Running a blockchain business without the right licenses isn’t just a paperwork oversight-it’s a legal time bomb. You might think that because blockchain is decentralized, rules don’t apply. But governments aren’t waiting for permission to act. From crypto exchanges to NFT marketplaces, token issuers to DeFi platforms, if you’re operating commercially in the U.S. or EU and haven’t secured the proper licenses, you’re already in violation. And the penalties aren’t gentle.

Why Licensing Matters in Blockchain

Blockchain isn’t lawless. It’s a tool. And like any tool used for financial services, it’s regulated. The core purpose of licensing in this space isn’t to stifle innovation-it’s to protect consumers, prevent money laundering, and ensure financial stability. The Financial Crimes Enforcement Network (FinCEN), the Securities and Exchange Commission (SEC), and state-level financial regulators all treat crypto businesses the same way they treat banks, money transmitters, and investment firms-if you’re handling other people’s money or assets, you need to be licensed.For example, if you run a crypto exchange that lets users trade Bitcoin for USD, you’re a Money Services Business (MSB) under U.S. federal law. That means you must register with FinCEN, implement AML/KYC procedures, and file suspicious activity reports. Skip that? You’re operating without a license. Same goes for platforms that issue tokens that function like securities. The SEC doesn’t care if your token is called a "utility token"-if it behaves like an investment, it’s a security. And selling unregistered securities is a federal offense.

What Happens When You Skip the License

The consequences aren’t theoretical. In 2023, the SEC shut down a DeFi lending platform called BlockLend for operating without registering as a broker-dealer or securities exchange. The founders faced civil penalties of $2.3 million, were barred from the industry for five years, and had to refund $17 million to users. That’s not a fine. That’s a business death sentence.State-level penalties are just as harsh. In New York, you need a BitLicense to operate any crypto business involving transmission or storage of digital assets. In 2022, a Brooklyn-based crypto wallet provider was fined $750,000 for operating without one-even though they claimed they were "just a tech company." The state didn’t buy it. They had custody of user keys. That’s a regulated activity. Period.

And it’s not just about money. Criminal charges are real. In 2023, a Florida-based NFT marketplace operator was indicted on federal charges of unlicensed money transmission after processing over $45 million in crypto transactions. He faced up to five years in prison. His defense? "I didn’t know I needed a license." The court didn’t care. Ignorance isn’t a legal shield.

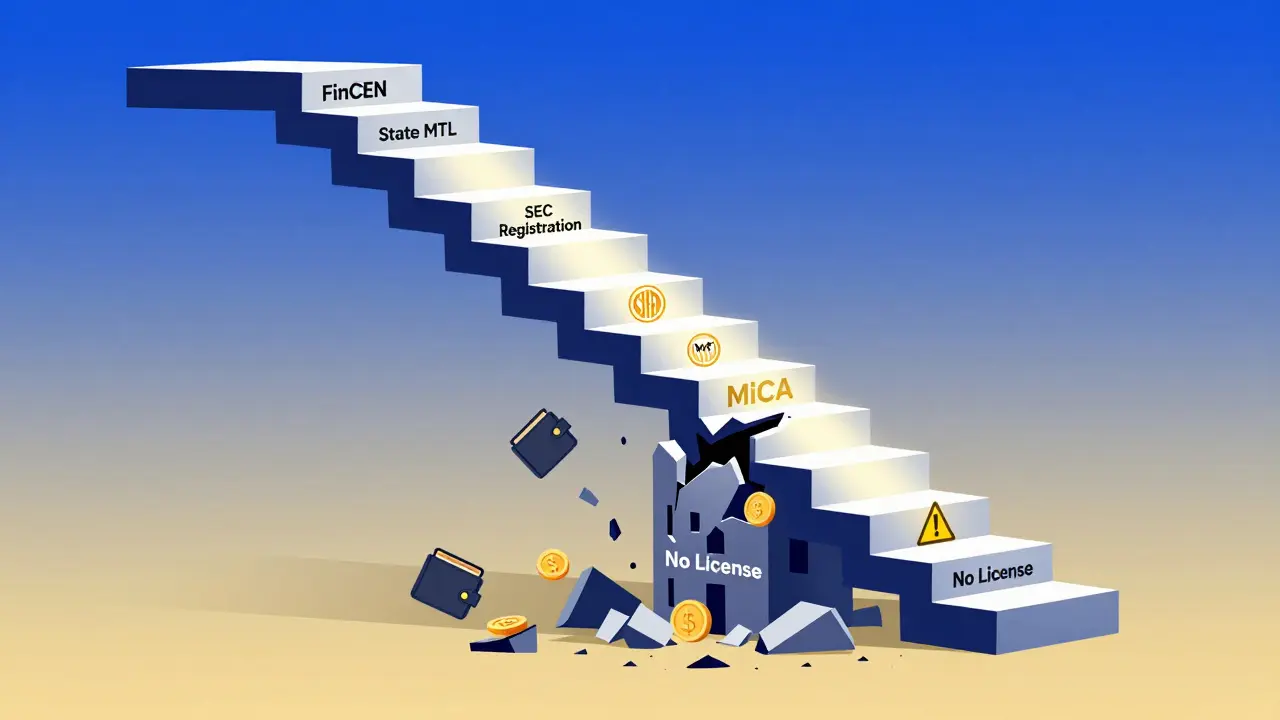

Which Licenses Do You Actually Need?

There’s no single blockchain license. It depends on what you do.- MSB Registration (FinCEN): Required for any business that transmits crypto as a service. Applies to exchanges, remittance platforms, and even some wallet providers.

- BitLicense (New York State): Mandatory for any crypto business operating in or serving New York residents. Even if you’re based in Texas but have a single New York user, you may need it.

- Securities Registration (SEC): Needed if you’re issuing or trading tokens that qualify as securities under the Howey Test. Most token sales fall into this category.

- Money Transmitter Licenses (MTLs): Required in 47 U.S. states for businesses moving crypto between users. Each state has its own application, fee, and bonding requirements.

- Virtual Currency Business License (California): Effective January 2024, California now requires all crypto businesses to obtain this license if they serve residents of the state.

And don’t forget international rules. If you’re serving EU customers, you need to comply with MiCA (Markets in Crypto-Assets Regulation), which requires licensing for crypto asset service providers starting in 2025. No license? No access to the EU market.

Real-World Costs of Skipping Compliance

The financial hit isn’t just the fine. It’s everything that comes after.A small crypto consulting firm in Austin started offering wallet management services in 2022 without realizing they needed an MTL. By the time they got caught, they had processed $3.2 million in transactions. Their penalties: $410,000 in fines, $180,000 in legal fees, $220,000 in retroactive licensing costs, and a two-year ban from working with any U.S.-based clients. They laid off their entire team. Their website is now offline.

Another case: a startup in Colorado launched a tokenized real estate platform. They thought they were exempt because they weren’t a bank. The SEC disagreed. They were forced to halt operations, return $8.7 million to investors, and pay a $1.5 million penalty. Their CEO now works as a blockchain compliance consultant-ironically, helping others avoid the same mistake.

And it’s not just startups. In 2023, a well-known crypto influencer with over 500,000 followers was fined $1.1 million for promoting an unregistered token without disclosing he was paid to do so. The SEC called it a "fraudulent scheme disguised as education." He lost his platform, his reputation, and his ability to legally promote any crypto product.

Why People Think They Can Get Away With It

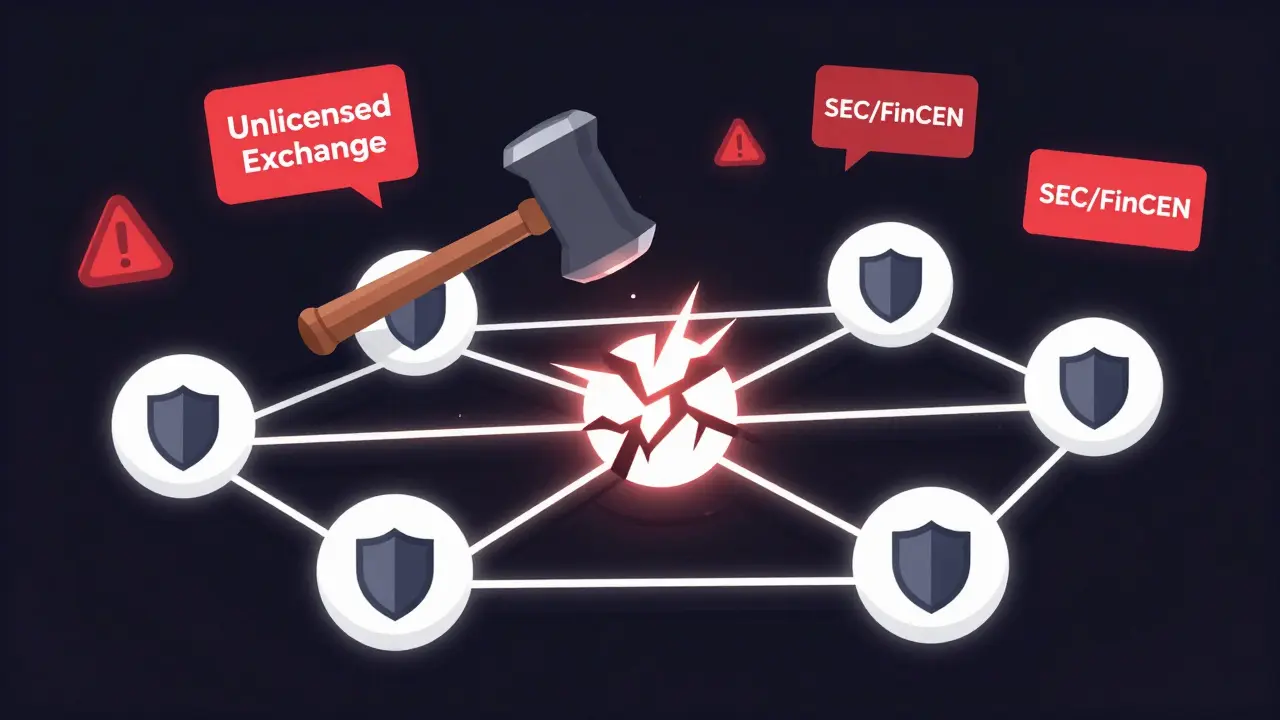

The biggest myth? "No one’s watching." That’s false. Regulators have tools now that make unlicensed activity nearly impossible to hide.Blockchain is public. Every transaction is recorded. Regulators use chain analysis firms like Chainalysis and Elliptic to track flows between wallets and exchanges. If you’re moving large sums of crypto through a non-licensed platform, they’ll find you. And they’ll cross-reference that with tax filings, bank records, and domain registrations.

Another myth: "I’m just a developer. I didn’t handle money." But if your code is used by others to move funds, and you profit from it, you’re still part of the chain of custody. Courts have ruled that developers can be held liable if their software enables illegal activity and they knew or should have known.

And then there’s the "I’m decentralized" excuse. But decentralization doesn’t erase responsibility. If you’re running a platform that collects fees, controls key functions, or markets itself as a service, you’re the operator. The law doesn’t care if your code runs on a hundred nodes. If you’re the face of the project, you’re the target.

How to Get Licensed-Without Going Broke

Getting licensed doesn’t mean hiring a team of lawyers. There are smarter, cheaper paths.- Start with FinCEN: Registering as an MSB costs $100 and takes under 30 days. It’s the minimum federal baseline.

- Use compliance platforms: Tools like ComplyAdvantage, Chainalysis Compliance, and Sumsub automate KYC, AML checks, and reporting. They reduce manual errors and cut legal risk by 70%.

- Apply for state licenses in phases: Don’t try to get all 47 MTLs at once. Start with states where you have the most users. New York, California, and Texas are priority targets.

- Consult a blockchain attorney: A one-hour consultation with a specialist can save you $500,000. Look for firms with experience in SEC enforcement actions.

- Use regulatory sandboxes: States like Wyoming and Utah offer sandbox programs where startups can test products under supervision without full licensing-ideal for early-stage projects.

One blockchain startup in Utah used the state’s sandbox to launch a tokenized asset platform. After 18 months, they graduated to full licensing with zero penalties. Their revenue grew 300% after they gained investor trust through compliance.

What’s Changing in 2025-2026

The rules are tightening fast. By mid-2025, the SEC will require all crypto exchanges to prove they’re licensed before listing any new token. The European Union’s MiCA regulation will go fully live, forcing non-compliant platforms out of the EU market. And the U.S. Treasury is rolling out a new blockchain monitoring system that links crypto addresses to taxpayer IDs-making unlicensed activity far easier to trace.By 2026, AI-powered compliance tools will be standard. Platforms that still rely on manual checks will be flagged as high-risk. Insurance companies will refuse to cover unlicensed crypto businesses. Banks will freeze accounts linked to unregistered entities. The ecosystem is moving toward full integration with traditional finance-and you’re either in or out.

Bottom Line: Compliance Isn’t Optional

Operating without proper licensing in blockchain isn’t a gray area. It’s a red zone. The risks aren’t hypothetical. They’re documented, enforced, and growing. The cost of compliance is a fraction of the cost of getting caught.If you’re building a blockchain business, treat licensing like your foundation-not an afterthought. Register. Document. Verify. Follow the rules. Because in this space, trust isn’t built on code. It’s built on legality.

Can I operate a crypto exchange without a license if I’m outside the U.S.?

No. If your platform serves U.S. users-even one-you’re subject to U.S. regulations. The SEC and FinCEN actively pursue foreign operators who target American customers. In 2023, a Singapore-based exchange was fined $12 million for failing to block U.S. IP addresses. Location doesn’t protect you if your customers do.

Do I need a license to create and sell NFTs?

It depends. If you’re selling NFTs as collectibles or digital art with no financial promise, you likely don’t need a license. But if you’re marketing them as investments-promising royalties, profit-sharing, or future value-you’re selling securities. That requires SEC registration. The SEC has already taken action against multiple NFT projects for this exact reason.

What’s the difference between a BitLicense and an MSB registration?

MSB is a federal registration with FinCEN that applies to any money transmitter, including crypto businesses. BitLicense is a New York State-specific license that’s much stricter. It requires higher capital reserves, detailed audits, and ongoing reporting. You can be an MSB without a BitLicense-but if you serve New York users, you need both.

Can I get fined for not having a license even if I didn’t make any money?

Yes. Regulators don’t require profit to impose penalties. Operating without a license is a violation of procedure, not just revenue. In 2022, a crypto startup in California was fined $350,000 for operating an unlicensed wallet service-even though they didn’t charge fees. They were still handling user funds.

Is there a grace period to get licensed after starting operations?

No. There is no legal grace period. Some regulators may allow you to apply retroactively and pay penalties, but you’re still in violation from day one. The longer you wait, the higher the fines and the greater the risk of criminal referral. Don’t assume you have time.

Freddy Wiryadi

January 30, 2026 AT 01:48Brianne Hurley

February 1, 2026 AT 00:35christal Rodriguez

February 2, 2026 AT 04:33Calvin Tucker

February 2, 2026 AT 21:31Gustavo Gonzalez

February 3, 2026 AT 23:39Gavin Francis

February 5, 2026 AT 22:23Tom Sheppard

February 6, 2026 AT 01:33Aaron Poole

February 6, 2026 AT 09:24Andrea Demontis

February 7, 2026 AT 09:51Meenal Sharma

February 8, 2026 AT 04:39