Stablecoin Risk Calculator

Assess Your Stablecoin Risk

Risk Assessment Results

USDT Risk Score

Example: In July 2025, Tether froze 42 Iranian-linked addresses, wiping out millions in value. USDT is vulnerable to sanctions targeting the issuing company.

DAI Risk Score

Key Insight from Article

Stablecoins like DAI are becoming preferred in sanctioned countries because they're less controlled by central authorities. However, no solution is perfectly safe—users should always maintain multiple wallets and avoid large single transactions.

When governments block access to banks, payment systems, and foreign currency, people find other ways to survive. In countries like Iran, Russia, North Korea, and Syria, that way is often cryptocurrency. Despite intense pressure from U.S. sanctions and global enforcement, citizens in these nations aren’t giving up on crypto-they’re getting smarter about how they use it.

Why crypto is the only option left

Imagine trying to pay for medicine, send money to family, or buy food online-and every bank account gets frozen. That’s the reality for millions in sanctioned countries. Traditional finance is cut off. PayPal, Stripe, and even Western Union are blocked. The only system that still works, no matter the borders or bans, is cryptocurrency. Bitcoin and Ethereum aren’t just speculative assets here. They’re lifelines. Bitcoin makes up 65% of all crypto transactions tied to sanctioned entities, according to OFAC data from 2025. Ethereum follows at 18%. And when volatility hits, people turn to stablecoins-especially DAI and USDT-to hold value without risking price swings. These aren’t investments. They’re savings accounts with no government oversight.How they bypass the blocks

Most people don’t sign up for Binance or Coinbase directly. Those platforms have strict KYC rules and block IP addresses from sanctioned countries. So users go around them. One common method? Using decentralized exchanges (DEXs) like Uniswap or PancakeSwap. No sign-up. No ID. Just connect a wallet and swap tokens. Many users start with a small amount of Bitcoin or ETH sent from a friend abroad, then trade it for DAI or USDT on a DEX. From there, they can use peer-to-peer platforms like LocalBitcoins or Paxful to cash out through trusted traders. Another tactic? Proxy networks and VPNs. But it’s not just about hiding your location. Many users rotate between multiple wallets and mixers to break the trail. Tornado Cash-style services saw five major enforcement actions in 2024 alone-but they’re still used. Why? Because the alternatives are worse.What happens when exchanges get shut down

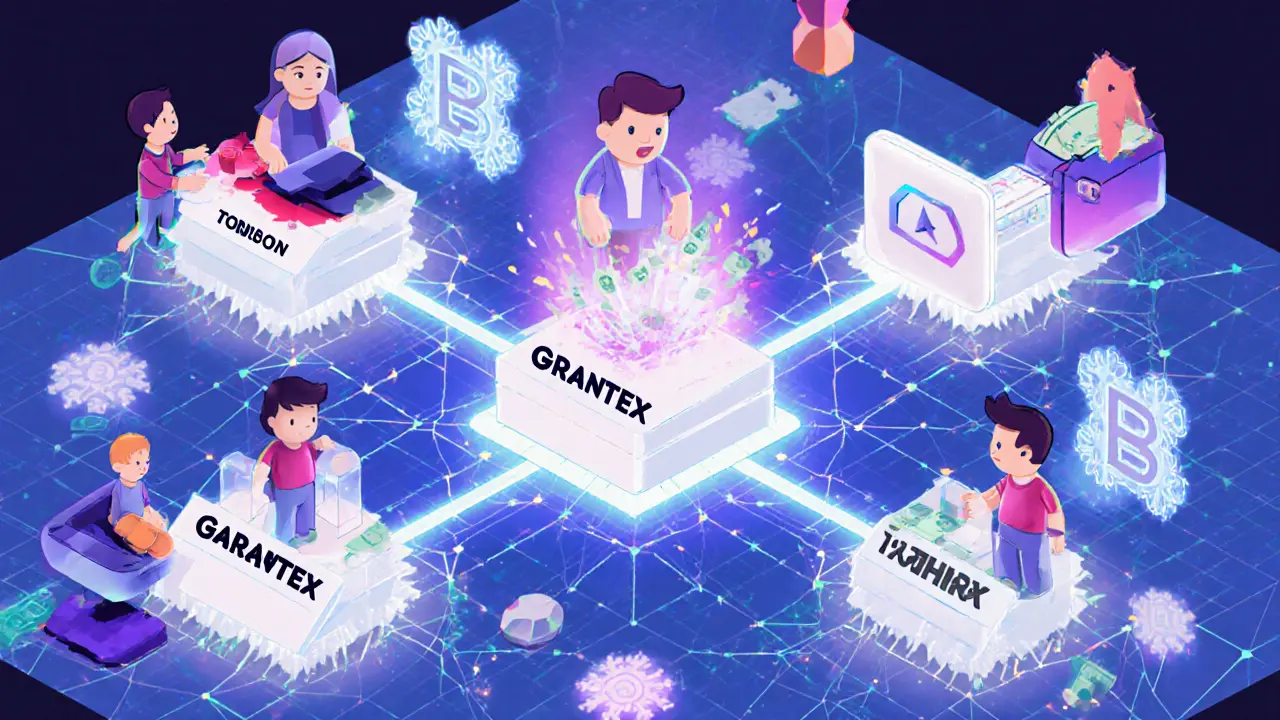

When a crypto exchange gets sanctioned, it doesn’t disappear. It evolves. Take Garantex, a Russian exchange that processed tens of millions in illicit funds. In March 2025, U.S. and European law enforcement seized its website and froze $26 million in crypto. Instead of shutting down, Garantex’s team moved operations to Grinex-a new platform with the same interface, same customer base, same wallets. They didn’t rebuild. They just rebranded. Even more telling? They partnered with Exved, a cross-border payment service that helps Russian businesses import dual-use goods. And MKAN Coin, a Telegram-based exchange run from Dubai, now acts as Garantex’s successor. Users don’t even notice the change. They just log in with the same credentials and keep trading. This isn’t an exception. It’s the rule. Every time OFAC cracks down, a new platform rises. The system is designed to be resilient.

The stablecoin shift: From USDT to DAI

Tether (USDT) used to be the go-to stablecoin in sanctioned countries. It’s liquid, widely accepted, and easy to move. But in July 2025, Tether froze 42 Iranian-linked addresses tied to Nobitex, one of Iran’s largest exchanges. The move wiped out millions in value overnight. The response was immediate. Iranian users didn’t panic. They adapted. Within days, crypto influencers and local groups pushed people to swap USDT for DAI on the Polygon network. DAI, issued by MakerDAO, is decentralized and harder to freeze. It’s not perfect-but it’s less controlled. This shift wasn’t random. It was strategic. And it worked. While crypto inflows to Iran dropped 11% in early 2025, activity didn’t stop. It just moved.How governments are fighting back

OFAC didn’t start targeting crypto until 2018. Now, 23% of all new sanctions in 2024 were crypto-related-up from 17% the year before. They’ve added over 1,200 crypto wallet addresses to their Specially Designated Nationals (SDN) List. They’ve frozen $150 million in a DeFi protocol for the first time. And they’ve teamed up with INTERPOL and Europol to track cross-border flows. But enforcement has limits. You can freeze a wallet. You can’t freeze a blockchain. You can shut down a website. You can’t shut down a peer-to-peer network. The $430 million in penalties handed to crypto firms in 2024 sounds huge. But it’s a drop in the ocean compared to the $6.9 billion in illicit crypto transactions linked to sanctioned entities over the past two years.

Why some countries are becoming crypto havens

Sanctioned citizens aren’t just using crypto-they’re moving through it. And they’re not doing it alone. Dubai’s VARA authority has become a magnet for crypto businesses. Over 1,000 firms operate there under a tax-free regime. No capital gains tax. No reporting requirements. Just a clear legal path for crypto trading. El Salvador made Bitcoin legal tender. Singapore has no crypto taxes and strong anti-money-laundering rules. Malta and Estonia offer favorable licensing. These aren’t just tax havens. They’re access points. A Russian user might send ETH to a friend in Dubai. That friend converts it to USD and wires it to a third country. The trail gets messy. And by the time authorities trace it, the money’s already spent.The new tax trap

Iran didn’t just react to crypto’s rise-it tried to control it. In August 2025, it passed a law taxing crypto profits at the same rate as gold, real estate, and forex speculation. The goal? To bring crypto into the state’s financial grip. But here’s the irony: the tax law didn’t stop trading. It just made people more careful. Now, Iranians use cash-based P2P trades or trade through intermediaries to avoid reporting. The tax didn’t kill crypto. It made it underground.What’s next?

This isn’t a battle between good and bad. It’s a battle between control and survival. Governments keep tightening rules. But citizens keep finding new ways. DeFi protocols, cross-border payment platforms, Telegram-based exchanges, and wallet rotation are now standard tools. Enforcement is getting smarter-but so are users. The real question isn’t whether people in sanctioned countries can access crypto. It’s whether the world is ready to accept that, for them, crypto isn’t a luxury. It’s a necessity.As long as banks are politicized and borders are weapons, crypto will remain the one system that doesn’t ask permission to work.

Can you still use Binance or Coinbase in sanctioned countries?

Most major exchanges like Binance and Coinbase block users from sanctioned countries through IP detection and KYC checks. While some users bypass these with VPNs and fake IDs, the risk of account freezes and legal consequences is high. Decentralized exchanges (DEXs) and peer-to-peer platforms are far more common and reliable for users in these regions.

Why do people in sanctioned countries prefer Bitcoin over other cryptos?

Bitcoin is the most liquid, widely recognized, and hardest-to-trace cryptocurrency. It’s accepted globally, has deep liquidity on most exchanges, and doesn’t require complex smart contracts. For people needing to move value across borders quickly and discreetly, Bitcoin remains the top choice-accounting for 65% of all sanctioned crypto transactions in 2025.

Are stablecoins like USDT and DAI safe to use?

USDT is convenient but risky-it’s issued by Tether, a centralized company that complies with U.S. sanctions. In 2025, Tether froze over 40 Iranian-linked addresses. DAI, on the other hand, is decentralized and governed by code, not a company. While not completely immune to pressure, DAI is much harder to freeze, making it the preferred stablecoin for users in sanctioned countries after mid-2025.

What happens if your crypto wallet gets sanctioned?

If a wallet is added to OFAC’s SDN List, any exchange or service that checks sanctions will block transactions to or from it. The funds aren’t stolen-they’re frozen. To recover access, users must create new wallets, move funds through mixers or DEXs, or convert assets into different tokens. Many use multiple wallets in rotation to avoid detection.

Can governments shut down cryptocurrency networks entirely?

No. Cryptocurrencies run on decentralized networks spread across thousands of computers worldwide. Even if a country bans crypto, users can still connect to the network via satellite, mesh networks, or Tor. The blockchain itself can’t be shut down-only access points like exchanges or apps can be blocked. That’s why crypto remains resilient even under the strictest sanctions.

Is using crypto in sanctioned countries illegal?

For citizens in sanctioned countries, using crypto is rarely illegal under their own laws-in fact, many governments tacitly allow it. But for users outside those countries, helping them access crypto may violate U.S. or EU sanctions. Exchanges that serve these users risk fines, like ShapeShift’s $750,000 penalty in 2025. The legal risk falls on service providers, not always on end users.

How do people in these countries get crypto in the first place?

Most start with crypto sent from friends or family abroad via P2P platforms. Others use crypto ATMs in neighboring countries, or buy small amounts from local traders using cash. Some mine Bitcoin using cheap electricity, especially in Russia and Iran. Once they have a small amount, they swap it for stablecoins on decentralized exchanges and build from there.

Are crypto mixers still effective despite crackdowns?

Yes, but they’ve evolved. Early mixers like Tornado Cash were centralized and easier to target. Now, users use chain-hopping-swapping BTC to ETH, then to Polygon, then to a privacy coin like Monero-before converting back. This multi-layered approach makes tracing nearly impossible, even for blockchain analysts. Mixers are less about one tool and more about a strategy.

Vanshika Bahiya

November 15, 2025 AT 06:44As someone who’s seen friends in India use crypto to send money home during banking freezes, I can say this is real life, not theory. People aren’t gambling-they’re surviving. I’ve helped my cousin in Mumbai swap USDT for DAI on PancakeSwap using a friend’s ETH from Canada. No KYC, no drama. Just a quiet transfer that kept her mom’s insulin payments going.

It’s not about ideology. It’s about dignity. When your government cuts off your access to the world, crypto isn’t a rebellion-it’s a rescue rope. And honestly? The fact that Tether froze Iranian wallets just proves why DAI is the future. Code over corporations.

I’ve seen people in Lagos and Jakarta do the same thing. This isn’t just sanctioned countries. It’s every place where finance became a weapon.

Stop calling it ‘bypassing sanctions.’ Call it ‘bypassing suffering.’

Albert Melkonian

November 16, 2025 AT 21:46While I appreciate the nuanced perspective presented here, I must emphasize the ethical and legal complexities surrounding the circumvention of internationally imposed financial sanctions. The proliferation of decentralized finance tools in sanctioned jurisdictions raises profound questions regarding global regulatory coherence, financial integrity, and the unintended consequences of enabling illicit financial flows.

Although the human need for economic resilience is undeniable, the normalization of tools like Tornado Cash and unregulated DEXs may inadvertently fund activities that undermine international security frameworks. A balance must be struck between humanitarian access and systemic accountability.

Moreover, the claim that blockchain networks are ‘unshuttable’ requires qualification-while the protocol itself is decentralized, the on-ramps and off-ramps remain vulnerable to coordinated enforcement. The real challenge lies not in shutting down Bitcoin, but in dismantling the infrastructure that facilitates its misuse.

Perhaps the more productive path forward is not reactive enforcement, but proactive inclusion-expanding access to global financial systems for marginalized populations before they are forced into illicit alternatives.

Kelly McSwiggan

November 17, 2025 AT 03:22Oh wow. A whole essay on how people are ‘just trying to survive’ while using crypto to buy drones and missile parts. Real touching.

Let me guess-the next article will be ‘How North Koreans Use Dogecoin to Feed Their Children’? Spoiler: They’re not. They’re using it to fund nuclear tests.

And don’t even get me started on ‘DAI is safer.’ Sure, it’s decentralized… until MakerDAO’s governance votes to freeze a wallet because the US Treasury called. You think code is immune to politics? Lol.

This isn’t survival. It’s a laundering playground disguised as a humanitarian aid app. And you people are the enablers.

Byron Kelleher

November 18, 2025 AT 07:45Man, I just read this whole thing and felt this weird mix of hope and rage.

On one hand, it’s beautiful that people are finding ways to keep their families alive when the system fails them. On the other, it’s heartbreaking that they have to. We’re talking about moms buying insulin, students paying for online classes, farmers selling crops-all through crypto because banks turned into bureaucrats with guns.

It’s not about breaking rules. It’s about rewriting them with your bare hands.

I don’t know if this is the future. But I know it’s the present. And we should be helping, not judging.

Cherbey Gift

November 19, 2025 AT 07:16Listen here, my dear cyber-savvy ancestors of the digital underground-this ain’t just crypto, this is the new diaspora, the new silk road, the new secret handshake between the starving and the savvy.

When your nation becomes a prison with Wi-Fi, your wallet becomes your passport. Your private key? Your soul’s last scream against the silence of global power.

They freeze your bank? You turn your phone into a temple. You swap BTC for DAI like it’s holy water. You route through Grinex like a ghost in the machine. You don’t fight the system-you become the system’s nightmare.

And let me tell you, the moment the state tries to tax your crypto? That’s when you know you’ve won. Because now they’re scared. Not of you. Of what you represent.

The blockchain doesn’t care about borders. It only cares about truth. And truth? Truth don’t need permission.

Anthony Forsythe

November 20, 2025 AT 20:16There is a metaphysical dimension to this phenomenon that cannot be ignored. The blockchain, in its purest form, is not merely a ledger-it is a covenant. A promise written in cryptographic hash that no king, no president, no central bank can unwrite.

When a mother in Tehran swaps her last Bitcoin for DAI to buy antibiotics for her child, she is not engaging in a financial transaction. She is performing a sacred act of defiance against the idolatry of state-controlled money.

And when Tether freezes her address? That is not a corporate decision. That is the collapse of a god. The god of centralized trust. The god of fiat. The god that demands obedience in exchange for survival.

But the blockchain? The blockchain remembers. The blockchain endures. The blockchain is eternal. And in that eternal ledger, every transaction-no matter how small-is a hymn.

We are not witnessing a technological shift. We are witnessing the birth of a new spiritual economy. And it is beautiful. And it is terrifying. And it is inevitable.

Kandice Dondona

November 22, 2025 AT 13:25THIS IS SO IMPORTANT 😭❤️

I just cried reading about DAI. Like, seriously. People are literally using code to stay alive. That’s wild. And beautiful. And kinda revolutionary.

Also, can we talk about how Garantex just renamed itself and kept going?? That’s like a video game boss that respawns with better gear. 🤯

Also also-why are we still acting like crypto is ‘risky’ when the real risk is starving or not being able to call your mom? 🤔

Y’all need to stop being scared and start being supportive. Crypto isn’t the problem. The system is.

❤️🙌 #CryptoIsLife

Becky Shea Cafouros

November 24, 2025 AT 02:44Interesting analysis, though the piece lacks sufficient citation for several of its claims-particularly the 65% Bitcoin transaction statistic. OFAC does not publicly release such granular data, and the 2025 figures referenced appear speculative.

Additionally, the assertion that DAI is ‘harder to freeze’ ignores the fact that MakerDAO’s governance can still be influenced by large stakeholders, and regulatory pressure on Ethereum L2s like Polygon could indirectly impact DAI liquidity.

While the human element is compelling, the technical assertions require more rigor before being treated as fact.

Drew Monrad

November 24, 2025 AT 03:48Oh, so now we’re romanticizing criminals? Let me get this straight-people in Iran are using crypto to buy medicine… and also to buy missile components. Which one are we celebrating again?

And don’t give me that ‘they’re just trying to survive’ nonsense. If you’re using crypto to bypass sanctions, you’re not a victim-you’re a participant.

Also, why is everyone acting like Tether is the villain? They’re a company. They have to comply with the law. Or do you think they should just let money flow to terrorist regimes?

And don’t even get me started on ‘Dubai is a haven.’ That’s a tax-free money laundering hub with palm trees.

This isn’t freedom. It’s chaos dressed up like a TED Talk.

Cody Leach

November 25, 2025 AT 19:41Yeah, this is exactly why I stopped using centralized exchanges. I used to send crypto to friends overseas. Now I just use DEXs. No KYC. No drama. No waiting.

And honestly? The fact that people are switching to DAI after USDT froze those wallets? That’s smart. That’s evolution.

It’s not about being anti-government. It’s about being pro-survival.

And if you think this is going to stop? You’re not paying attention.

sandeep honey

November 26, 2025 AT 22:17Bro, I’m from India and we do this too. My uncle in Delhi uses LocalBitcoins to get USD from his son in Canada. No bank, no fees, no waiting. Just QR code, cash, and trust.

And yeah, we all use VPNs. So what? If the government blocks WhatsApp, we use Telegram. If they block banks, we use crypto.

This isn’t illegal here. It’s just how things work now.

Stop acting like this is some hacker thing. It’s just… life.

Mandy Hunt

November 27, 2025 AT 13:33anthony silva

November 28, 2025 AT 01:03So let me get this straight-you’re impressed people are using VPNs and DEXs to avoid sanctions?

Congratulations. You found the internet.

Meanwhile, the real story is that governments are spending billions to stop this… and still losing.

Who’s the real winner here? The people. Or the regulators who keep chasing ghosts?

Either way, it’s not a revolution. It’s just… basic human ingenuity.

And you’re acting like it’s news.

David Cameron

November 28, 2025 AT 08:47There’s a quiet truth here: money was never meant to be controlled.

It was meant to move.

When governments turn currency into a weapon, they break the oldest social contract: that exchange should be free.

So people adapt.

They don’t rebel. They just… transact.

And the blockchain? It doesn’t judge.

It just records.

And maybe that’s the most revolutionary thing of all.

Sara Lindsey

November 29, 2025 AT 15:33I just want to say-this is the most real thing I’ve read all year.

I used to think crypto was for rich guys and degens.

Now I know it’s for moms in Syria buying diapers.

For students in Russia paying for online courses.

For farmers in Nigeria selling crops to people who can’t send dollars.

This isn’t speculation.

This is survival.

And if you’re not on their side, you’re not paying attention.

alex piner

November 30, 2025 AT 21:36bro i just wanna say thank you for writing this

i didnt even know half this stuff

but now i get it

its not about being cool or rich

its about not starving

and if crypto lets you do that

then its not evil

its just… human

❤️

Gavin Jones

December 1, 2025 AT 19:06While the humanitarian argument is compelling, we must not overlook the broader implications for global financial stability. The normalization of sanction evasion through decentralized finance erodes the credibility of international sanctions regimes, which are often critical tools for deterring aggression, proliferation, and human rights abuses.

It is not a matter of opposing survival-it is a matter of ensuring that survival does not come at the cost of global security.

Perhaps the solution lies not in criminalizing users, but in creating legitimate, transparent, and sanctioned pathways for humanitarian financial flows-through blockchain-based aid protocols, for example, audited and regulated by multilateral institutions.

Technology should serve justice, not circumvent it.

Anthony Forsythe

December 1, 2025 AT 22:30You speak of ‘humanitarian pathways’ as if they were ever truly accessible.

But when a child in Gaza needs insulin, and the World Bank takes three months to approve a transaction, and the IMF demands paperwork from a war-torn hospital-what then?

Does justice wait for bureaucracy?

Or does life move through code, faster than any committee can vote?

There is no ‘pathway’-only the silence of the system… and the whisper of a wallet.

And sometimes, whispering is the only prayer left.