When you're looking to trade cryptocurrencies, safety should come first. Not speed. Not flashy ads. Not promises of quick profits. But if you've seen LYOTRADE (also called LioTrade) pop up in your search results, you might be wondering: is this just another crypto platform, or is it dangerous? The answer isn't complicated - and it’s not what the website wants you to believe.

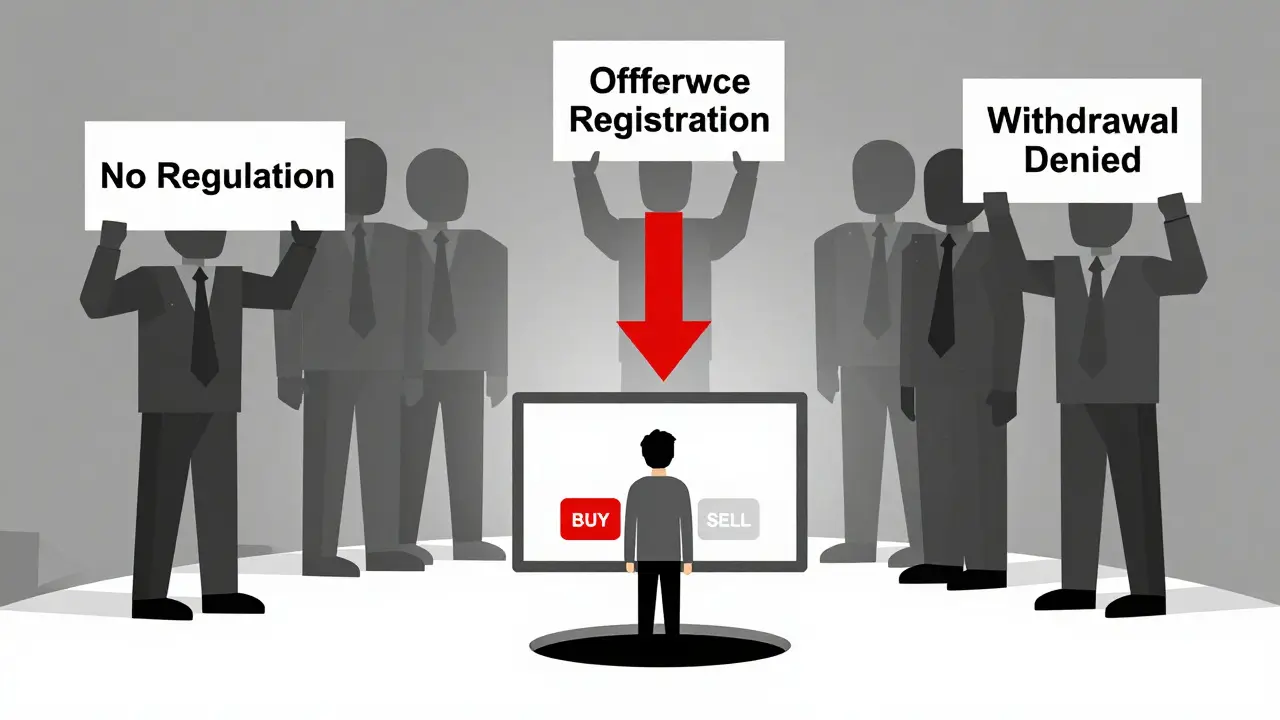

LYOTRADE Is Not Regulated - And That’s a Big Red Flag

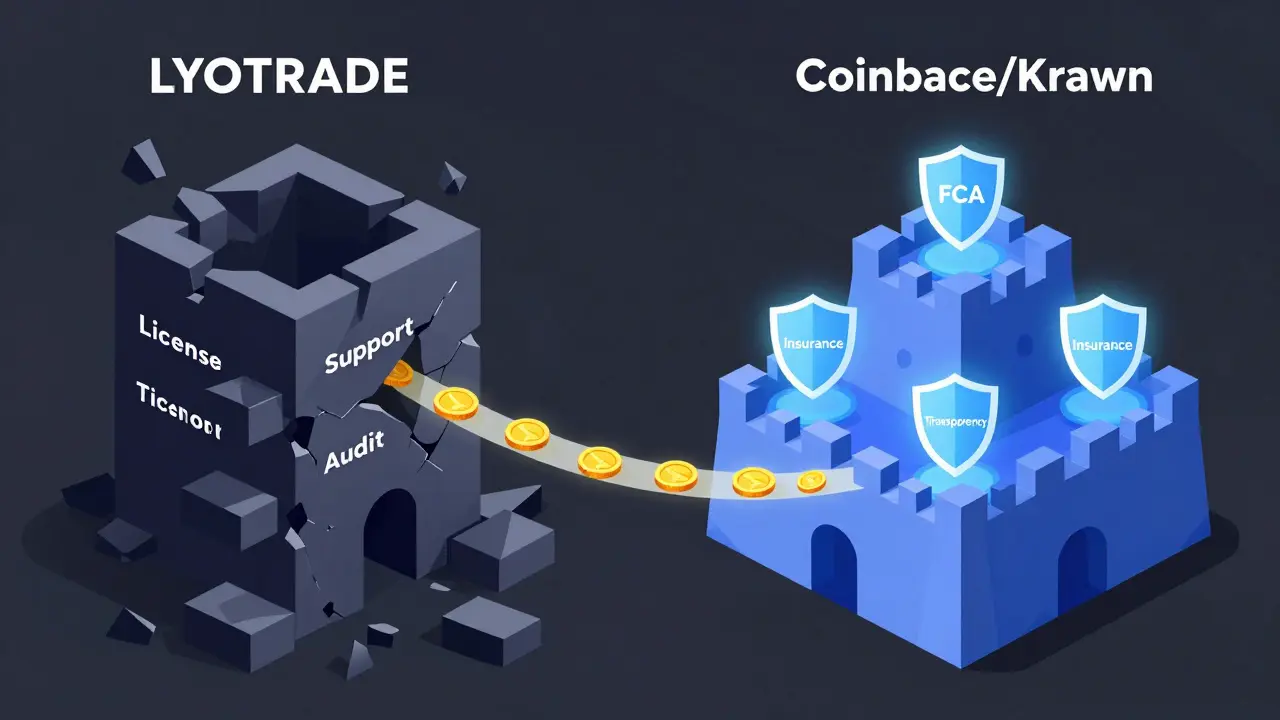

LYOTRADE claims to be a cryptocurrency exchange, but it doesn’t have a license from any major financial authority. The UK’s Financial Conduct Authority (FCA) has publicly listed LioTrade as an unregulated broker. That means they’re not required to follow any rules about how they handle your money. No segregation of client funds. No insurance. No audits. No accountability. Compare that to Coinbase, which is regulated in the U.S., EU, and UK. Or Binance, which operates under strict oversight in multiple jurisdictions. These platforms keep your crypto safe because the law forces them to. LYOTRADE doesn’t have that pressure. They’re registered in Saint Vincent and the Grenadines - a place known for letting offshore companies operate with almost no oversight. That’s not a feature. It’s a warning sign.Users Are Reporting Withdrawal Problems and Technical Glitches

If the platform worked perfectly, you might overlook the lack of regulation. But it doesn’t. Multiple users across review sites like Trustpilot, Reddit, and WikiBit report the same issues:- Trades don’t execute at the price you clicked

- Deposits disappear or get stuck for days

- Withdrawals are delayed or denied without explanation

- The website freezes or crashes during high-volume periods

The Interface Looks Simple - But That’s a Trap

LYOTRADE’s website is clean. Minimalist. Easy to navigate. It looks like it was made for beginners. And that’s exactly the point. Real exchanges like Kraken or KuCoin give you charts, order types, API access, and advanced tools. They assume you know what you’re doing. LYOTRADE strips all that away. No advanced orders. No margin trading. No real-time data feeds. Just a simple buy/sell button. That’s not user-friendly - it’s lazy. And it’s intentional. Beginners are easy targets. They don’t know what to look for. They see a simple interface and think, “This must be safe.” But safety isn’t about how pretty the buttons are. It’s about who’s behind them. And LYOTRADE hides behind offshore paperwork and silence.

There Are No Real Customer Support Channels

When something goes wrong, where do you go? Most legitimate exchanges offer live chat, email support, and even phone lines. LYOTRADE? You’re left with a contact form that might never get answered. Some users report waiting over two weeks for a reply - if they get one at all. No support means no recourse. If your funds are frozen, you can’t call someone to fix it. If you’re charged extra fees you didn’t agree to, you can’t dispute it. There’s no third-party mediator. No ombudsman. No regulatory body to file a complaint with. You’re on your own.Why LYOTRADE Exists - And Who It Targets

LYOTRADE isn’t trying to compete with Binance or Coinbase. It doesn’t have the infrastructure, the team, or the compliance budget. It doesn’t need to. It’s built to attract people who are new to crypto, desperate for quick gains, and unaware of the risks. It uses social media ads, fake testimonials, and influencer promotions to lure in users. Once you deposit, the platform makes it hard to leave. Withdrawal limits, fake verification requests, and sudden “security holds” are common tactics. This isn’t trading. It’s a confidence game. And the people running it aren’t traders - they’re operators of a digital shell game.

What to Do Instead

You don’t need LYOTRADE. There are dozens of safe, regulated, and reliable alternatives:- Coinbase - Best for beginners in the U.S. and Europe. Fully regulated, insured, easy to use.

- Kraken - Strong security, low fees, advanced tools for experienced traders.

- Bybit - Popular for derivatives and futures trading with solid regulatory standing in several regions.

- Binance - Largest exchange by volume. Offers everything - but check local regulations.

Final Verdict: Avoid LYOTRADE

LYOTRADE doesn’t belong in a serious crypto portfolio. It’s not a bad exchange - it’s not an exchange at all. It’s a high-risk, unregulated platform with documented fraud patterns, withdrawal issues, and zero accountability. The FCA warning alone should be enough to walk away. If you’re new to crypto, start with a platform that’s built to protect you - not one that’s built to take your money. The difference isn’t in the interface. It’s in the license.Is LYOTRADE a scam?

Based on regulatory warnings from the UK’s FCA, consistent user reports of withdrawal issues, and its offshore registration in Saint Vincent and the Grenadines, LYOTRADE exhibits multiple red flags of a scam operation. It lacks licensing, insurance, and transparent customer support - all hallmarks of legitimate exchanges. While it may not be a traditional “scam” in the sense of outright theft, it operates in a way that puts users’ funds at extreme risk.

Can I withdraw my money from LYOTRADE?

Many users report being unable to withdraw funds or facing unreasonable delays. Withdrawals are often blocked under vague pretenses like “security verification” or “compliance checks.” Once funds are deposited, the platform controls access. There is no guarantee you’ll get your money back - and no regulatory body can force them to release it.

Is LYOTRADE regulated by any government?

No. LYOTRADE is not regulated by any major financial authority. It is registered in Saint Vincent and the Grenadines, a jurisdiction that does not require crypto exchanges to hold licenses or follow consumer protection rules. The UK’s Financial Conduct Authority (FCA) has explicitly warned that LYOTRADE is an unregulated broker, meaning it operates outside legal oversight.

What are safer alternatives to LYOTRADE?

Safer alternatives include Coinbase (regulated in the U.S. and EU), Kraken (strong security and transparency), Bybit (popular for derivatives with solid compliance), and Binance (largest global exchange, though check local regulations). These platforms have public licenses, insurance on deposits, verified customer support, and years of operational history.

Why does LYOTRADE look so professional if it’s risky?

Scammers invest in clean websites and polished marketing because it lowers suspicion. A professional-looking interface tricks people into thinking the platform is legitimate. But appearance doesn’t equal safety. Real exchanges prove trust through licenses, audits, and public records - not just a nice design. LYOTRADE’s professionalism is a facade.

Should I use LYOTRADE if I’m just testing with a small amount?

No. Even small deposits carry the same risk. If the platform is unregulated and has a history of blocking withdrawals, there’s no such thing as a “safe test.” Once your money is in, you lose control. You’re not testing the platform - you’re testing whether you’ll ever see your funds again. The odds are stacked against you.

Brenda Platt

January 26, 2026 AT 17:15OMG I literally just lost $800 on this thing 😭 I thought it was legit because the site looked so clean, but then my withdrawal got stuck for 11 days. No reply from support. Just silence. Don’t be me. 🚫💸

Mark Estareja

January 28, 2026 AT 14:09Unregulated offshore entity with zero AML/KYC compliance infrastructure - classic red flag architecture. The FCA listing alone should trigger institutional-grade risk aversion. This isn’t crypto, it’s a regulatory arbitrage play disguised as a trading platform.

carol johnson

January 29, 2026 AT 15:55YASSS queen 💅 I saw someone on TikTok say ‘it’s just a test deposit’ - honey, that’s how you end up on Reddit begging strangers for help. This isn’t a platform, it’s a digital mugging with a UI upgrade. I’m crying for the beginners. 😭

Paru Somashekar

January 29, 2026 AT 22:53Dear all, I have been working in fintech compliance for over 12 years. The registration jurisdiction of Saint Vincent and the Grenadines is a well-known jurisdiction for shell entities with no oversight. The absence of any regulatory license, combined with documented withdrawal delays, constitutes a high-risk operational environment. I strongly advise against any financial engagement with this entity.

Steve Fennell

January 30, 2026 AT 05:41I appreciate the clarity here. Many people don’t realize that a clean interface doesn’t equal security - it’s often the opposite. Real platforms give you tools because they trust you to use them. LYOTRADE strips everything down because they don’t want you to understand what’s happening behind the curtain. Smart post.

Melissa Contreras López

January 30, 2026 AT 14:16You’re not alone. I almost fell for it too - I thought, ‘It’s just $50, I’ll see what happens.’ Well, that $50 is gone, and I’m now spending my weekends warning new crypto folks on Discord. Please, if you’re reading this and thinking about depositing - just close the tab. Your future self will thank you. 💛

Mike Stay

February 1, 2026 AT 00:04It's important to contextualize this within the broader evolution of decentralized finance. While traditional exchanges operate under centralized regulatory frameworks, the proliferation of unlicensed offshore platforms reflects a systemic failure in global financial governance. The absence of jurisdictional enforcement allows predatory actors to exploit regulatory vacuums, particularly targeting individuals with limited financial literacy. This is not an isolated incident - it is a structural vulnerability in the current crypto ecosystem.

Tammy Goodwin

February 2, 2026 AT 17:07I don’t know why people keep falling for this. I mean, if it were safe, wouldn’t it be on Coinbase’s partner list? Or at least have a single review that isn’t a sob story? 🤔

Andy Simms

February 4, 2026 AT 16:59One thing people miss: LYOTRADE’s ‘simple’ interface is designed to prevent you from spotting the manipulation. No limit orders? No order history? No price charts? That’s not beginner-friendly - that’s predatory. Real platforms teach you. This one traps you.

Shamari Harrison

February 6, 2026 AT 00:33Been there. Did the $200 ‘test’. Took 17 days to get a reply. Got a generic ‘your account is under review’ email. Then the site went down for 48 hours. When it came back, my balance was gone. I reported it to the FTC. No response. Don’t trust pretty buttons.

Nadia Silva

February 6, 2026 AT 18:19Why are Americans even using this? Canada has Binance CA, Coinbase, Kraken - all regulated. This is just a scam site targeting people too lazy to use real exchanges. Stop enabling this nonsense.

Deepu Verma

February 8, 2026 AT 12:31Hey everyone, I’m from India and I’ve seen similar scams here too. The trick is always the same: simple UI, fake testimonials, ‘limited-time bonus’. I’ve warned my cousins not to touch anything without a SEBI or RBI license. If it’s not regulated where you live, don’t touch it. Your money isn’t worth the risk.

Julene Soria Marqués

February 10, 2026 AT 08:13Wait, so you’re saying LYOTRADE isn’t the *only* one? 😅 I thought I was just unlucky. I guess I’m the 47th person to post this exact thing on Reddit this week. My bad.

Bonnie Sands

February 11, 2026 AT 09:53Just saying… what if this is all a government sting? Like, what if LYOTRADE is actually run by the FBI to catch crypto scammers? I mean, why else would they leave so many obvious red flags? 🤔