lighting cuts rejection rates by over 60%.

Is my personal data safe with KYC?

It depends on the exchange. Reputable platforms like Coinbase and Kraken use bank-level encryption and don’t sell your data. But breaches have happened. Always choose well-established exchanges with strong security records. Avoid small, unknown platforms asking for sensitive documents. Also, watch for phishing sites pretending to be KYC portals.

Will KYC ever be replaced by something better?

Not replaced-but improved. New systems like decentralized identity (DID) and verifiable credentials let you prove your identity without giving your documents to a company. You control the data and share only what’s needed. Pilot programs are already live in Europe. These won’t eliminate KYC, but they’ll make it more private and secure. The future is permissioned verification, not mass data collection.

MICHELLE SANTOYO

October 30, 2025 AT 16:52they call it security but it's control dressed up in compliance pajamas

Frech Patz

November 1, 2025 AT 09:28Lawrence rajini

November 1, 2025 AT 22:06like yeah it's annoying but at least I know my funds aren't sitting next to drug money in some shady wallet

Matt Zara

November 2, 2025 AT 00:31it's not about trust it's about not letting the whole system collapse because one exchange got hacked and everyone lost everything

Jean Manel

November 2, 2025 AT 10:0372% of illicit funds still slip through with fake docs

you're just giving the government your ID so they can sell it to advertisers

William P. Barrett

November 3, 2025 AT 05:53Bitcoin promised freedom but freedom without responsibility becomes chaos

KYC is the uncomfortable compromise we made so this could scale beyond basement operations

Cory Munoz

November 4, 2025 AT 12:34I realized this isn't about surveillance

it's about having someone to call when things go wrong

Jasmine Neo

November 5, 2025 AT 05:02if you're not KYC you're not legal

if you're not legal you're not worth my time

why are we even debating this in 2025

Ron Murphy

November 7, 2025 AT 02:06UK exchanges still accept handwritten utility bills while US ones demand notarized affidavits

global standardization is the real next step

Prateek Kumar Mondal

November 7, 2025 AT 14:50if you want to pay rent with crypto you need to prove you are who you say you are

no free lunch in finance

Nick Cooney

November 9, 2025 AT 12:18irony level: max

also i typed this on my phone so forgive the typos

Clarice Coelho Marlière Arruda

November 10, 2025 AT 06:31why is this so hard

my phone is fine

Brian Collett

November 10, 2025 AT 14:37I thought they were the whole point of crypto

so we're just trading tokens in a walled garden now?

Allison Andrews

November 11, 2025 AT 06:22It feels like a performance of security rather than actual security

we're measuring the wrong things

Wayne Overton

November 13, 2025 AT 03:54KYC is the end of crypto

get used to it

Lena Novikova

November 13, 2025 AT 10:37you don't need to give your passport to Coinbase

you just prove you're not a bot and move on

why is this so hard to understand