Crypto Coin: What They Are, How They Work, and What You Need to Know

When you hear crypto coin, a digital asset built on a blockchain that acts as a medium of exchange or store of value. Also known as cryptocurrency, it’s not just digital money—it’s code that runs on decentralized networks, secured by math, not banks. Unlike traditional money, crypto coins don’t need a central authority to exist. They’re created, transferred, and verified by thousands of computers around the world. Some, like Bitcoin, are meant to be digital gold. Others, like DAI or USDC, are designed to stay steady in value—these are called stablecoins, crypto coins pegged to real-world assets like the US dollar to reduce volatility. Then there are coins built for specific uses: Monero for privacy, DEGO for NFT trading, or BICITY that promised AI tools but vanished overnight.

Crypto coins don’t work in isolation. They rely on blockchain, a public digital ledger that records every transaction across a network of computers to stay secure and transparent. But not all blockchains are the same. Some use proof-of-work, which eats massive amounts of electricity—this is why countries like Sweden and China are cracking down. Others use proof-of-stake, which is far more efficient and now powers most major coins. The difference matters because it affects how fast transactions go, how much they cost, and whether the network can survive regulation. Then there’s DeFi, a system of financial apps built on blockchains that let you lend, borrow, or trade without banks. Many crypto coins exist just to fuel DeFi protocols—like Lido’s stETH or Aave’s AAVE—giving users control over their money without middlemen.

But here’s the truth: most crypto coins fail. Out of thousands launched, only a handful have lasting value. Some collapse because the team disappears. Others get banned by regulators, like Monero and Zcash in 2025. Some are outright scams, like the fake NAMA or MONES airdrops that trick people into handing over private keys. Even big-name airdrops, like ElonDoge or FEAR NFT tickets, often lead to nothing. That’s why knowing the difference between a real project and a shell game is more important than chasing the next pump. You don’t need to understand every technical detail—but you do need to ask: Is this coin solving a real problem? Is the team real? Is the code open? Is it being used, or just hyped?

The posts below cut through the noise. You’ll find deep dives into how crypto coins are regulated in places like South Korea, Bolivia, and Russia. You’ll see how stablecoins like USDC and DAI are used in DeFi. You’ll learn why ERC-1155 changed how NFTs work, and how BIP39 seed phrases protect your coins. You’ll also find warnings about scams, failed projects, and exchanges that look safe but aren’t. This isn’t a list of hot tips—it’s a practical guide to what actually matters when you’re dealing with crypto coins in 2025.

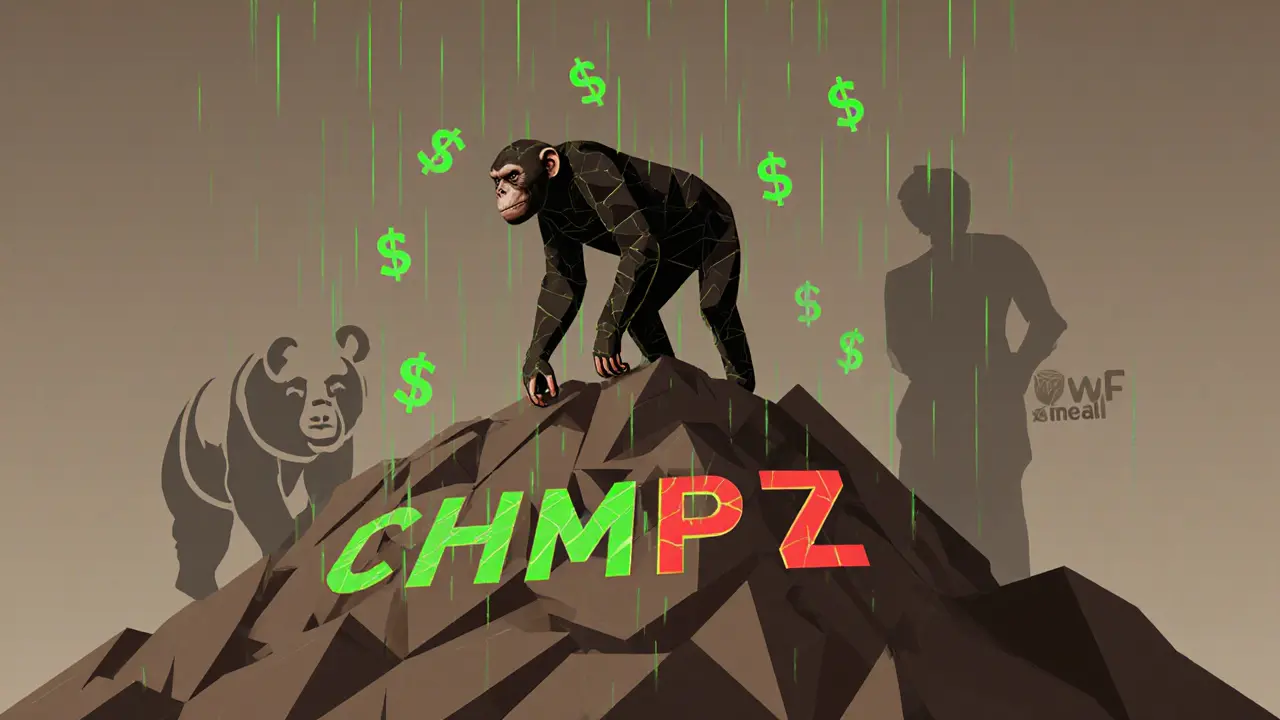

What is Chimpzee (CHMPZ) Crypto Coin? Facts, Risks, and Real-World Impact

Chimpzee (CHMPZ) is a crypto token promising passive income and animal conservation - but it lacks proof of donations, has extreme volatility, and trades only on small exchanges. Here's what you really need to know before buying.

learn more