LABS price: What drives the value of this crypto token and where to find real data

When you look up LABS price, a cryptocurrency token tied to a blockchain-based project, often associated with decentralized computing or AI infrastructure. Also known as LABS token, it’s one of many niche tokens that appear on exchanges but rarely have clear utility or trading volume. Most people chasing the LABS price are either hoping for a quick gain or confused by fake listings. The truth? The token’s value isn’t driven by market demand—it’s often manipulated by low-liquidity pools and bot-driven trades.

What actually moves the LABS price? Not fundamentals. Not adoption. Usually, it’s hype from obscure social media groups or fake volume on small DEXs. You’ll see price spikes on CoinGecko or CoinMarketCap, but check the trading pairs—most are paired with unstable tokens like USDT or BNB on platforms with zero user base. Real projects with lasting value, like those using Decentralized Finance (DeFi), a system of financial applications built on blockchain that removes intermediaries like banks, have transparent liquidity, audits, and active communities. LABS doesn’t. And that’s why you’ll find more posts about abandoned tokens like Zayedcoin or GemSwap than real analysis on LABS.

There’s also confusion with similar-sounding tokens. Some users mix up LABS with AI cryptocurrency, tokens designed to reward users for contributing computing power to train AI models, like τemplar (SN3). But LABS isn’t built for AI training. It doesn’t have a working product, public roadmap, or team. If you’re looking for real value in crypto, focus on projects with verifiable code, active GitHub commits, and exchange listings on reputable platforms like RabbitX or Aster—not obscure DEXs with no traffic.

Don’t chase the LABS price because someone posted a screenshot of a 500% gain. That gain likely vanished the next hour. Real crypto trading isn’t about guessing which random token will pop—it’s about understanding what gives a token value in the first place. You’ll find dozens of posts below that break down exactly how to spot the difference between a real project and a ghost token. Some show you how to check liquidity. Others expose fake exchanges. One even walks through how to verify if a token’s contract is locked. All of them are based on real data, not rumors.

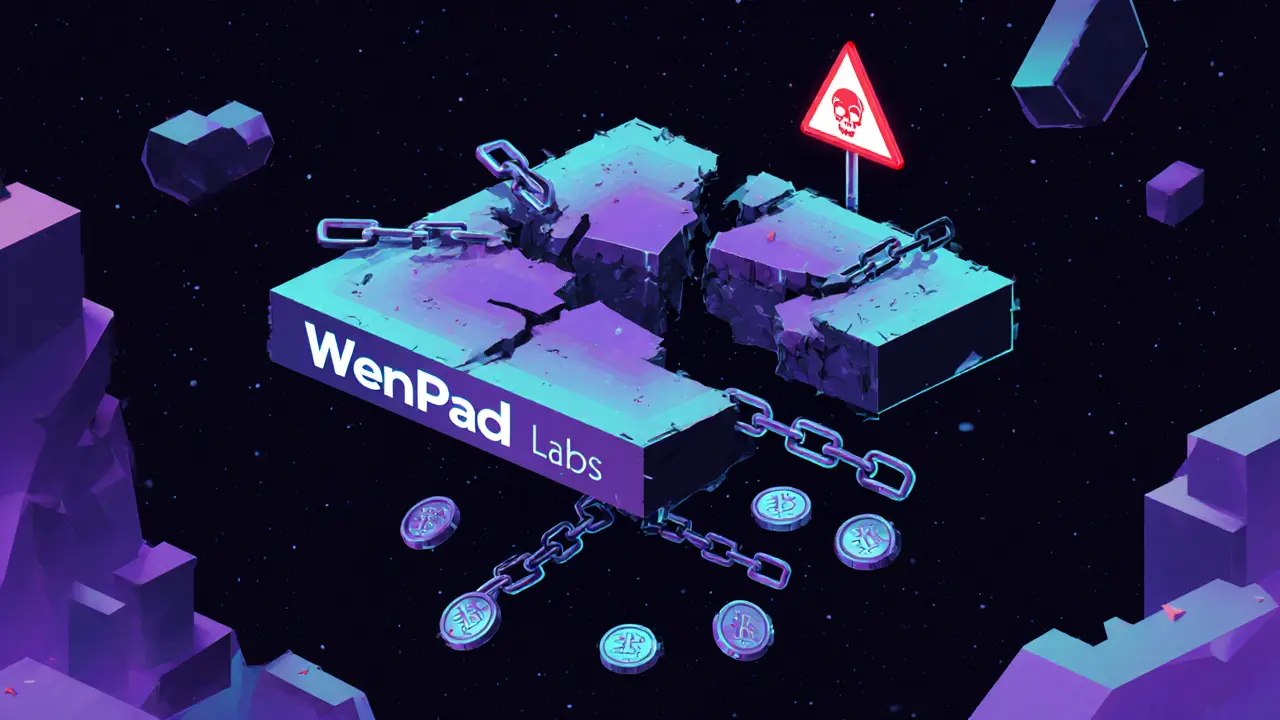

What is WenPad Labs (LABS) crypto coin? Real risks, no liquidity, and why most investors avoid it

WenPad Labs (LABS) is a crypto launchpad with almost no trading volume, no exchange listings, and zero community trust. Despite promises of investor protection, it's inactive, unaudited, and likely to be abandoned.

learn more