NFT DeFi: How Non-Fungible Tokens Power Decentralized Finance

When you hear NFT DeFi, the fusion of non-fungible tokens with decentralized finance protocols that let you borrow, lend, and trade digital assets without banks. Also known as NFT-backed finance, it’s not just about owning a cool image—it’s about using that image as collateral, a ticket, or a share in a game economy. Most people think NFTs are just JPEGs you buy for hype, but in DeFi, they’re functional tools. A single NFT can unlock a loan, earn yield in a liquidity pool, or give you voting rights in a DAO. The real shift isn’t in how you look at art—it’s in how you look at ownership.

DeFi protocols like Aave and MakerDAO started with ERC-20 tokens, but now they’re integrating NFTs through standards like ERC-1155, which lets one contract handle both fungible and non-fungible assets. That’s why blockchain games are moving fast—they need one system to manage weapons, currency, and skins. But here’s the catch: most NFTs don’t actually hold their value because their metadata lives on a server that could vanish tomorrow. If the link between your NFT and the digital asset breaks, your token becomes a digital ghost. That’s why projects using IPFS or Arweave for storage have a real edge—they’re built to last.

Liquidity pools powered by NFTs are another growing area. Instead of locking up ETH or USDC, some protocols let you stake NFTs to earn fees from trades. But that comes with risks—impermanent loss hits harder when the asset isn’t liquid, and rug pulls are common when teams abandon projects after a pump. The NFT DeFi space is full of hype, but only a few projects survive because they solve real problems: giving gamers true ownership, letting collectors earn passive income, or letting creators monetize without middlemen.

What you’ll find below isn’t a list of shiny new tokens. It’s a collection of real stories—why the FEAR NFT airdrop vanished, how HAI tokens got flooded by hackers, and why that "NAMA Protocol" airdrop you saw online was never real. These aren’t warnings for beginners—they’re lessons for anyone who’s ever clicked "claim your free tokens." The truth about NFT DeFi isn’t in the price charts. It’s in the code, the storage, and the people behind the projects.

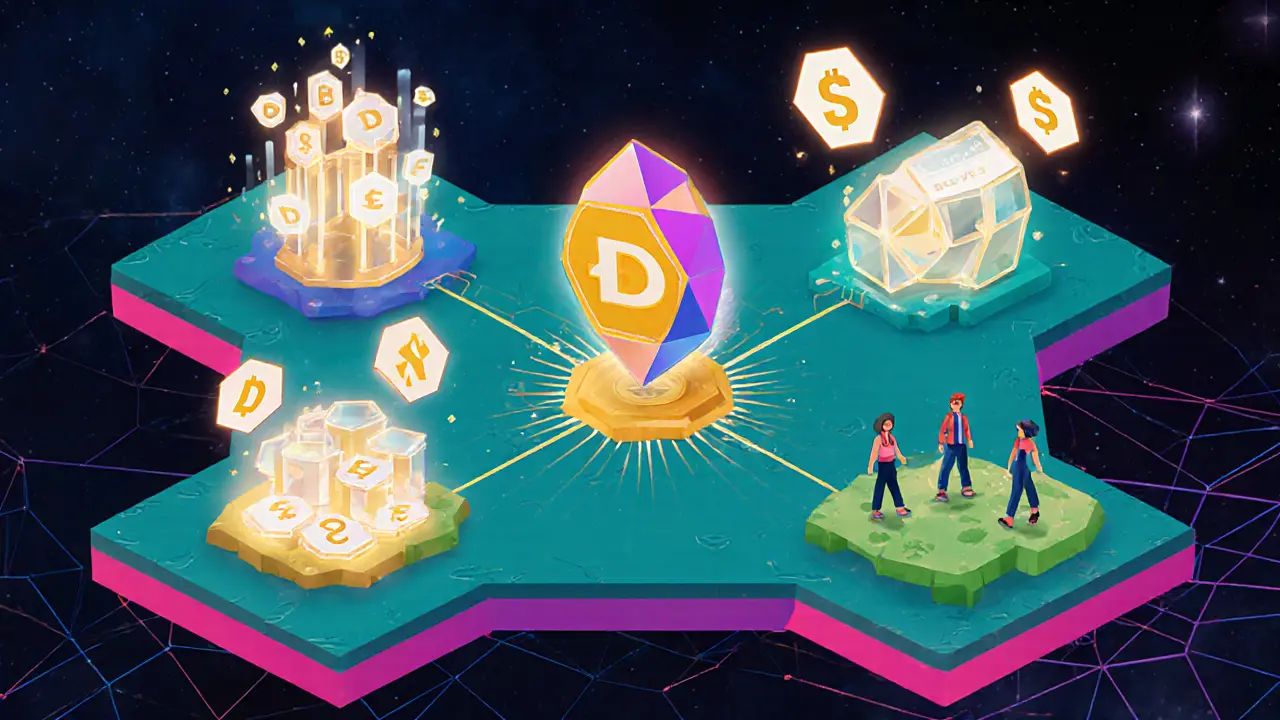

What is Dego Finance (DEGO) Crypto Coin? A Clear Breakdown of the NFT+DeFi Ecosystem

Dego Finance (DEGO) is a Web3 ecosystem that combines DeFi, NFTs, and a metaverse into one platform. Learn how the DEGO token powers staking, NFT minting, governance, and virtual worlds - and whether it's more than just another crypto coin.

learn more