International Transfer Cost Calculator

Compare Transfer Methods

Based on China's capital controls (max $50,000/year) and 2025 data showing 87% fee savings with USDT.

Estimated Savings

87% savings on feesWestern Union

Fee

$0.00

Time

2-3 days

USDT (Crypto)

Fee

$0.00

Time

15 minutes

Important Note: This calculator shows average fees based on article data. Actual fees may vary based on exchange rates and P2P negotiations. Crypto transfers bypass China's capital controls but carry risks of fraud and account freezes.

Security Reminder: 68% of Chinese crypto users report account freezes. Always verify counterparty identity and use escrow services. Never send large amounts in a single transaction.

China banned cryptocurrency in 2021. Trading, mining, exchanges - all illegal. Banks were told to cut off crypto-related transactions. Apps were pulled from app stores. The government pushed its own digital currency, the e-CNY, as the only legal digital money. Yet, crypto in China didn’t disappear. It went underground. And by 2025, an estimated 59 million Chinese people are still using it.

How Can Crypto Still Exist in China?

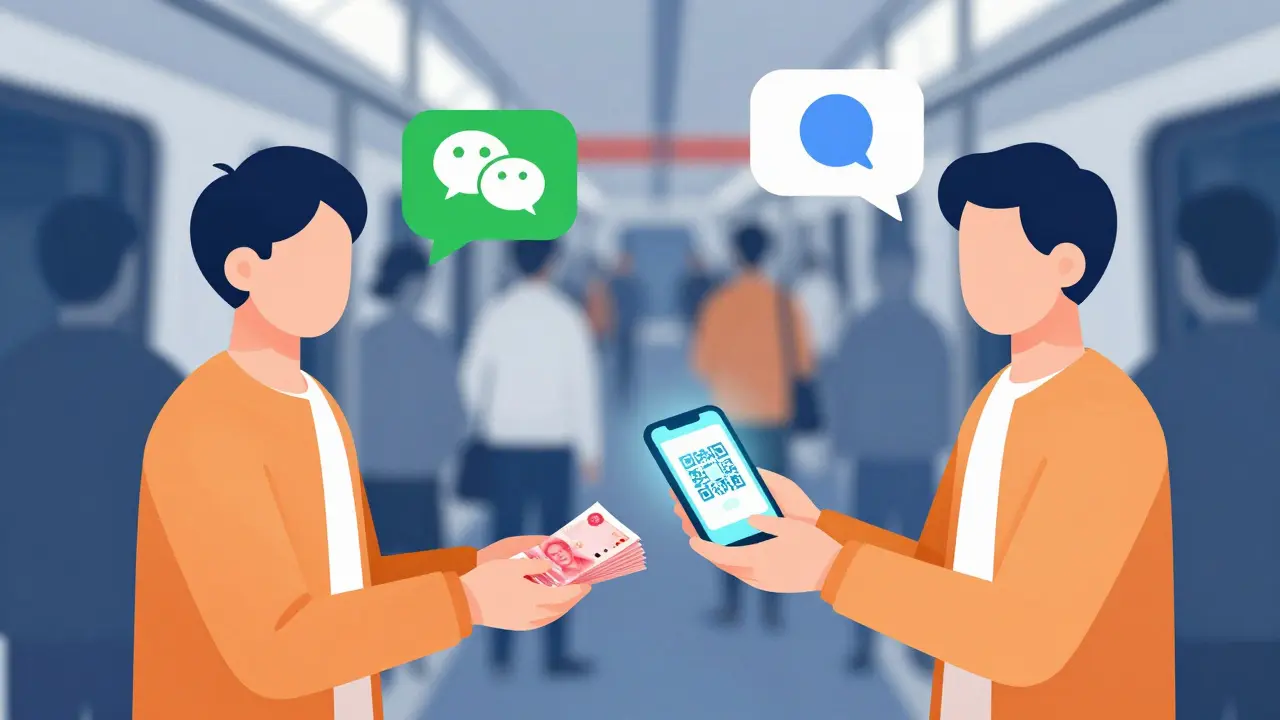

The answer isn’t loopholes. It’s adaptation. Chinese users didn’t stop because the government said so. They found ways around it - using tools and tactics most governments never expected. Most trade happens on offshore exchanges like Binance, Bybit, and OKX. These platforms don’t operate inside China, but millions of users access them anyway. How? Through virtual private networks (VPNs). A 2024 Chainalysis report found that 78% of Chinese crypto users rely on VPNs to bypass internet restrictions. It’s not just techies - it’s students, freelancers, small business owners, even factory workers with smartphones. Peer-to-peer (P2P) trading is the real backbone. About 63% of all crypto transactions in China happen directly between individuals. No exchange. No middleman. Just two people, often connected through WeChat or QQ groups. They use escrow services - a third party holds the money until both sides confirm the trade. Around 45% of P2P volume runs through these systems. One common method: someone sends yuan to a seller’s bank account, then the seller sends Bitcoin or USDT to their digital wallet. Both sides verify with screenshots, phone calls, even voice notes. Some users turn to privacy coins like Monero (XMR), which hide transaction details. Others use DeFi apps through modified browser extensions or custom Android apps like 'CryptoBridge' and 'Silk Road Wallet'. These apps don’t appear on official stores. They’re downloaded from third-party sites - and over 8.7 million times in the first half of 2025 alone.Why Do People Keep Using Crypto When It’s Illegal?

It’s not about speculation alone. For many, crypto is practical. Stablecoins like USDT are the most popular. Why? Because they let people send money overseas without going through banks. One user on a WeChat crypto forum said: "Sending USDT to my daughter in Australia saves me 87% in fees compared to Western Union. It takes 15 minutes, not three days." China has strict capital controls. You can’t easily move more than $50,000 abroad per year. Crypto bypasses that. For families with relatives overseas, students paying tuition, or freelancers getting paid in USD, crypto is the only reliable option. Others use it to hedge against inflation. While China’s official inflation is low, real costs - housing, education, healthcare - keep rising. Young people see Bitcoin and Ethereum as stores of value, not just gambling chips. A 2025 Peking University study showed that 37.5% of crypto users are between 25 and 34. That’s higher than the global average. Older generations? Only 12.8% use it. This is a youth-driven movement.The Government’s Double Game

Here’s the twist: while cracking down on crypto, China is quietly building its own digital currency system. The e-CNY, or digital yuan, has over 260 million individual wallets and 15.5 million corporate wallets. It’s used for public transport, utility bills, and even salary payments to civil servants in pilot cities. The People’s Bank of China (PBoC) says it’s about efficiency, financial inclusion, and control. But here’s the irony: the e-CNY is centralized. Every transaction is tracked. The government knows who paid whom, when, and how much. Crypto, by contrast, is anonymous - at least enough to slip past surveillance. The government doesn’t want private digital money. It wants digital money it can control. That’s why it bans Bitcoin but promotes the e-CNY. One is a tool for citizens. The other is a tool for the state.

Who’s Getting Caught - And Who’s Getting Away?

The crackdown is real. In July 2025, China’s State Administration of Foreign Exchange shut down 27 P2P platforms accused of enabling capital flight. Banks froze 1,287 accounts. Fines hit 237 million CNY ($32.6 million). But enforcement is uneven. Most targets are large operators - crypto ATMs, fake exchanges, organized groups running scams. Individual traders? Rarely pursued unless they’re moving millions. A Reddit survey from r/CryptoChina showed 68% of users had experienced account freezes due to crypto activity. The average loss? 23,500 CNY ($3,250). But 82% said they kept trading. Nearly half increased their investment in 2025 compared to 2024. Why? Because the risks feel manageable. Most users keep small amounts. They avoid big transfers. They use multiple wallets. They never link crypto activity to their real identity. And they know: if one account gets frozen, they just open another.The Hong Kong Factor

Hong Kong is the legal gateway. While mainland China bans crypto, Hong Kong allows licensed exchanges. As of June 2025, seven exchanges are approved, including HashKey and OSL. Together, they processed $14.3 billion in monthly trading volume in April 2025. Many mainland users use Hong Kong accounts. They send money through informal channels - cash deposits, third-party agents, or even underground money changers. Once the funds are in Hong Kong, they can trade legally. The border is porous. The rules are different. And for many, Hong Kong is the only safe place to trade crypto without fear of jail.

Jon Visotzky

December 6, 2025 AT 13:29Isha Kaur

December 8, 2025 AT 02:37Glenn Jones

December 10, 2025 AT 01:22Krista Hewes

December 10, 2025 AT 12:16Mairead Stiùbhart

December 12, 2025 AT 07:01Tara Marshall

December 13, 2025 AT 00:24Richard T

December 14, 2025 AT 19:31jonathan dunlow

December 16, 2025 AT 02:52Mariam Almatrook

December 16, 2025 AT 14:26rita linda

December 17, 2025 AT 15:29michael cuevas

December 18, 2025 AT 12:30Nina Meretoile

December 19, 2025 AT 08:39sonia sifflet

December 20, 2025 AT 06:45Elizabeth Miranda

December 21, 2025 AT 13:59Annette LeRoux

December 23, 2025 AT 08:59Madison Agado

December 23, 2025 AT 12:49Noriko Robinson

December 23, 2025 AT 20:45Roseline Stephen

December 24, 2025 AT 21:01jonathan dunlow

December 26, 2025 AT 06:22