LABS crypto: What it is, why it matters, and the projects you should know

When people talk about LABS crypto, crypto projects built to develop new blockchain tools, protocols, or infrastructure. Also known as blockchain R&D initiatives, it refers to teams that don’t just launch tokens—they build the engines behind them. These aren’t meme coins or speculative bets. They’re the quiet builders: the teams writing smart contracts, testing consensus models, or creating decentralized infrastructure that others later use.

LABS crypto often overlaps with blockchain innovation, the process of improving how blockchains handle scale, security, and usability. Think of it like software development, but for money systems. Projects like crypto R&D, structured efforts to solve core problems in decentralization, privacy, or interoperability usually come from universities, venture-backed teams, or open-source collectives. They’re the ones making things like Starknet, zk-Rollups, or decentralized oracles possible. Without them, exchanges like RabbitX or Aster wouldn’t exist—and airdrops like BAKE or τemplar (SN3) wouldn’t have the tech to run.

What you’ll find here isn’t hype. It’s hard analysis. You’ll read about tokens tied to actual research—like τemplar (SN3), which pays users to train AI models using their hardware. You’ll see why exchanges like Lifinity or GemSwap failed not because of bad marketing, but because they skipped the fundamentals LABS crypto teams build. You’ll learn how compliance costs and KYC rules affect the real-world viability of new projects. These aren’t guesses. They’re post-mortems, technical breakdowns, and user reports from people who tried the tools and walked away—or stayed.

If you’ve ever wondered why some crypto projects last and others vanish, the answer starts with LABS crypto. It’s not about how loud a team is on Twitter. It’s about what they actually built, who’s using it, and whether it works under pressure. Below, you’ll find real examples—some successful, some abandoned—each one showing what happens when theory meets reality in crypto.

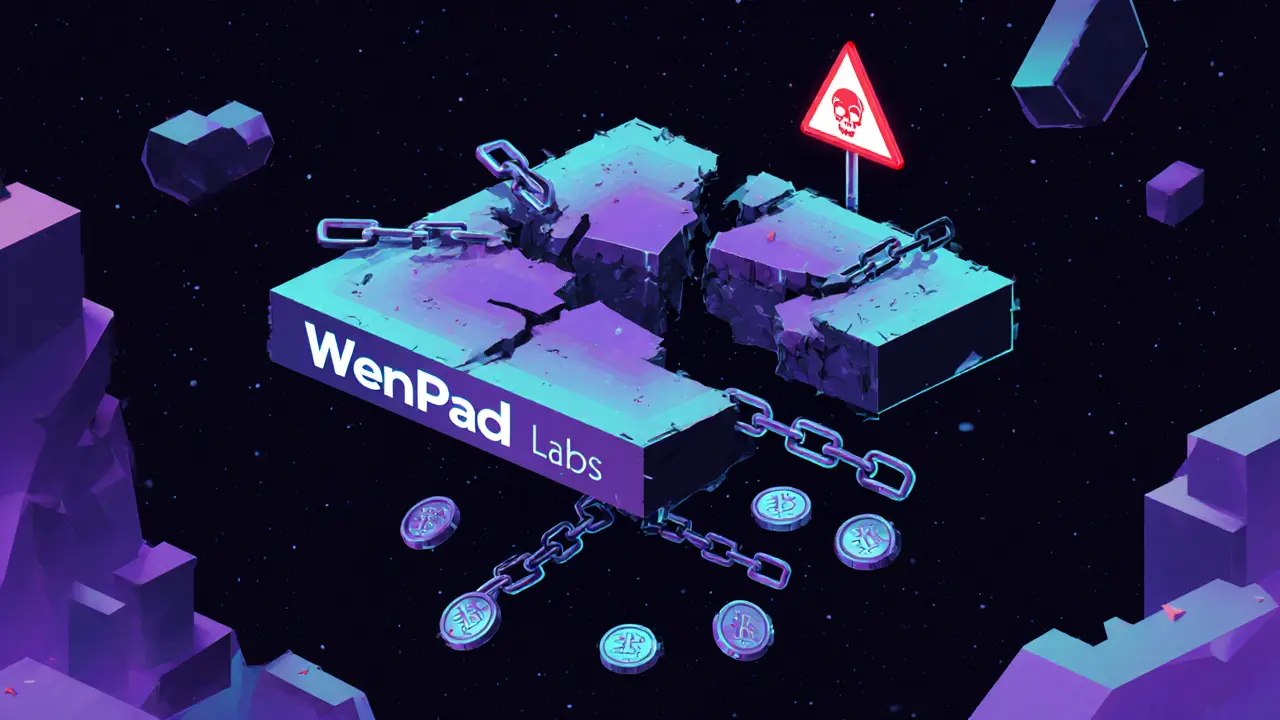

What is WenPad Labs (LABS) crypto coin? Real risks, no liquidity, and why most investors avoid it

WenPad Labs (LABS) is a crypto launchpad with almost no trading volume, no exchange listings, and zero community trust. Despite promises of investor protection, it's inactive, unaudited, and likely to be abandoned.

learn more