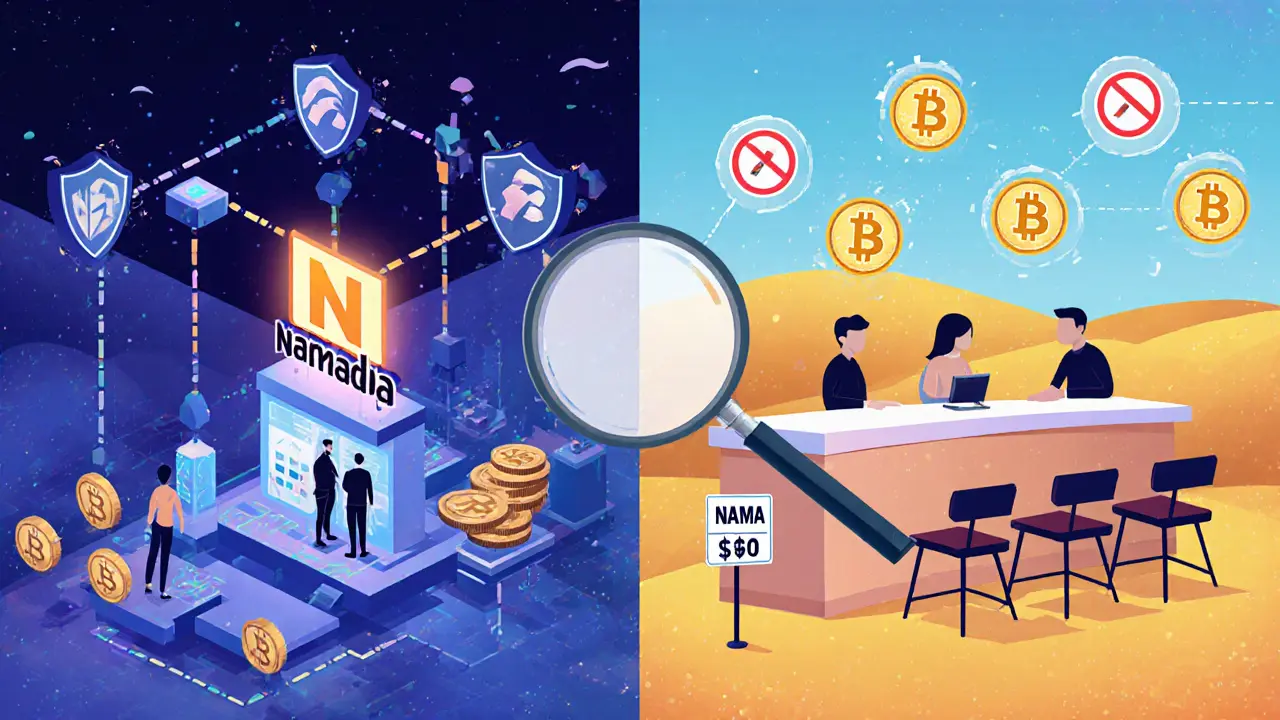

There’s a lot of noise online about a NAMA Protocol airdrop from Nama Finance - but here’s the truth: NAMA didn’t run a public airdrop. What you’re probably hearing about is NAM, the token from Namada, a completely different project with a nearly identical name. This mix-up has cost people time, money, and trust. Let’s cut through the confusion.

Why People Think Nama Finance Ran an Airdrop

The name "NAMA" sounds like "NAM". Both projects are in crypto. Both use tokens. Both are built on blockchain. And both have been mentioned in the same forums, Discord servers, and Twitter threads. That’s enough for misinformation to spread fast. If you searched for "NAMA airdrop" in late 2024, you likely saw posts from people claiming they got 200-300 dollars in free tokens. Those weren’t from Nama Finance. They were from Namada’s Retroactive Public Goods Funding (RPGF) airdrop - a 65 million NAM token distribution worth millions at the time. The confusion isn’t accidental. It’s misleading.Namada (NAM) vs. Nama Finance (NAMA): The Real Difference

These two projects have nothing in common except their names. Here’s how they actually compare:| Feature | Namada (NAM) | Nama Finance (NAMA) |

|---|---|---|

| Primary Purpose | Privacy-focused multichain asset hub | NFT collateral lending platform |

| Core Tech | Multi-Asset Shielded Pool (MASP), Zero-Knowledge Proofs | NFT-backed loans on Ethereum, Binance, Solana |

| Token Use | Staking, governance, fee payment | Lending rewards, governance |

| Airdrop? | Yes - 65M NAM tokens distributed in 2024 | No public airdrop ever announced |

| Eligibility | ZK contributors, Gitcoin donors, ATOM/OSMO stakers, BadKid NFT holders | N/A |

| Current Trading Status | Active on major exchanges | No trading volume, $0 price on CoinMarketCap |

Namada’s goal is to make every asset - from Bitcoin to Bored Apes - privately transferable across blockchains. Nama Finance’s goal is to let you borrow money against your NFTs without selling them. One is about privacy. The other is about liquidity. They’re not competitors. They’re not even in the same neighborhood.

What Actually Happened With the Namada NAM Airdrop

The real airdrop - the one that made headlines - was run by the Anoma Foundation for their Namada protocol. It wasn’t a random giveaway. It was a reward for people who helped build the foundation of privacy tech in crypto. Eligible participants included:- Developers who contributed to Zcash or Rust programming language

- Gitcoin donors to privacy-focused open-source projects

- Stakers of ATOM or OSMO tokens who held at least $100 worth by November 1, 2024

- Owners of BadKid NFTs (at least one held by November 14, 2024)

- Participants in Namada’s Trusted Setup ceremony in 2023

Those who qualified received between $50 and $300 worth of NAM tokens, depending on their contribution level. The deadline to claim was December 28, 2024. That window is closed. No extensions. No exceptions.

If someone tells you they can still claim NAM tokens from that drop, they’re either mistaken or trying to scam you. The claiming portal - rpgfdrop.namada.net - is offline. The blockchain records show the tokens were distributed and locked according to the rules.

What About Nama Finance’s NAMA Token?

Nama Finance does have a token called NAMA. But as of November 2025, there’s no public record of any airdrop. No announcement. No whitelist. No claim portal. Nothing. Instead, NAMA tokens are distributed as rewards within their own platform:- Lenders who stake USDC, USDT, or DAI earn NAMA tokens as interest - up to 35% APY

- Borrowers who use NFTs as collateral get NAMA tokens as a bonus for taking out loans

There’s no free token drop. You have to lend or borrow to earn. And since there’s no trading volume - the token is listed at $0 on CoinMarketCap - these rewards are essentially worthless outside the Nama Finance ecosystem. If you’re not using their lending platform, you can’t access or use the token.

Why This Confusion Matters

Crypto scams thrive on confusion. When people mix up Namada and Nama Finance, they end up:- Visiting fake websites claiming to be "NAMA Finance Airdrop"

- Connecting their wallets to phishing pages that drain funds

- Buying NAMA tokens thinking they’re about to launch a public sale

- Missing out on real opportunities because they’re chasing ghosts

The Namada airdrop was legitimate, transparent, and time-bound. It had a website, a GitHub repository, a public governance forum, and clear documentation. Nama Finance has none of that for any airdrop. If you’re looking for free crypto, don’t chase names. Chase evidence.

What You Should Do Now

If you’re still hoping to get something from Nama Finance:- Don’t send any funds or connect your wallet to any site claiming to offer NAMA airdrops

- Check their official website - nama.finance - for updates on their lending platform

- If you want to earn NAMA tokens, you must lend or borrow using their system

- Don’t buy NAMA tokens expecting price growth - there’s no market for them

If you missed the Namada NAM airdrop, you’re not alone. But you can still learn from it. The best airdrops aren’t random. They reward real work - coding, donating, staking, building. The next big one won’t be announced on Twitter. It’ll be announced on a Gitcoin page, a GitHub commit, or a blockchain explorer.

What’s Next for Both Projects

Namada continues to grow as a privacy hub. New assets are being added to its shielded pools. More chains are joining its IBC network. Its Cubic Proof-of-Stake system is being tested under real network stress. The community is active. The code is public. The token has value because it’s used. Nama Finance is still in early development. Their NFT lending model is technically sound, but adoption is slow. Without trading volume, liquidity is low. Without airdrops, community growth is flat. Their future depends on whether they can attract real borrowers and lenders - not hype.One project built a privacy layer for the entire multichain world. The other built a niche tool for NFT loans. One had a massive, community-driven airdrop. The other didn’t. Don’t let a name fool you again.

Was there ever a NAMA airdrop from Nama Finance?

No. Nama Finance has never run a public airdrop for its NAMA token. Any claims of a free NAMA token drop are false. The NAMA token is only distributed as rewards within Nama Finance’s lending platform, not as a free giveaway.

I heard about a 65 million token airdrop - was that NAMA?

That was the Namada (NAM) airdrop by the Anoma Foundation, not Nama Finance. Namada distributed 65 million NAM tokens to contributors of privacy tech, ZK projects, and stakers of ATOM/OSMO. The deadline to claim ended in December 2024. NAMA tokens are unrelated.

Can I still claim the Namada NAM airdrop?

No. The claiming period for the Namada RPGF airdrop ended on December 28, 2024. The official portal (rpgfdrop.namada.net) is no longer active. If someone says they can help you claim now, it’s a scam.

Is NAMA token worth buying?

As of November 2025, NAMA has no trading volume and is listed at $0 on CoinMarketCap. It can’t be bought or sold on any exchange. Its only use is as a reward inside Nama Finance’s lending platform. Buying it outside that system is pointless.

How do I tell NAMA apart from NAM?

Look at the project, not just the token symbol. NAMA is from Nama Finance - an NFT lending protocol. NAM is from Namada - a privacy blockchain that lets you send any asset anonymously across chains. Check their official websites: nama.finance vs. namada.net. Never trust a name alone.

Jay Davies

November 18, 2025 AT 06:09Let me just say this once and for all: NAMA Finance never did an airdrop. Ever. The fact that people still think they did is either a testament to how lazy crypto research has become or how good scammers are at copy-pasting names.

Stop chasing ghosts. Check the blockchain. Check the official docs. Check CoinMarketCap. $0 price. No liquidity. No airdrop. End of story.

Darren Jones

November 19, 2025 AT 02:05Thank you for this clear breakdown-seriously, this is the kind of post that saves people from losing money.

Just to add: if you’re looking at a site that says ‘claim your NAMA airdrop,’ and it asks for your seed phrase, run. Run far and fast.

Real airdrops don’t need your private keys. They don’t even need your email. They just show up in your wallet if you qualified.

And if you didn’t qualify for Namada’s? Don’t panic. There will be others-just make sure you’re contributing to real tech, not just hopping on hype.

Carol Rice

November 19, 2025 AT 09:04OH MY GOD, I’M SO GLAD SOMEONE FINALLY SAID THIS!

People are literally losing money because they think ‘NAMA’ = ‘NAM’ and they’re connecting wallets to sketchy sites like it’s a game of bingo!

Let me scream into the void: NAMA FINANCE HAS NO AIRDROP. NONE. ZIP. ZILCH. NADA.

And if you’re still buying NAMA tokens on some DEX because you think they’re gonna pump? Sweetheart, that’s not investing-that’s donating to a ghost.

Go stake ATOM. Go donate to ZK projects. That’s how you earn real value. Not by chasing names that sound like each other. 🙏

Gaurang Kulkarni

November 20, 2025 AT 20:22NAMA from nama finance is just a token inside their own lending platform no trading volume no exchange listing no airdrop ever no nothing

people confuse the two because the names are close and crypto is full of idiots who dont read anything

you dont get free money in crypto unless you did something

stop looking for handouts

Nidhi Gaur

November 21, 2025 AT 00:32turned out they meant NAM and just typed NAMA by accident

then 5 other people started replying ‘me too!’ and linking to a phishing site lol

crypto is wild sometimes

glad someone wrote this out clearly

Usnish Guha

November 21, 2025 AT 14:03rahul saha

November 22, 2025 AT 08:16like... we’ve had blockchain for 15 years and we still can’t tell the difference between two 3-letter tokens?

it’s not that the projects are similar-it’s that we’ve trained ourselves to click first, read never

the real airdrop was for people who built privacy tech

the fake one is for people who want free money without lifting a finger

we’re not just confused-we’re complicit

Marcia Birgen

November 23, 2025 AT 19:21Y’all, I just want to hug the person who wrote this.

So many people are getting scammed because they don’t know the difference between NAM and NAMA-and honestly? It’s heartbreaking.

If you’re new to crypto, please don’t feel bad for getting confused. The naming is intentionally misleading.

But now you know. And now you can help others. Share this. Save someone’s wallet. 💛

And if you ever see someone asking about ‘NAMA airdrop’? Gently point them here. No judgment. Just love.

Jerrad Kyle

November 24, 2025 AT 18:41As someone who’s been in crypto since 2017, I’ve seen this exact script play out a dozen times.

Names that sound alike. Tokens that look identical. Airdrops that never existed.

The real lesson here isn’t about NAM vs NAMA-it’s about how crypto culture rewards speed over substance.

People don’t want to read. They want the free money. And scammers? They’re not just exploiting ignorance-they’re exploiting hope.

So yeah, this post matters. A lot.

Keep fighting the good fight.

Usama Ahmad

November 25, 2025 AT 00:56lol

thanks for this post man

now i know what to tell him next time

Nathan Ross

November 25, 2025 AT 14:52garrett goggin

November 26, 2025 AT 09:23Ohhhhh so THAT’S why my uncle lost $4K last week.

He thought NAMA was the new Solana airdrop and connected his wallet to some site that looked like ‘nama.finance’ but had a .xyz domain.

Now he’s convinced the whole crypto industry is a CIA operation to track his ‘crypto habits’.

And now he’s got a ‘blockchain security consultant’ on Telegram who wants $500 to ‘recover’ his tokens.

God help us all.

This post is the only thing keeping me sane.

Bill Henry

November 27, 2025 AT 01:45one looks like a team of devs who actually care

the other looks like a canva template from 2021

and people still think they’re the same?

it’s not even close

but i guess if you’re not looking for truth you’ll find whatever fits your wish

Jess Zafarris

November 28, 2025 AT 15:26It’s fascinating how the same people who scream about ‘decentralization’ and ‘self-custody’ will happily click a link that says ‘claim your free NAMA’ without checking the URL.

There’s a cognitive dissonance here.

We want to be sovereign, but we outsource our due diligence to Twitter threads.

So when the scam happens, we blame the project.

But the project didn’t ask you to click.

You did.

And that’s the real tragedy.

jesani amit

November 29, 2025 AT 17:54Man, I remember when I first heard about NAM airdrop-I was staking ATOM and I got a tiny bit. Didn’t even know what I was getting until I read the docs. Took me 3 days to understand it.

But then I saw people on Reddit saying ‘NAMA airdrop is live’ and linking to some random site.

I spent an hour replying to 12 comments just saying ‘no, that’s not it, here’s the real link’.

It’s exhausting, but someone’s gotta do it.

Thanks for writing this. I’ll share it again. Maybe one day people will learn to read before they click.