Why Quantum Key Distribution Matters for Crypto Right Now

Imagine a future where today’s strongest encryption - the kind protecting your Bitcoin wallet or exchange login - gets broken overnight. Not because someone cracked the code, but because a quantum computer solved it in seconds. This isn’t science fiction. It’s the real threat looming over blockchain and crypto systems. That’s where quantum key distribution comes in. Unlike traditional methods that rely on math puzzles, QKD uses the laws of physics to make eavesdropping impossible. If someone tries to intercept the key, the quantum state changes, and you know instantly. For crypto, where keys are everything, this isn’t just an upgrade - it’s a survival tool.

How QKD Actually Works (No PhD Required)

Here’s the simple version: Alice wants to send a secret key to Bob. Instead of sending bits like 0s and 1s, she sends individual photons - tiny particles of light - each with a specific quantum state. These states could be polarized at 0°, 45°, 90°, or 135°, representing bits in different ways. Bob doesn’t know which polarization to check for each photon, so he guesses randomly. After transmission, they compare which measurement bases they used (not the actual bits) over a regular internet connection. Only the bits where their bases matched become part of the final key. Any eavesdropper, Eve, has to measure the photons to read them. But measuring quantum particles changes them. If Eve interferes, the error rate spikes. Alice and Bob detect that spike and throw the whole key away. No data stolen. No guesswork. Just physics doing the work.

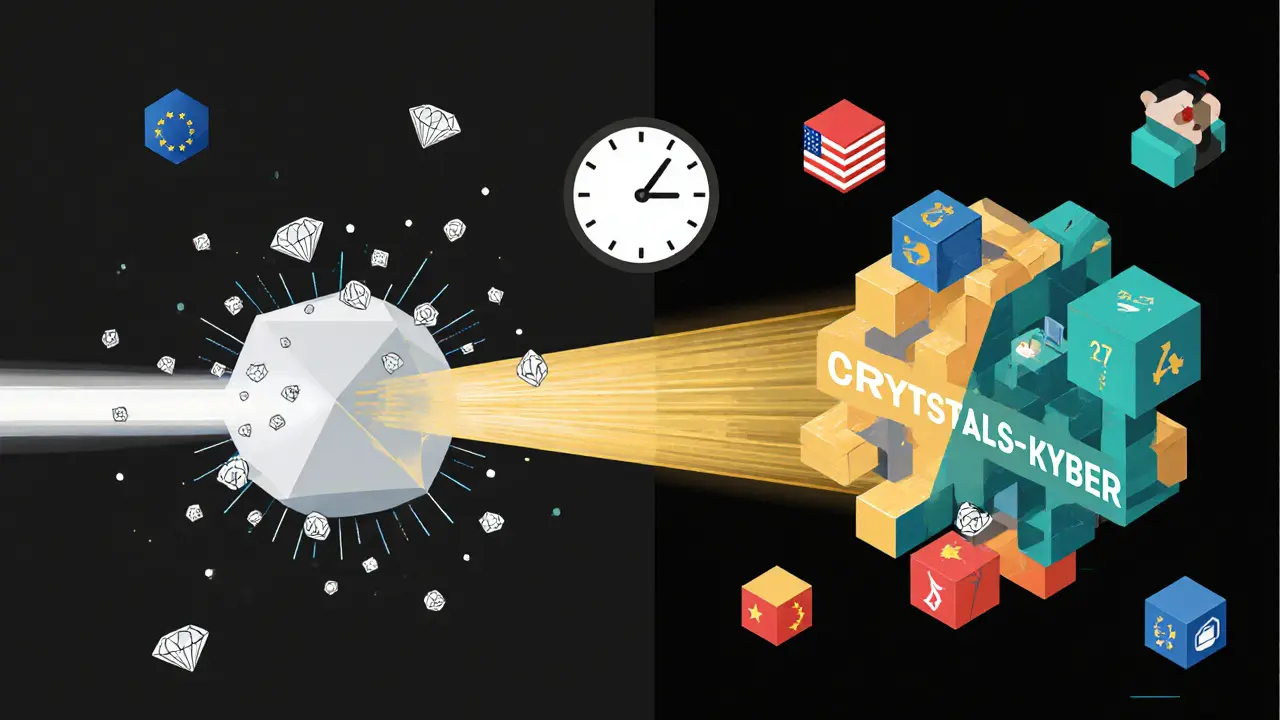

QKD vs. Post-Quantum Cryptography: Two Paths, One Goal

There are two main ways to fight the quantum threat: QKD and post-quantum cryptography (PQC). PQC is software-based. It replaces today’s RSA or ECC algorithms with new math problems that even quantum computers can’t solve quickly. NIST is already standardizing these, with CRYSTALS-Kyber leading the pack. The big plus? You can update your existing systems with a software patch. No new hardware. No rewiring. QKD, on the other hand, needs special equipment: lasers that emit single photons, ultra-sensitive detectors cooled to near absolute zero, and fiber optic lines with perfect alignment. It’s expensive - $50,000 to $100,000 per node. But here’s the catch: PQC can’t tell you if someone’s trying to crack it. QKD can. If you’re securing a blockchain node that holds millions in assets or a government ledger, knowing an attack is happening in real time is priceless. For most crypto users, PQC is the practical choice. For institutions with the budget and need for absolute assurance, QKD is the gold standard.

Where QKD Is Already Being Used in Crypto and Finance

It’s not just theory. Switzerland has used QKD to secure its electronic voting system since 2007. China runs a 4,600-kilometer quantum backbone between Beijing and Shanghai, protecting financial and government traffic. The European Union’s EuroQCI project is building a continent-wide quantum network, set to finish by 2027. In the U.S., the Department of Energy operates a 500-mile quantum network across Illinois. These aren’t experiments - they’re operational systems handling real data. Financial institutions in London, Zurich, and Tokyo are testing QKD between data centers to protect cross-border transactions. Even though it’s rare in retail crypto, major exchanges and custody providers are watching closely. The UK’s National Cyber Security Centre now requires QKD for all new high-assurance communication systems by 2025. If your crypto operation handles institutional funds, regulatory pressure is coming.

The Real Problems with QKD (And Why It’s Not for Everyone)

Let’s be honest: QKD has serious flaws. First, distance. In fiber optics, photons get lost. After 300-500 km, the signal is too weak. You need quantum repeaters - still experimental - to go further. Second, speed. QKD keys are generated at maybe 10 Mbps. Compare that to your home internet at 1 Gbps. That’s why QKD doesn’t encrypt your data directly. It only refreshes AES-256 keys every few minutes. Third, cost. You’re not just buying a box. You need engineers who understand quantum optics, not just Python. Training a team takes 6-12 months. Fourth, hardware hacks. In 2010, researchers showed that commercial QKD devices could be tricked by blinding the detectors with bright light. The protocol is perfect. The hardware? Not so much. If you’re a small crypto project or a retail trader, QKD is like using a tank to commute to work. Overkill. But if you’re running a cold storage vault for a hedge fund or a sovereign wealth fund? Then it’s the only option that gives you true, physics-backed security.

What You Need to Get Started with QKD

If you’re seriously considering QKD, here’s what you’re signing up for. First, pick a vendor. ID Quantique, Toshiba, and QuintessenceLabs are the leaders. Their systems come as hardware units you install at both ends of a fiber link. Second, lay the fiber. You need a dedicated, stable optical channel. No sharing with regular internet traffic. Third, integrate. QKD doesn’t talk to your blockchain node directly. You need a key management system that takes the quantum-generated key and feeds it into your AES-256 encryption engine. Fourth, train your team. At least one person needs a deep understanding of quantum mechanics and optical engineering. Most QKD operators hold master’s or PhDs in physics. Fifth, plan for maintenance. Temperature changes cause fiber to twist slightly, messing up photon polarization. You’ll need active compensation systems. And you’ll need to monitor error rates 24/7. It’s not plug-and-play. It’s a full-time security operation.

The Future: Hybrid Systems Are the Real Answer

Experts agree: the future isn’t QKD or PQC. It’s QKD and PQC. Imagine this: QKD generates ultra-secure keys for your most critical assets - your master wallet, your exchange’s hot wallet, your node’s signing key. PQC handles authentication, user logins, and transaction signatures. You get the best of both: detection of attacks from QKD, and scalable, software-friendly security from PQC. Companies like IBM and Cisco are already building hybrid platforms. China’s Micius satellite proved you can do QKD across continents. The EU’s EuroQCI will connect 27 countries. By 2027, most high-security blockchain networks will use this combo. For crypto, that means your security won’t just be strong - it’ll be future-proof, layered, and auditable. The question isn’t whether you need quantum security. It’s whether you’re ready to act before your competitors are.

Is QKD Worth It for Your Crypto Project?

Ask yourself: Are you securing millions in assets? Are you regulated? Do you have a team with physics or optical engineering skills? Do you have a dedicated fiber link? If you answered yes to all four, QKD might be your next move. If you’re a solo trader, a DeFi protocol, or a small NFT marketplace? Stick with PQC. Use NIST’s standardized algorithms. Update your software. Monitor for threats. You’re not falling behind - you’re being smart. QKD isn’t for everyone. But for those who need it, there’s no alternative. The laws of physics don’t negotiate. And in crypto, where trust is everything, that’s worth more than any algorithm.

Kymberley Sant

November 1, 2025 AT 19:02Matthew Affrunti

November 2, 2025 AT 23:32mark Hayes

November 3, 2025 AT 21:58Masechaba Setona

November 4, 2025 AT 07:00Phyllis Nordquist

November 5, 2025 AT 23:24bob marley

November 6, 2025 AT 22:45Brett Benton

November 8, 2025 AT 18:17Derek Hardman

November 8, 2025 AT 19:00Edgerton Trowbridge

November 10, 2025 AT 05:53Sammy Krigs

November 12, 2025 AT 00:53naveen kumar

November 12, 2025 AT 08:26Jeremy Jaramillo

November 13, 2025 AT 13:46Eric Redman

November 14, 2025 AT 20:51Eliane Karp Toledo

November 15, 2025 AT 09:33