What smart contract interaction tracking really means

When you send a transaction to a smart contract-whether it’s swapping tokens on Uniswap, staking ETH in a yield pool, or minting an NFT-you’re not just clicking a button. You’re triggering code that runs on hundreds or thousands of computers worldwide. Every step of that process gets permanently recorded on the blockchain. That’s smart contract interaction tracking: the act of watching, recording, and analyzing every single action a smart contract takes when it responds to user input or other contracts.

It’s not just about seeing if a transaction went through. It’s about knowing what happened inside the contract, when it happened, who triggered it, and what data changed. Think of it like a security camera for blockchain logic. You don’t just see someone entering a building-you see which door they used, what room they went to, and what files they accessed.

How smart contracts leave digital footprints

Smart contracts don’t just execute-they communicate. When a contract runs, it can emit events. These aren’t regular transactions. They’re lightweight logs, like print statements in code, but stored permanently on the blockchain. Each event can carry up to four indexed pieces of data called topics, which make them easy to search later.

For example, when a token transfer happens, the contract emits an event like:

- Topic 1: Transfer (the event name)

- Topic 2: Sender address

- Topic 3: Recipient address

- Data payload: Amount transferred

Tools like Etherscan use these events to show you exactly what happened. Without them, you’d be stuck guessing what a transaction did just by looking at raw hex data.

But events aren’t the whole story. Smart contracts also change the blockchain’s world state-the live database of account balances, contract storage, and settings. Tracking those changes means seeing how variables like "totalSupply" or "owner" shift over time. That’s how you know if a contract was manipulated or if a DAO vote actually passed.

The four types of interaction you need to track

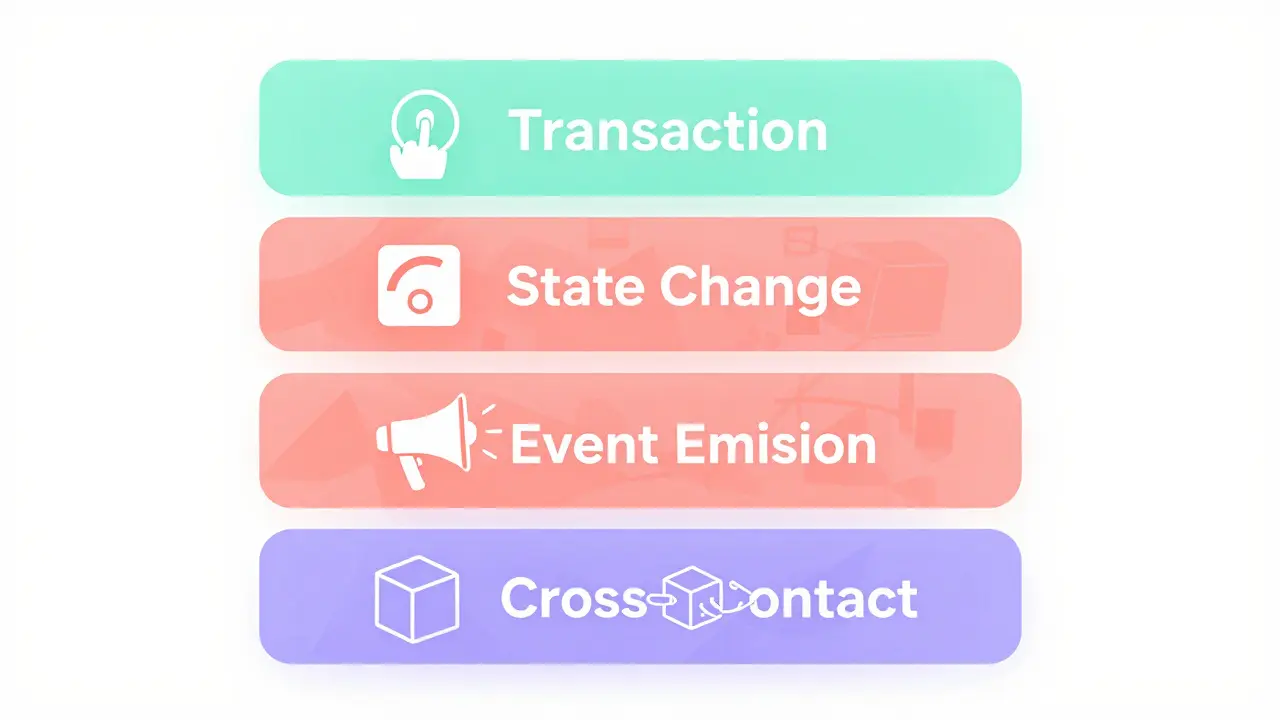

Not all smart contract activity is the same. To really understand what’s going on, you need to monitor four key layers:

- Transaction-level tracking - Who called the contract? What function did they use? How much gas did it cost? Did it succeed or fail? This is the basic entry point.

- State change tracking - What data inside the contract changed? Did the balance of a liquidity pool drop by 500 ETH? Did the voting threshold get updated? These are the real consequences of interactions.

- Event emission tracking - What did the contract announce? Events are designed for external systems to listen to. They’re the contract’s way of shouting, "Hey, something happened!"

- Cross-contract tracking - Did Contract A call Contract B, which then called Contract C? This is where things get complex. In DeFi, one transaction might trigger five different contracts in sequence. Missing one link breaks the whole picture.

Most blockchain explorers only show you the first layer. But if you’re auditing a protocol or investigating a hack, you need all four.

How different blockchains handle tracking

Not all blockchains track interactions the same way. Ethereum uses a system built around the EVM’s LOG opcodes. Every event you see on Etherscan comes from LOG0 to LOG4 instructions in the contract’s bytecode. These logs are stored in transaction receipts and indexed for fast lookup.

Hyperledger Fabric, used by enterprises, takes a different route. It doesn’t rely on public logs. Instead, it uses endorsement policies and transaction validation records. Interactions are tracked within private channels, and only authorized parties can see the full history. This gives more control but less transparency.

Solana uses a completely different model. It processes transactions in parallel and stores event data in accounts rather than logs. Tools like Solana Explorer show interactions by scanning account updates, not event logs. This makes tracking faster but harder to standardize across platforms.

The takeaway? If you’re building something that needs to work across chains, don’t assume tracking works the same everywhere. You’ll need platform-specific tools-or a middleware layer that normalizes the data.

Tools that make tracking practical

You don’t have to read raw blockchain data to track interactions. Several tools do the heavy lifting for you:

- Etherscan, BscScan, Polygonscan - Free, public explorers that show transaction history, event logs, and internal calls. Good for basic checks.

- Chainlens - A SaaS platform for deeper analytics. It tracks interaction patterns, flags unusual behavior, and even predicts gas spikes before they happen.

- Dune Analytics - Lets you write SQL queries against on-chain data. Want to see how many users have interacted with a specific contract in the last 30 days? You can build that dashboard yourself.

- Tenderly - A developer tool that simulates transactions before they’re sent. It shows you exactly what state changes and events will occur, helping you debug before you pay gas.

For serious users-auditors, fund managers, security researchers-these aren’t nice-to-haves. They’re essential. A single overlooked event could mean missing a critical exploit or a fraudulent transfer.

Why tracking matters in real-world use cases

Tracking isn’t just for techies. It’s critical in real business scenarios:

- DeFi - If you’re farming yield, you need to track whether your staked assets are being used as collateral, if fees are being correctly distributed, or if a protocol is secretly minting new tokens. Without tracking, you’re flying blind.

- NFTs - Royalty payments are enforced by smart contracts. Tracking ensures creators get paid every time their NFT resells. If a marketplace bypasses the contract, you’ll know because the royalty event never fires.

- Supply chains - A company shipping pharmaceuticals can use smart contracts to log each handoff-from manufacturer to warehouse to hospital. If a shipment is delayed, tracking shows exactly where the contract failed to update.

- Healthcare - In some EU countries, hospitals use blockchain to share patient records securely. Smart contracts control who can access what. Tracking ensures no unauthorized access happens, and audits can prove compliance.

In each case, the ability to prove what happened-without relying on a central authority-is the whole point of blockchain.

Big challenges you can’t ignore

Tracking sounds simple, but it’s full of traps:

- Gas costs - Every event you log costs gas. Too many events, and your contract becomes too expensive to use. Developers often cut corners and omit important logs to save money-making tracking incomplete.

- Scalability - Ethereum processes 15-20 transactions per second. At scale, that’s millions of events per day. Storing and querying that data efficiently requires specialized infrastructure.

- Privacy - If you’re tracking interactions in a business contract, you might not want everyone to see your supplier names or pricing. Public blockchains don’t offer privacy by default. Solutions like zero-knowledge proofs are emerging, but they’re still complex to implement.

- Cross-chain chaos - If a contract moves assets from Ethereum to Solana to Polygon, tracking that entire flow is nearly impossible without bridges that support standardized logging. Most don’t.

These aren’t theoretical problems. In 2025, a major DeFi protocol lost $80 million because their tracking system didn’t catch a reentrancy attack-because they disabled a key event to save gas.

What’s next for smart contract tracking

The future of tracking is smarter, faster, and more automated:

- AI-powered anomaly detection - Platforms are now using machine learning to spot unusual patterns. If a contract suddenly starts sending 10,000 tiny transfers to random addresses, the system flags it as a possible drain attack.

- Real-time alerts - Instead of checking dashboards, you’ll get notifications when key events happen. "Your liquidity position dropped below 10%" or "New owner assigned to your NFT collection."

- Enterprise integration - Companies are connecting blockchain tracking to SAP, Oracle, and Salesforce. Now, a smart contract update can automatically trigger an invoice or update inventory records.

- Privacy-preserving tracking - Zero-knowledge proofs are being tested to let you prove an interaction happened without revealing the details. Imagine proving you paid a royalty without showing the buyer’s identity.

The goal isn’t just to see what happened. It’s to predict what will happen-and stop it before it goes wrong.

Final thought: Tracking is your safety net

Smart contracts are supposed to be trustless. But that doesn’t mean you should be careless. Without interaction tracking, you’re trusting code you can’t fully see. Even the most secure contract can have hidden flaws. Tracking gives you visibility. It turns abstract blockchain logic into concrete, verifiable history.

If you’re using DeFi, NFTs, or any blockchain-based service, you owe it to yourself to understand how to track what’s happening on-chain. It’s not optional anymore. It’s basic due diligence.

What is the difference between a blockchain transaction and a smart contract event?

A blockchain transaction is the actual call made to a smart contract-like sending ETH or calling a function. It’s recorded on the chain and costs gas. An event is a log emitted by the contract during execution. It doesn’t cost extra gas beyond the transaction, but it’s designed to be read by external tools. Think of the transaction as the action, and the event as the announcement of what happened.

Can I track smart contract interactions on any blockchain?

Yes, but the tools and methods vary. Ethereum, BNB Chain, and Polygon use event logs that work with Etherscan-style explorers. Solana tracks changes through account updates. Hyperledger Fabric uses private channels and endorsement records. You need platform-specific tools to get full visibility. There’s no universal tracker yet.

Do I need to pay to track smart contract interactions?

Basic tracking is free. Etherscan, BscScan, and Dune Analytics let you view data without paying. But advanced tools like Chainlens or Tenderly offer alerts, analytics, and historical data backups-those usually require a subscription. If you’re just checking your own transactions, you don’t need to pay.

Why can’t I see all the data inside a smart contract?

Smart contracts can store private data in their storage, but that data isn’t automatically exposed. Only what’s emitted as an event or returned by a public function is visible. If a contract doesn’t log something, you can’t see it-unless you reverse-engineer the bytecode, which is difficult and often impossible with obfuscated code.

How do I know if a smart contract is being exploited?

Look for unusual patterns: repeated calls to the same function in a short time, large transfers to unknown addresses, or events that don’t match the contract’s documented behavior. Tools like Tenderly and Chainlens can flag these automatically. If you notice a contract suddenly behaving differently than before, investigate immediately.

Edward Drawde

February 4, 2026 AT 01:39Will Pimblett

February 5, 2026 AT 13:21Nickole Fennell

February 6, 2026 AT 23:50Elle M

February 7, 2026 AT 05:11Rico Romano

February 8, 2026 AT 01:08Crystal Underwood

February 9, 2026 AT 15:57Jack Petty

February 10, 2026 AT 20:16Meenal Sharma

February 11, 2026 AT 20:55Freddy Wiryadi

February 12, 2026 AT 16:55Brianne Hurley

February 13, 2026 AT 07:05christal Rodriguez

February 14, 2026 AT 15:17Gustavo Gonzalez

February 14, 2026 AT 19:00Gavin Francis

February 16, 2026 AT 11:15Rob Duber

February 17, 2026 AT 08:17Steven Dilla

February 17, 2026 AT 20:39Aaron Poole

February 18, 2026 AT 20:09Devyn Ranere-Carleton

February 18, 2026 AT 20:14