Crypto Key Security Assessment Tool

Secure Your Crypto Assets

How secure is your private key storage? Answer these 4 questions to assess your risk of permanent loss.

Imagine waking up one day and realizing you can’t access your Bitcoin. Not because the market crashed, not because the exchange went down - but because you lost a string of 64 characters. That string? Your private key. It’s the only thing standing between you and full control of your crypto. No bank. No password reset. No customer support. Just you and that key.

What Exactly Is a Private Key?

A private key is a long, random string of letters and numbers - usually 64 hexadecimal characters - that acts as your digital signature on the blockchain. Think of it like a unique fingerprint that only you should ever have. It’s not a password you set. It’s mathematically generated when you create a wallet. And it’s the only way to prove you own the crypto tied to a specific public address. Every crypto wallet creates a matching pair: a private key and a public key. Your public key is like your email address - you can share it freely so others can send you Bitcoin or Ethereum. But your private key? That’s the password to open your mailbox. If someone else gets it, they can drain your funds. And there’s no way to recover it. No help desk. No ‘forgot password?’ link. Just silence. This is why the crypto community says: "Not your keys, not your coins." If you keep your crypto on an exchange like Coinbase or Binance, you don’t actually hold the private keys. The exchange does. That means you’re trusting them to keep your money safe. And history has shown that trusting third parties can be dangerous. In 2022, FTX collapsed, and thousands lost access to their funds because they never held their own keys. Meanwhile, people who kept their crypto in self-custody wallets walked away untouched.How Private Keys Actually Work

Behind the scenes, private keys use something called asymmetric encryption. This means your private key and public key are mathematically linked - but you can’t reverse-engineer the private key from the public one. Even the most powerful supercomputers can’t crack it. That’s what makes blockchain secure. When you send crypto, here’s what happens:- You open your wallet and enter the recipient’s public address and amount.

- Your wallet uses your private key to create a digital signature for that transaction.

- The network checks that signature using your public key to confirm it matches.

- If it checks out, the transaction gets added to the blockchain.

Where Do You Store Your Private Key?

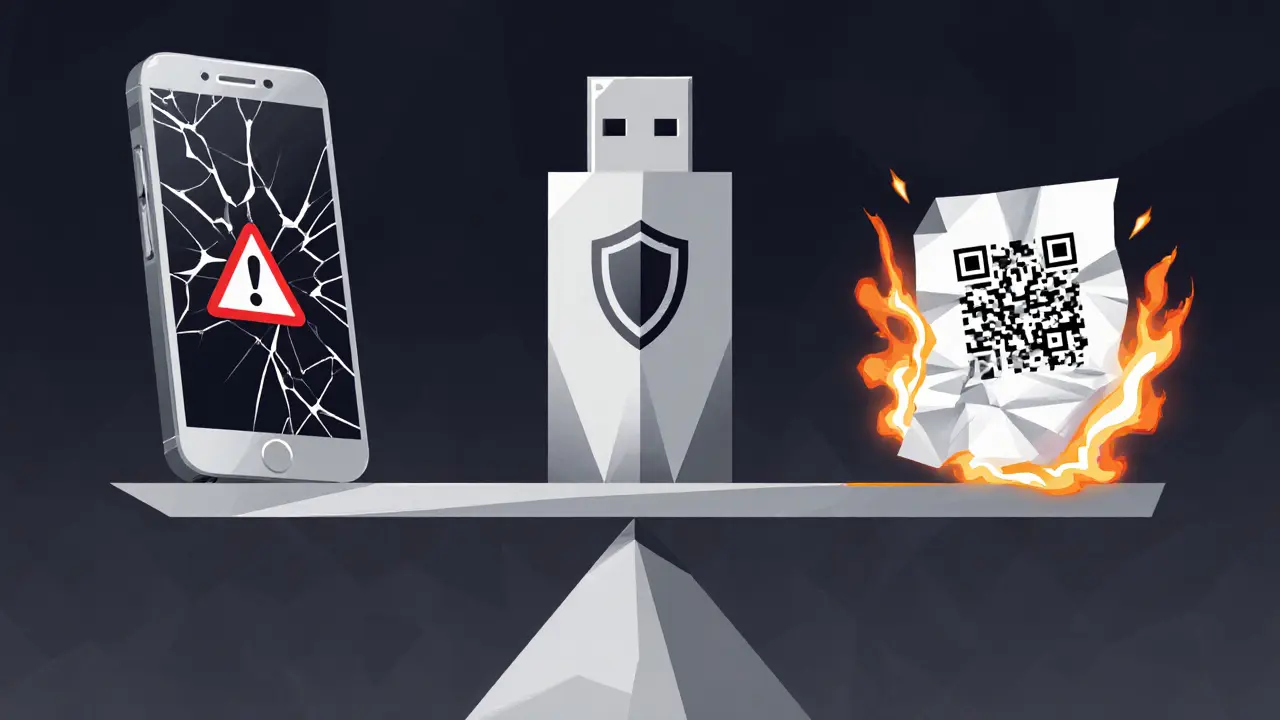

There are three main ways to store private keys - and your choice determines your risk level.1. Software Wallets (Hot Wallets)

These are apps on your phone or computer - like MetaMask, Trust Wallet, or Electrum. They’re convenient. You can send crypto in seconds. But they’re connected to the internet. That makes them vulnerable to malware, phishing, and hacking. If your phone gets infected with a keylogger, your private key could be stolen in seconds.2. Hardware Wallets (Cold Wallets)

Devices like Ledger, Trezor, or OneKey are purpose-built for security. They look like USB sticks. Your private key is stored inside a secure chip, never exposed to your computer or phone. To send crypto, you plug it in, confirm the transaction on its screen, and sign it offline. Even if your laptop is hacked, your keys stay safe. Hardware wallets became popular after the 2014 Mt. Gox hack and surged again after the 2022 FTX collapse. Sales of these devices jumped over 400% during market downturns. People realized: if you want real ownership, you need cold storage.3. Paper Wallets

Some people print their private key on paper - sometimes as a QR code. It’s cheap. It’s offline. But it’s also fragile. Fire, water, fading ink, or just misplacing it can mean permanent loss. Paper wallets are rarely recommended today unless you’re a crypto historian or doing a very specific security setup.

Why Self-Custody Matters More Than Ever

In 2025, governments are starting to regulate crypto more aggressively. Some countries are pushing for mandatory KYC on wallets. Others are considering laws that force exchanges to freeze accounts under certain conditions. If you hold your crypto on an exchange, you’re at their mercy. They can freeze your funds. They can delay withdrawals. They can even shut down entirely - and you have no recourse. But if you hold your own private keys? No one can touch your crypto. Not a bank. Not a regulator. Not a hacker who breaches their server. Only you can move it. This isn’t just theory. In 2023, a user in the UK kept 12 BTC in a Trezor wallet. When his local bank froze his account for "suspicious activity," he didn’t lose access to his crypto. He didn’t need the bank’s permission. He just opened his wallet and sent the funds to another address. That’s financial sovereignty.The Real Danger: Human Error

The biggest threat to your crypto isn’t hackers. It’s you. A 2024 study by Chainalysis found that over 15% of all Bitcoin ever mined is permanently lost - mostly because people forgot their private keys or lost their recovery phrases. One man in Australia threw away a hard drive with 7,000 BTC on it. It was worth $450 million in 2025. He didn’t even realize what he’d thrown out. Here’s what most beginners get wrong:- Writing their recovery phrase on a sticky note and leaving it on their desk.

- Taking a photo of their seed phrase and saving it in their phone gallery.

- Using the same password for their wallet and their email.

- Not testing their backup by restoring it on a new device.

- Write your 12- or 24-word recovery phrase by hand on metal or fireproof paper. Never digital.

- Store copies in separate, secure locations - one at home, one with a trusted family member.

- Test your backup every year. Restore your wallet on a clean device to make sure it works.

What About New Tech Like MPC and Multi-Sig?

Some newer wallets use Multi-Party Computation (MPC) or multi-signature setups. These split your key into parts stored across different devices. For example, one part stays on your phone, another on your laptop, and a third on a hardware device. You need two out of three to sign a transaction. This reduces the risk of losing everything if one device fails. It’s great for businesses or people with high-value holdings. But it’s also more complex. For most users, a single hardware wallet with a properly backed-up recovery phrase is still the safest, simplest option.

Clarice Coelho Marlière Arruda

October 29, 2025 AT 22:36so i just lost my phone and i think my seed phrase was on the lock screen lol oops

Alisa Rosner

October 31, 2025 AT 21:25PLEASE PLEASE PLEASE write your recovery phrase on metal! 🛠️ Not paper. Not a photo. Not a note on your desk. I’ve seen so many people lose everything because they thought ‘I’ll remember it’ or ‘it’s fine where it is.’ You wouldn’t leave your house key under the mat. Why would you do it with your life savings? 💪

Olav Hans-Ols

November 1, 2025 AT 23:06Man I remember when I first got into crypto and thought ‘I’ll just keep it on Binance, it’s fine.’ Then FTX happened and I had a panic attack for a week. Bought a Ledger the next day. Best $100 I ever spent. Now I sleep like a baby. 🛌

Brian Collett

November 2, 2025 AT 19:52Wait so if I use MPC, does that mean I can’t lose my keys? Like I can just use my phone and laptop and if one dies I’m fine? That sounds too good to be true.

Allison Andrews

November 3, 2025 AT 08:21The philosophical implication here is profound: ownership is not a legal construct, but a cryptographic one. The state cannot seize what it cannot access. The bank cannot freeze what it never held. The only authority is the private key, and its existence is a silent assertion of individual sovereignty. This changes the nature of property itself.

Wayne Overton

November 4, 2025 AT 22:34you dont own crypto if you dont have the key

Lena Novikova

November 5, 2025 AT 07:02Everyone’s acting like hardware wallets are magic. Newsflash: they still connect to your computer. Malware can still intercept the transaction confirmation. You think Ledger is unhackable? Please. The real security is not having any crypto at all

Derajanique Mckinney

November 6, 2025 AT 02:25why do people even use crypto its just a scam anyway 🤡

MICHELLE SANTOYO

November 6, 2025 AT 03:40the real conspiracy? they want you to think you own your keys so you don’t demand regulation. Meanwhile the devs control the upgrades. You think you’re free? You’re just a user in a new system. Wake up

Kevin Johnston

November 7, 2025 AT 05:02DO IT TODAY. Seriously. 30 minutes. Your future self will hug you. 🙌

Dr. Monica Ellis-Blied

November 7, 2025 AT 16:22It is imperative, as a responsible participant in the digital economy, that individuals internalize the non-reversible nature of cryptographic ownership. Failure to implement redundant, physically secure, and geographically separated backup protocols constitutes gross negligence. I urge all readers to consult formal documentation from Ledger and Trezor immediately.

Herbert Ruiz

November 8, 2025 AT 00:09Why are you all acting like this is new? We’ve known this since 2013. People just don’t want to be responsible.

Saurav Deshpande

November 8, 2025 AT 09:29Private keys? That’s just the government’s way to track you. They already know your public address. Everything is monitored. Even hardware wallets are compromised. The real truth? They’ll shut down the whole network when they’re ready.

Paul Lyman

November 9, 2025 AT 07:41my recovery phrase is written on a metal plate i buried in my backyard with a gps tracker. also i gave a copy to my dog. he’s the only one i trust. 🐶

Frech Patz

November 10, 2025 AT 21:03Can you provide empirical data on the failure rate of software wallets versus hardware wallets in the last five years? The article makes assertions without citing peer-reviewed studies.

Sheetal Tolambe

November 12, 2025 AT 08:43I just started learning about crypto and this post helped me so much. I wrote my phrase on metal and kept one copy with my mom. I feel so much calmer now. Thank you for sharing this.

Rosanna Gulisano

November 13, 2025 AT 06:18if you dont own your keys you deserve to lose it

gurmukh bhambra

November 14, 2025 AT 08:55you think your ledger is safe? they’re made in china. everything is tracked. your keys are already in their hands. you’re just being played

Matt Zara

November 14, 2025 AT 20:01I used to think crypto was just gambling until I realized it’s the first time in my life I actually owned something without needing permission. My grandma doesn’t get it. She thinks I’m crazy for not keeping it in the bank. But when she saw me send money to my cousin in Nigeria in 10 minutes with $0.50 fee? She asked how to get her own wallet. That’s the real power here.

It’s not about getting rich. It’s about being free. And freedom isn’t free - it’s a habit. You have to practice it. Write it down. Store it safe. Test it. Don’t wait until it’s too late.

My first crypto was $20 worth of Dogecoin. I lost it. But I learned. Now I have 1 BTC in a Ledger. And I sleep better than I did when I had $20k in a brokerage account.

People say ‘crypto is volatile.’ Yeah. But so is inflation. So is banking fees. So is being locked out of your own money because some algorithm flagged your ‘suspicious activity.’

Own your keys. Not because it’s trendy. Because it’s your right.

Brian Collett

November 16, 2025 AT 03:27Wait so if I use MPC, does that mean I can’t lose my keys? Like I can just use my phone and laptop and if one dies I’m fine? That sounds too good to be true.

Matt Zara

November 16, 2025 AT 22:12Exactly. MPC doesn’t store the full key anywhere - it’s split. So if your phone dies, you still have the laptop and hardware device. You need 2 of 3. It’s like having three locks on a safe and needing two keys to open it. Much safer than one single phrase. But yeah, more setup. Worth it if you’re holding more than a few grand.