Nigeria Crypto Compliance Penalty Calculator

Calculate potential fines for non-compliance with Nigeria's new crypto regulations under the National Tax Administration Act (NTAA) 2025.

Warning: Under Nigeria's NTAA 2025, failure to comply with crypto tax regulations results in severe penalties. First month: ₦10 million ($6,693). Each additional month: ₦1 million ($669). SEC can suspend or revoke licenses.

For years, Nigeria’s relationship with cryptocurrency was a mess. Banks blocked transactions. Accounts got frozen. People traded peer-to-peer just to keep using Bitcoin and Ethereum. The government didn’t say yes, but it didn’t say no either. That chaos ended in 2025. Today, crypto is fully regulated in Nigeria - and the rules are clear, strict, and actively enforced.

What Changed in 2025?

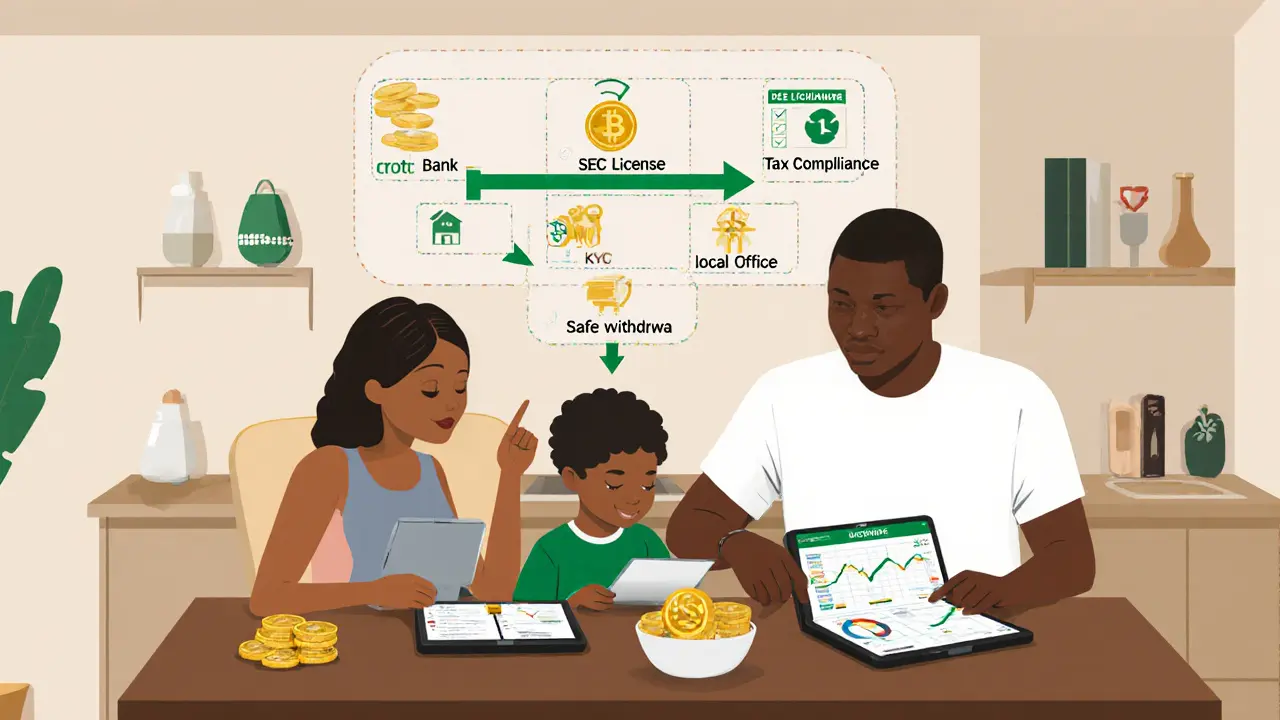

The big shift came in March 2025, when President Bola Ahmed Tinubu signed the Investments and Securities Act (ISA) 2025. This law didn’t just tweak old rules - it rewrote them. For the first time, cryptocurrencies like Bitcoin, Ethereum, and even NFTs used for investment were officially recognized as securities under Nigerian law. That means they’re now treated the same way as stocks or bonds - and that puts them under the direct control of the Securities and Exchange Commission (SEC). Before this, the Central Bank of Nigeria (CBN) had banned banks from dealing with crypto businesses in 2021. That ban wasn’t fully enforced, but it created chaos. People couldn’t cash out. Exchanges couldn’t operate legally. Now, the CBN has reversed course. In December 2023, it released the Virtual Asset Service Provider (VASP) Guidelines, telling banks they can open accounts for licensed crypto firms. That’s a huge deal. It means Nigerian users can now deposit naira into regulated exchanges and withdraw profits without fear of account freezes.Who Needs a License?

If you’re running a crypto exchange, wallet service, or any platform that lets people trade, buy, or sell digital assets in Nigeria - you need a license. The SEC created specific categories for this. There’s no gray area. You either register or shut down. To get licensed, companies must meet several hard requirements:- Pay a minimum paid-up capital (exact amount varies by license type)

- Obtain a fidelity bond (insurance against fraud or theft)

- Be officially registered as a Nigerian company

- Have a physical office in Nigeria

- Employ Nigerian management staff

What’s Covered - and What’s Not

The rules don’t apply to everything. Artistic NFTs - like digital art or collectibles - are fine, as long as they’re not sold as investment opportunities. If someone markets an NFT as a way to earn dividends or profit from price increases? That’s a security. And that’s regulated. Online forex trading platforms that use crypto as a base currency are also covered. If you’re trading crypto pairs like BTC/USD or ETH/NGN on a Nigerian platform, you’re under SEC rules. The same goes for token sales and initial coin offerings (ICOs). If money is being raised from the public, the SEC is watching.

Who’s Watching?

Nigeria didn’t just hand regulation to one agency. It built a team. The SEC works with:- CBN - for banking and payment rules

- EFCC - the Economic and Financial Crimes Commission, which handles fraud

- NFIU - the Nigerian Financial Intelligence Unit, which tracks money laundering

Taxes Are Coming - And They’re Harsh

In June 2025, Nigeria passed the National Tax Administration Act (NTAA) 2025. It takes effect in 2026. This law introduces the first-ever crypto-specific tax rules in the country. Here’s what happens if you don’t comply:- First month of non-compliance: ₦10 million ($6,693) fine

- Each additional month: ₦1 million ($669) extra

- SEC can suspend or revoke your license

How Are People Reacting?

Nigerians are still among the top crypto adopters in the world. Between July 2024 and June 2025, the country received over $92 billion in crypto value - nearly double what South Africa got. People didn’t stop using crypto during the ban. They just moved to P2P platforms like Paxful and LocalBitcoins. Now, with regulation, sentiment is shifting. Many users are relieved. No more bank freezes. No more fear of getting locked out of their own money. But there’s also worry. Some users fear the government will use the new surveillance powers to track every transaction. Others are frustrated by how long licensing takes. A small exchange owner in Lagos told a local news outlet: “We spent eight months preparing documents. The SEC asked for five different versions of the same thing. We’re not a bank. Why does this feel like applying for a passport?”What Does This Mean for You?

If you’re a Nigerian crypto user:- Stick to licensed exchanges like Quidax or Busha. Avoid unregulated platforms.

- Keep records of all trades - you’ll need them for taxes in 2026.

- Don’t assume P2P trading is safe forever. The SEC may start regulating peer-to-peer marketplaces next.

- Start the SEC licensing process now. Delays are common.

- Hire a local legal expert who understands both securities law and blockchain.

- Build compliance into your tech - KYC, AML, transaction monitoring.

Is Nigeria a Crypto Hub Now?

Yes - but not because of freedom. It’s because of clarity. Kenya and South Africa introduced crypto taxes earlier. Nigeria went further: it built a full legal structure. That’s attracting foreign investors. Fintech startups are relocating to Lagos. Venture capital firms are setting up offices. The goal isn’t to crush crypto. It’s to bring it into the formal economy. That means more jobs, better financial services, and a chance to include Nigeria’s 40 million unbanked adults in the digital financial system. The road ahead isn’t easy. Compliance is expensive. The rules are complex. But for the first time, everyone knows the game. No more guessing. No more hidden traps. That’s progress.Is cryptocurrency legal in Nigeria in 2025?

Yes, cryptocurrency is fully legal in Nigeria as of 2025. The Investments and Securities Act (ISA) 2025 officially recognizes digital assets as securities, placing them under the regulation of the Securities and Exchange Commission (SEC). Banks are now allowed to serve licensed crypto businesses, ending the 2021 transaction ban.

Do I need a license to trade crypto in Nigeria?

If you’re a regular user buying or selling crypto on a licensed exchange like Quidax or Busha, you don’t need a license. But if you’re operating a crypto exchange, wallet service, or any platform that facilitates trading for others, you must register with the SEC and meet strict capital, location, and management requirements.

Can Nigerian banks still block crypto transactions?

No. Since December 2023, the Central Bank of Nigeria (CBN) has allowed banks to provide services to licensed Virtual Asset Service Providers (VASPs). Banks can no longer freeze accounts solely for crypto-related activity - unless the account is linked to an unlicensed or fraudulent platform.

Are NFTs regulated in Nigeria?

Only investment-focused NFTs are regulated. If an NFT is sold as a financial product - for example, promising dividends, profit-sharing, or resale value - it’s treated as a security and falls under SEC rules. Artistic or collectible NFTs with no financial promise are not regulated.

What happens if I don’t pay crypto taxes in Nigeria?

Under the National Tax Administration Act (NTAA) 2025, which takes effect in 2026, failure to report crypto income or pay taxes will result in fines: ₦10 million ($6,693) for the first month, plus ₦1 million ($669) for each additional month. The SEC can also suspend or revoke business licenses for non-compliance.

Is peer-to-peer (P2P) crypto trading still allowed?

Yes, P2P trading is still allowed. The current regulations target platforms and businesses, not individual users. However, regulators have signaled that P2P marketplaces may be brought under licensing requirements in the future to prevent money laundering and fraud.

How long does it take to get a crypto license in Nigeria?

The process takes between 6 to 12 months on average. The SEC conducts deep background checks, reviews financial statements, and verifies local presence. Even established companies like Quidax and Busha faced delays. Rushing the application or submitting incomplete documents can add months to the timeline.

Jessica Hulst

November 2, 2025 AT 23:49So let me get this straight - Nigeria went from ‘crypto? we don’t talk about that’ to ‘here’s a 300-page regulatory bible with tax penalties that could buy you a small island’ in four years? I mean, I respect the ambition, but this feels less like regulation and more like a government trying to catch up to a technology that’s already left the building. People were trading Bitcoin on WhatsApp while the CBN was busy pretending it didn’t exist. Now they’re forcing compliance like it’s a mandatory church service? The irony is delicious. At least now you can withdraw your money without your bank calling the FBI. But god help the guy who forgot to log his 0.002 BTC gain from last Tuesday. That’s a ₦1 million fine for a coffee.

Kaela Coren

November 3, 2025 AT 15:28The institutionalization of cryptocurrency under the ISA 2025 represents a significant paradigm shift in Nigeria’s financial architecture. The alignment of virtual asset regulation with securities law demonstrates a deliberate effort to integrate decentralized financial instruments into the formal economy. While the administrative burden on service providers is considerable, the establishment of clear legal boundaries mitigates systemic risk and enhances investor protection. The multi-agency oversight framework, particularly the inclusion of EFCC and NFIU, suggests a robust enforcement mechanism that may serve as a model for other emerging markets.

Nabil ben Salah Nasri

November 5, 2025 AT 07:08YESSSS!!! 🎉 Nigeria finally got it right!!! 🇳🇬✨ No more bank freezes, no more sketchy P2P dodging, no more ‘is this legit?’ paranoia - now you can actually sleep at night knowing your crypto isn’t gonna vanish because some clerk at GTBank got scared of a blockchain. Quidax and Busha are legit now, and that’s HUGE. Also, kudos to the SEC for not rushing it - better slow and safe than fast and scammy. 💪🔥 This is the kind of leadership Africa needs. Let’s gooooo!!! 🚀❤️

alvin Bachtiar

November 5, 2025 AT 13:18Let’s be real - this isn’t regulation. It’s a tax grab wrapped in a compliance straitjacket. The SEC’s ‘deep vetting’ is just bureaucratic torture disguised as due diligence. Eight months to get a license? For a tech company? That’s not diligence - that’s sabotage. And don’t even get me started on the ‘fidelity bond’ requirement - you’re forcing startups to buy insurance against their own existence? Meanwhile, the tax penalties are straight-up extortion: ₦10 million for a missed filing? That’s more than the annual revenue of 80% of Nigerian crypto startups. This isn’t innovation - it’s institutionalized extortion with a Nigerian flag on it.

DeeDee Kallam

November 6, 2025 AT 06:48so like… if i buy btc on busha and sell it for profit… i gotta like… file taxes? like… for real? 😭 i dont even file my salary taxes. this is too much. my brain hurts. can i just keep trading on p2p and pretend this never happened???

Helen Hardman

November 7, 2025 AT 16:42Okay, I just want to say how proud I am of Nigeria right now - this is HUGE. 🥹 After years of being ignored or demonized, crypto users finally have a clear path forward. Yes, the rules are strict - but isn’t that better than the wild west? Imagine a kid in Enugu who’s been saving up to buy a laptop with crypto, and now he can do it without his mom’s bank account getting frozen. That’s real progress. And the tax system? Yeah, it’s a lot, but if you’re making money, you should pay your fair share. Let’s make this work, y’all! Let’s build something sustainable, not just get rich quick. You got this, Nigeria! 💪🌍

Bhavna Suri

November 8, 2025 AT 06:22This is too much work. Why must everything be regulated? In India, we just trade and no one cares. Nigeria is making it complicated. I do not understand why they need so many agencies. One is enough. Also, who will pay for all these lawyers? It is not good.

Elizabeth Melendez

November 8, 2025 AT 15:23OMG I’m so glad this happened!! 🙌 I’ve been using Quidax since 2022 and every time I tried to cash out, my bank would freeze me like I was laundering drugs 😭 Now I can finally withdraw without panic! And honestly, the tax thing? Yeah, it’s scary, but if you’re smart about it - like, keep a spreadsheet or use a crypto tax app - it’s totally doable. I started tracking all my trades last year and now I’m kinda proud of myself for being organized 😅 Also, if you’re a small trader, don’t stress - the SEC’s not coming after you, they’re going after the sketchy exchanges. Stick to the licensed ones and you’ll be fine! You got this!! 💕

Phil Higgins

November 8, 2025 AT 18:54Regulation is not the enemy of innovation - it is its necessary scaffolding. What Nigeria has done is not overreach; it is responsibility. The fact that they’ve chosen to integrate crypto into the formal financial system - rather than isolate it - is a masterstroke. The multi-agency approach ensures accountability. The licensing process, while slow, prevents the kind of predatory platforms that have destroyed trust in other markets. The tax framework, though severe, is a signal: this is not a loophole. This is a legitimate asset class. To those who complain about bureaucracy - remember: the alternative is chaos. And chaos always favors the powerful. This system, flawed as it may be, empowers the individual. That is worth the wait.

Genevieve Rachal

November 10, 2025 AT 06:38Let’s be honest - this is performative governance. They didn’t regulate crypto because they care about investors. They did it because they saw the money flowing out and realized they couldn’t stop it. So now they’re trying to control it - and tax it - and make it look like they’re in charge. But here’s the truth: most Nigerians are still trading on P2P. The ‘licensed’ exchanges? They’re tiny. The real market is still underground. And the tax enforcement? It’ll be selective. The rich will hire accountants. The poor will get fined into oblivion. This isn’t progress - it’s extraction with a nice PowerPoint presentation.