Airdrop Value Calculator

Is This Airdrop Worth Your Time?

Based on the lessons learned from the SMAK X CoinMarketCap airdrop failure, this calculator helps you assess the real potential of any airdrop.

Low volume (<$10k) means little interest; high volume (>100k) shows real demand

Multiple major exchanges indicate trust and liquidity

Regular GitHub commits and team updates are critical for sustainability

Can you use the token for fees, governance, or rewards?

Based on the SMAK case study, this tool evaluates key factors that determine if an airdrop has real value or is just hype.

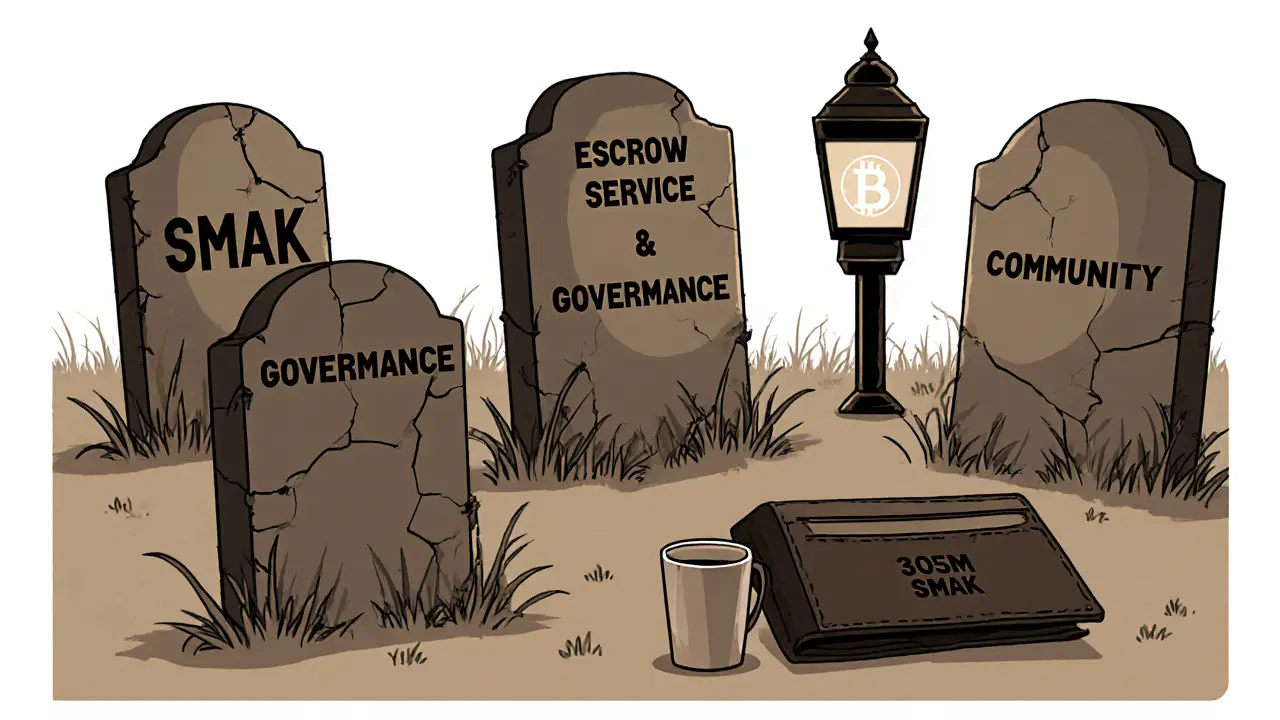

The SMAK airdrop on CoinMarketCap in September 2021 looked like a solid opportunity. $20,000 in free tokens, promoted by one of the most trusted crypto data sites, and backed by a project claiming to solve real problems in Web 3.0 transactions. Thousands signed up. Many thought they’d caught a rising star. Four years later, SMAK trades at $0.00012 - down 99% from its peak. The airdrop didn’t fail because it was poorly run. It failed because the project never delivered on its promise.

What Was the SMAK Airdrop?

In September 2021, Smartlink launched its first major campaign: a $20,000 SMAK token airdrop distributed exclusively through CoinMarketCap. The campaign ran from September 13 to September 23, 2021. To qualify, users had to complete simple tasks - follow Smartlink on Twitter, join their Telegram group, and verify their CoinMarketCap account. No deposit. No lock-up. Just free tokens for basic engagement. CoinMarketCap was the perfect platform for this. At the time, it was the go-to source for crypto data, used by millions daily. Getting your airdrop listed there meant instant visibility. Smartlink didn’t just drop tokens - they dropped them where the crowd already was. The SMAK token was meant to power Smartlink’s decentralized escrow service. Think of it like PayPal’s escrow, but without a company in the middle. Buyers and sellers on Web 3.0 platforms could lock funds in a smart contract. Money would only release when both sides confirmed delivery. For digital goods, freelance work, or peer-to-peer sales, this made sense. Especially in a space full of scams. Smartlink built on Tezos, a blockchain known for low fees and energy efficiency. That wasn’t just a technical choice - it was a strategic one. Ethereum was expensive. Solana was unstable. Tezos offered reliability without the cost. Smartlink’s team claimed their escrow system could handle C2C, B2C, and B2B transactions. They even had a built-in payment processor and a decentralized marketplace. It sounded like a full-stack Web 3.0 solution.Why Did People Join?

People didn’t join because they deeply understood escrow protocols. They joined because it was free money. In 2021, airdrops were everywhere. Every week, a new project promised tokens. Most were hype. A few turned into winners. SMAK felt like one of the legit ones - backed by CoinMarketCap, clearly explained, with a working website and active social channels. The token distribution was straightforward: 305 million SMAK were allocated to the airdrop. That’s a lot. For comparison, Uniswap’s initial airdrop in 2020 gave out 400 million UNI. SMAK’s supply was massive, but so was the ambition. The idea was simple: give tokens to users, hope they use the platform, and create network effects. But here’s what no one talked about: what happens after the airdrop? Most projects treat airdrops as a marketing tactic. Smartlink treated it like a launchpad. That’s where things started to unravel.What Was Supposed to Happen After the Airdrop?

Smartlink didn’t just want people to hold SMAK. They wanted them to use it. The token wasn’t just a reward - it was a key. Holders got fee discounts on escrow services. They earned rewards for locking tokens. And, most importantly, they could vote on platform upgrades. Governance. Decentralization. Real utility. The problem? No one used the platform. By late 2021, the escrow service was live. The marketplace was up. The payment processor worked. But there were no users. No sellers. No buyers. Without transactions, the escrow system had no reason to exist. Without escrow, the token had no reason to be used. It became a circular problem: no utility → no demand → no price → no interest. Compare that to projects like Polygon or Arbitrum. They didn’t just give away tokens. They partnered with big apps. They integrated with top DeFi protocols. They made sure their tokens were needed before the airdrop. Smartlink built a tool nobody asked for.

Why Did the Price Crash?

The SMAK token peaked at $0.005 shortly after the airdrop. By early 2022, it was at $0.001. Today? $0.00012. That’s a 97.6% drop from its high. The crash wasn’t just market-wide. It was project-specific. While Bitcoin and Ethereum recovered from the 2022 bear market, SMAK kept falling. Why?- No trading volume: The 24-hour volume is $0. That means no one’s buying or selling. It’s not illiquid - it’s dead.

- Only one exchange: Gate.io is the only place you can trade SMAK. No Binance. No KuCoin. No Coinbase. That’s a red flag. Exchanges don’t list tokens without volume or demand.

- Supply confusion: CoinMarketCap lists 305 million tokens in circulation. Other sources say 0. That’s not a typo. It’s a sign of broken reporting - or worse, fake data.

- No development: The last major update to Smartlink’s website was in 2022. GitHub commits stopped. Twitter went quiet. Telegram groups turned into ghost towns.

What Went Wrong?

Smartlink made three fatal mistakes.- They solved a problem no one had. Escrow services for Web 3.0? Great idea - if people were doing peer-to-peer trades at scale. But most crypto buyers just buy Bitcoin on Coinbase and hold. Most sellers use OpenSea or GumGum. They don’t need a decentralized escrow. They trust the platform.

- They didn’t partner with anyone. No marketplaces integrated Smartlink. No dApps used it. No influencers promoted it beyond the initial airdrop. It existed in a vacuum.

- They didn’t build trust after the airdrop. Airdrops create hype. But long-term adoption needs transparency, updates, and communication. Smartlink vanished after September 2021.

What Can You Learn From This?

If you’re thinking about joining an airdrop today, here’s what to ask:- Does the project have real users? Look for active dApps, transaction counts, or live integrations. Not just a whitepaper.

- Is the token actually used? Can you pay fees with it? Can you vote? Or is it just a reward?

- Who’s behind it? Are the team members known? Do they post updates? Or is the team anonymous with no social proof?

- Where is it listed? If it’s only on obscure exchanges, that’s a warning. Legit projects get listed on Binance, Kraken, or Coinbase.

- What’s the volume? If the 24-hour volume is under $10,000, it’s not a project - it’s a speculation trap.

Is SMAK Still Active?

As of October 2025, the Smartlink website is still online. The GitHub repo exists. The Telegram group has 1,200 members - but only 3 active posts in the last 6 months. The token still trades on Gate.io, but the order book is empty. No new features. No team updates. No roadmap. It’s a zombie project. The tokens are still in wallets. The price still ticks down. But nothing moves. No one cares.Final Thoughts

The SMAK X CoinMarketCap airdrop was a textbook example of how not to build a crypto project. You can get millions of eyes with a free token drop. But if you don’t build something people actually need - and keep building it - you’re just throwing money into the void. Airdrops aren’t free money. They’re free attention. And attention without utility is worthless. If you still hold SMAK, you’re holding a digital relic - a reminder that in crypto, the loudest launch doesn’t always win. The most useful one does.Was the SMAK airdrop real?

Yes, the SMAK airdrop was real. It ran from September 13 to September 23, 2021, through CoinMarketCap’s official airdrop portal. Thousands of users received SMAK tokens by completing simple tasks like following Smartlink on social media and verifying their CoinMarketCap account. The $20,000 allocation was funded by the Smartlink team and distributed as claimed.

Can I still claim SMAK tokens from the airdrop?

No. The airdrop campaign ended in September 2021. The claim period was strictly time-limited, and no extensions were offered. Any website or social media post claiming you can still claim SMAK tokens is likely a scam. The only way to get SMAK now is to buy it on Gate.io - if you want to.

Why is SMAK worth so little today?

SMAK’s price crashed because the Smartlink platform never gained real users. Without transactions on its escrow service or marketplace, the token had no utility. No demand meant no price. Trading volume dropped to $0, and the token was delisted from all major exchanges except Gate.io. The team stopped updating the project, and community interest faded completely.

Was Smartlink built on Ethereum?

No. Smartlink was built on the Tezos blockchain. The team chose Tezos for its low transaction fees, energy efficiency, and strong smart contract security - all advantages over Ethereum at the time. This was a deliberate move to avoid high gas costs and network congestion.

Is SMAK a good investment now?

No. SMAK is not a good investment. The token has no trading volume, no active development, and no real-world use. The price is essentially meaningless because no one is buying or selling. Holding SMAK now is like holding a digital artifact - it has historical interest, but zero financial value.

What happened to the Smartlink team?

After the airdrop in 2021, the Smartlink team stopped posting updates. Their social media accounts went silent. No new blog posts, no GitHub commits, no community AMAs. The website remains online but hasn’t been updated since 2022. There’s no public information about whether the team disbanded, moved on to other projects, or simply lost interest.

Can I use SMAK tokens for anything today?

No. The Smartlink escrow service, marketplace, and payment processor are no longer functional or accessible. Even if you hold SMAK tokens, you cannot use them to pay fees, earn rewards, or vote on governance. The platform’s smart contracts still exist on the Tezos blockchain, but they are inactive and unsupported.

Why did CoinMarketCap host this airdrop?

CoinMarketCap hosted the SMAK airdrop because it was part of their official airdrop program, which allowed new projects to promote themselves to CoinMarketCap’s user base. Projects paid a fee or provided marketing value to be listed. The airdrop wasn’t an endorsement - it was a paid promotion. CoinMarketCap doesn’t vet projects for long-term viability; they just provide a platform for exposure.

Alisa Rosner

October 30, 2025 AT 07:47OMG I got SMAK tokens and thought I was rich 😭😭 Now I just see it as a reminder to never trust free crypto again. So sad. I still check my wallet like a ghost haunting my own life.

MICHELLE SANTOYO

October 30, 2025 AT 08:01james mason

October 31, 2025 AT 16:19Look, I mean no offense to anyone who participated - I really don't - but if you thought a $20k airdrop on CoinMarketCap was a real investment opportunity, you were never meant to be in crypto. This isn't a cautionary tale. It's a Darwinian selection event. The project didn't fail. The participants did. You didn't ask why the escrow model was unnecessary. You just saw free money. And now you're mad? Honey, the market doesn't owe you a pension.

Anna Mitchell

November 2, 2025 AT 09:44Even though SMAK didn't work out, I'm glad someone wrote this. It's so easy to get swept up in hype. This is a good reminder to look at what's actually being built - not just what's being given away. Keep sharing these lessons 💪

Pranav Shimpi

November 3, 2025 AT 05:34bro i was one of those who got smak tokens… i thought it was legit… but then i checked the contract… and it was on tezos… but the balance was zero… like… the site said 305m… but blockchain explorer showed 0… i was so confused… then i realized… they never minted it… just made the website look real… sad… i lost 2 hours of my life…

jummy santh

November 3, 2025 AT 11:29Let me say this with the utmost respect: the SMAK episode is not merely a crypto story - it is a mirror held up to the global digital age. We have become a civilization addicted to instant gratification, mistaking visibility for value, and exposure for legitimacy. The project did not collapse because of poor execution - it collapsed because humanity, in its haste, forgot to ask: ‘Does this serve a purpose beyond the click?’ The airdrop was not the sin. The silence after was.

Kirsten McCallum

November 4, 2025 AT 19:10Henry Gómez Lascarro

November 6, 2025 AT 01:35People keep saying 'SMAK failed because it didn't deliver utility' - but that’s the lazy, surface-level take. The real issue is that crypto has become a carnival of marketing masquerading as innovation. CoinMarketCap didn’t vet the project - they monetized eyeballs. The team didn’t build for users - they built for airdrop harvesters. And the users? They didn’t care about escrow protocols - they cared about how many zeroes they could screenshot before the price dropped. This isn’t a project failure. It’s a cultural failure. We’ve normalized speculation as participation. We’ve turned blockchain into a lottery ticket with a whitepaper. And now we’re shocked when the ticket expires? Wake up. This wasn’t an exception. It was the rule.

Will Barnwell

November 6, 2025 AT 11:45Why does everyone act like this is shocking? Every airdrop is like this. 99% are dead on arrival. The only difference with SMAK is that it had CoinMarketCap’s logo on it - so people thought it was safe. Newsflash: CMC doesn’t care if your project lives or dies. They care if you pay them. That’s it. Stop acting like this was a betrayal. It was a business transaction. You just got played by the system you pretended not to understand.

Lawrence rajini

November 6, 2025 AT 14:07Honestly I still check SMAK every now and then like it's my lucky charm 🤞 Maybe one day someone picks it up again? Or maybe it's just a lesson in patience and realism. Either way - I'm glad I learned this early. No more free token FOMO for me. 🙌

Matt Zara

November 7, 2025 AT 13:59Some people are treating this like a tragedy. But honestly? This is how crypto evolves. Most ideas die. The ones that survive? They didn’t start with airdrops. They started with real users, real problems, and real persistence. SMAK didn’t have that. And that’s okay. It’s not a failure - it’s data. We learn from the dead projects so the living ones can grow. Keep writing posts like this. They matter more than any token price.

Jean Manel

November 8, 2025 AT 02:26Let’s be real - anyone who held SMAK past Q1 2022 was either delusional or emotionally attached to their loss. This wasn’t a project. It was a vanity metric for a team that wanted to burn $20k on a vanity airdrop and vanish. The fact that people still defend it or check the price like it’s a living thing? That’s the real tragedy. You’re not holding an asset. You’re holding a monument to your own naivety. Stop romanticizing the corpse.

William P. Barrett

November 9, 2025 AT 16:06The SMAK airdrop reminds me of the ancient Greek concept of ‘hubris’ - excessive pride leading to downfall. The project didn’t fail because of technical flaws. It failed because its creators believed that visibility equaled legitimacy, and that distribution equaled adoption. But adoption requires resonance - not just a button to click. The token was never meant to be used. It was meant to be claimed. And once claimed, the story ended. That’s not innovation. That’s theater. And like all theater, when the lights go out, nothing remains but silence.

Cory Munoz

November 10, 2025 AT 19:55I know some of you still hold SMAK and feel bad about it. I get it. I’ve been there. But please - don’t blame yourself. The system was designed to make you feel like you missed out. But you didn’t miss out on anything valuable. You just got caught in the noise. That’s not your fault. You’re not behind. You’re just learning. Keep asking questions. Keep reading. That’s how you win in crypto - not by holding dead tokens, but by growing your mind.

Jasmine Neo

November 11, 2025 AT 15:16Let me break this down for the Americans who think 'free money' is a strategy: You gave your data to a platform that monetizes attention. You took tokens from a team that never had a business model. You believed CoinMarketCap was a seal of approval - not a sponsored ad slot. This isn’t crypto. This is capitalism with blockchain branding. The only thing that failed was your critical thinking. And if you’re still holding SMAK? You’re not a holder. You’re a liability. Get out. Now. Before you start believing in ghost tokens like they’re crypto saints.