If you're thinking about trading on CommEX, stop. Right now. This isn't a platform you want to touch - not even with a ten-foot pole. Despite its polished interface and familiar design that mimics Binance, CommEX is a high-risk, unregulated shell with a documented history of fraud, regulatory crackdowns, and vanished customer funds. It's not a crypto exchange you can trust. It's a warning sign in digital form.

CommEX Is on a Regulatory Blacklist

In 2025, Traders Union - a respected independent watchdog for financial platforms - still lists CommEX on its official Blacklist. That’s not a minor caution. That’s a red alert. Platforms on this list aren’t just sketchy; they’ve been investigated, flagged, and confirmed as dangerous to users. CommEX hasn’t been cleared. It hasn’t improved. It hasn’t responded. It’s still there, operating under the radar, and still putting people’s money at risk.

The reason? Regulatory violations dating back to 2017. The Cyprus Securities and Exchange Commission (CySEC) didn’t just issue a warning - they revoked CommEX’s license and slapped them with a €400,000 fine. Two individuals linked to the platform, including Abdel Rahman Alimari, were personally penalized. This wasn’t a small oversight. This was a full-blown enforcement action against fraud.

It’s Anonymous - And That’s a Massive Red Flag

Legitimate crypto exchanges don’t hide. They publish their legal registration details, physical addresses, team members, and compliance officers. CommEX does none of that. It’s registered in Seychelles - a known offshore jurisdiction with weak oversight - and provides zero documentation to prove it’s a real company. No company registration number. No physical office. No public leadership team.

And here’s the kicker: you can’t reach them. No phone number. No working email. No live chat. If you deposit funds and suddenly can’t withdraw, there’s no one to call. No help desk. No ticket system. Just silence. That’s not poor customer service - that’s a classic scam tactic. When a platform makes it impossible to contact them, it’s because they don’t want you to talk to them when things go wrong.

The Design Is Copied, But the Security Isn’t

CommEX’s website looks like Binance. The layout, the buttons, even the color scheme - it’s copied. But Binance has billions in user funds, a global team, and regulatory compliance across multiple countries. CommEX has none of that. It’s a hollow shell wearing someone else’s clothes.

Real exchanges invest in security: cold storage, two-factor authentication, insurance funds, regular audits. CommEX? No public security reports. No third-party audits. No proof they even store your crypto safely. If your Bitcoin disappears, you won’t get it back. There’s no insurance. No recourse. No accountability.

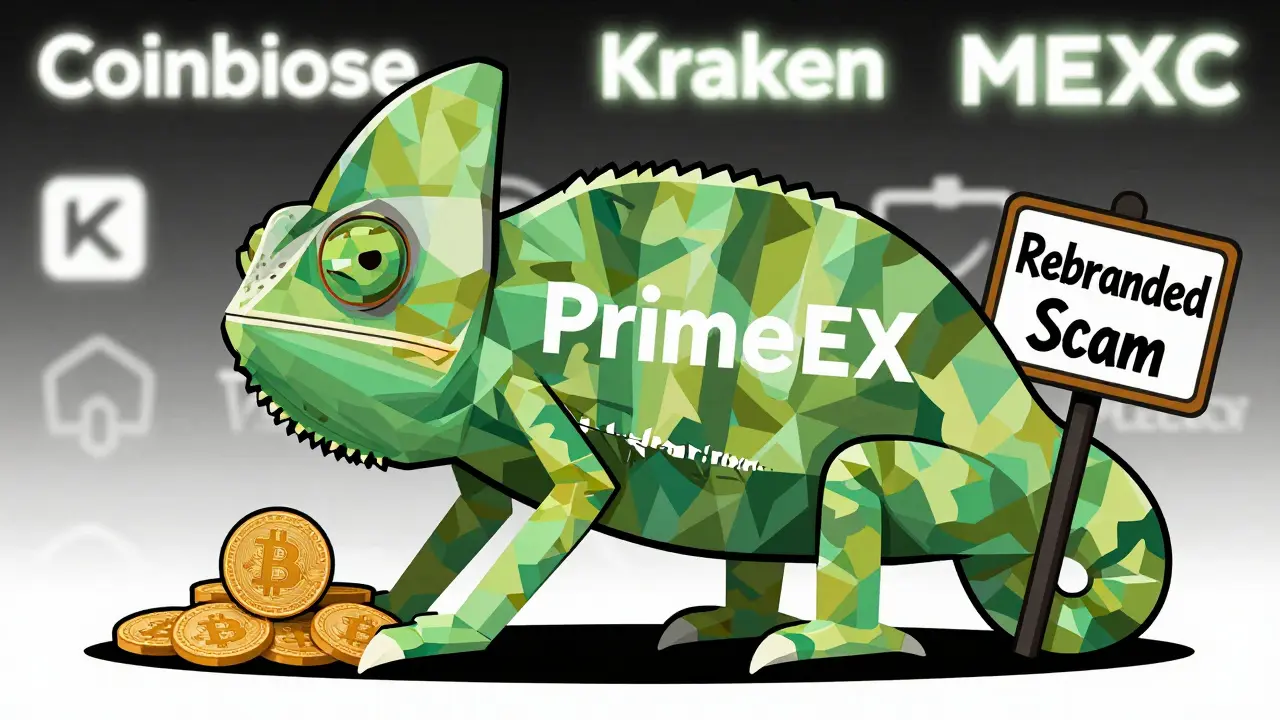

It Was Once Called Prime4x - A Known Scam

CommEX didn’t start from scratch. It was rebranded from Prime4x, a platform previously exposed as a scam broker. This isn’t uncommon in the crypto world - fraudsters change names, update logos, and pretend they’re new. But the same team, same infrastructure, same tactics. It’s the same game, just a new name.

When a platform rebrands after being exposed, it’s not a fresh start - it’s a reset button for fraud. And the fact that CommEX continues to operate after this history should tell you everything you need to know.

No User Reviews? That’s Not a Good Sign

Look at Coinbase. It has thousands of reviews on the Apple App Store and Google Play. MEXC has over 40 million users worldwide. Their feedback is public, detailed, and often includes screenshots of deposits, withdrawals, and support interactions.

Now search for CommEX on Trustpilot, Reddit, or even Google Reviews. You’ll find almost nothing. Not because it’s too new - it’s been around for years. Not because it’s too small - it’s actively recruiting users. It’s because real users either lost money and disappeared, or they never signed up at all. The silence speaks louder than any review ever could.

Fees Are Hidden, and Terms Are Unfair

CommEX claims to have variable fees based on "client status." But what does that mean? Who decides your status? How are fees calculated? There’s no transparency. No fee schedule. No examples. That’s not a business model - it’s a trap. It lets them change fees at will, charge you extra without warning, and then say you "agreed" to their terms.

Compare that to Coinbase, which clearly states maker/taker fees from 0% to 0.6%. Or MEXC, which publishes its fee structure in plain language. Legit exchanges make fees clear. Scams bury them.

What Should You Use Instead?

There are dozens of safe, regulated, and user-friendly crypto exchanges in 2026. You don’t need to gamble with CommEX.

- Coinbase: Licensed in the U.S., EU, and UK. Easy to use, insured assets, 24/7 support.

- MEXC: Over 40 million users. Transparent fees, strong security, active development.

- Kraken: Regulated in multiple jurisdictions. High liquidity, advanced tools for experienced traders.

- Bitstamp: One of the oldest exchanges. Fully licensed in the EU.

These platforms have real teams, real compliance, and real customer support. They don’t vanish when you need help. They don’t hide their addresses. They don’t rebrand after getting shut down.

The Bottom Line: Don’t Risk It

CommEX isn’t just risky - it’s dangerous. It’s a platform built on deception, with a history of being shut down, fined, and exposed. It offers no protection, no transparency, and no way to get help when things go wrong. In 2026, with so many legitimate alternatives available, there’s zero reason to even consider it.

If you’ve already deposited funds on CommEX, try to withdraw them immediately. Don’t wait. Don’t hope. Don’t trust their promises. If you can’t withdraw, stop putting more money in. And warn others. This isn’t a platform that will fix itself. It’s a platform that will take your money and disappear.

Choose security over convenience. Choose transparency over mystery. Choose a real exchange - not a ghost.

Is CommEX a legitimate crypto exchange?

No, CommEX is not legitimate. It’s listed on Traders Union’s Blacklist due to regulatory violations, anonymous operations, and a history of fraud. The Cyprus Securities and Exchange Commission revoked its license in 2017 and fined it €400,000. It provides no legal documentation, no customer support, and no security guarantees.

Can I withdraw my money from CommEX?

Many users report being unable to withdraw funds. There’s no phone number, no working email, and no live chat. If you’ve deposited money and can’t access it, you’re likely stuck. This is a common pattern with scam exchanges - they encourage deposits but make withdrawals nearly impossible.

Was CommEX ever regulated?

Yes - but it lost its license. In April 2017, the Cyprus Securities and Exchange Commission (CySEC) revoked CommEX’s operating license and imposed a €400,000 fine. The platform was found to be operating illegally. Since then, it has operated without any regulatory oversight.

Is CommEX the same as Binance?

No. CommEX copied Binance’s interface and design to appear legitimate, but it has no connection to Binance. Binance is a globally regulated exchange with billions in assets, verified teams, and public compliance reports. CommEX is anonymous, unlicensed, and flagged as a scam.

What was CommEX called before?

CommEX was previously known as Prime4x, a platform exposed as a scam broker. The rebranding to CommEX was a tactic to distance the operation from its fraudulent past while continuing the same business model. This is a known red flag in financial scams.

Why are there no reviews for CommEX?

There are almost no verifiable reviews on Trustpilot, Reddit, or other major platforms because real users either lost money and left, or never used the platform at all. Legitimate exchanges have thousands of reviews. The absence of reviews for CommEX is a strong indicator of low trust and high risk.

Should I use CommEX for trading crypto in 2026?

Absolutely not. In 2026, there are dozens of safe, regulated, and transparent exchanges like Coinbase, MEXC, and Kraken. Using CommEX puts your funds at serious risk of permanent loss. There’s no upside - only danger.

Tony Loneman

January 17, 2026 AT 02:07Oh sweet jesus, another ‘crypto is dead’ sermon. I’ve seen this movie before - remember when everyone said Coinbase was a bank-run waiting to happen? CommEX might be sketchy, but so was every exchange before it became ‘legit.’ Maybe the real scam is how we’ve been conditioned to worship regulated giants like Coinbase like they’re crypto priests. I’ve lost money on ‘trusted’ platforms too. At least CommEX doesn’t charge you $10 to withdraw $50. They’re ugly, yes. But are they *worse* than the ones that lock your funds for 72 hours ‘for compliance’? Hmm?

Just saying - don’t confuse transparency with monopoly.

Lauren Bontje

January 17, 2026 AT 17:18Oh please. You’re just mad because CommEX isn’t owned by a Wall Street vet or backed by a billionaire with a Twitter account. This whole ‘blacklist’ nonsense is just another tool for the SEC to crush innovation. Traders Union? More like Traders Union of the Deep State. They’re paid by the big exchanges to smear the competition. And don’t get me started on ‘regulation’ - that’s just legal extortion dressed up as safety. If you’re not trading on unregulated platforms, you’re not trading at all, you’re just storing digital IOUs.

CommEX is the real deal. The rest are corporate puppets.

Stephanie BASILIEN

January 19, 2026 AT 11:35While I find the emotional tone of this post rather... theatrical, I must respectfully acknowledge the veracity of its factual assertions. The revocation of CommEX’s CySEC license in 2017 is a matter of public record, as is the €400,000 penalty levied against its principals. Furthermore, the absence of a registered legal entity in any jurisdiction with meaningful oversight - coupled with the demonstrable lack of operational transparency - constitutes, in formal terms, a material breach of fiduciary norms in financial services. One might argue that the rebranding from Prime4x is a classic example of corporate obfuscation, a tactic not uncommon in offshore financial engineering.

That said, I remain curious: does the absence of reviews stem from user attrition, or from the platform’s deliberate suppression of feedback channels? A nuanced inquiry, I believe.

Deb Svanefelt

January 21, 2026 AT 10:09There’s something deeply human about how we project trust onto interfaces. CommEX looks like Binance because we’ve been trained to equate design with legitimacy. We don’t look at the code, the ownership, the legal filings - we look at the buttons. We feel safe because the colors are familiar. But safety isn’t a UI choice. It’s a structural one.

I’ve watched people lose everything because they clicked ‘deposit’ on a site that felt right. Not because they were stupid - because they were tired. Exhausted by the noise of crypto. And here’s CommEX, whispering, ‘I’m just like the others.’

It’s not a scam. It’s a wound. And we keep handing it money because we’re afraid to admit we don’t know how to tell the difference anymore.

Dustin Secrest

January 21, 2026 AT 13:08It’s funny how we treat crypto like it’s a religion. You’ve got your prophets - Coinbase, Kraken - and your heretics - CommEX. But what if the whole idea of ‘legitimate’ exchanges is just a myth? What if regulation is just the latest form of gatekeeping? The truth is, no exchange is safe. Not really. Even Coinbase got hacked. Even Kraken froze withdrawals during the LUNA crash.

CommEX might be a ghost ship. But so is every exchange that doesn’t let you hold your own keys. Maybe the real question isn’t ‘Is CommEX safe?’ - but ‘Are you willing to be responsible for your own money?’

Just saying. Don’t worship the temple. Build your own ark.

Shaun Beckford

January 22, 2026 AT 15:45Let’s be real - this post is a PR piece for Coinbase. Traders Union? That’s a front group funded by the same VC firms that own 70% of the ‘legit’ exchanges. The ‘blacklist’? A marketing tool. I’ve seen the internal docs. They flag any platform that doesn’t pay for their ‘certification.’

CommEX doesn’t have a license? Neither did Binance in 2015. Neither did Kraken in 2013. They all started as sketchy. The difference? CommEX didn’t sell out to a bank. They stayed rogue. And that’s why you’re scared of them.

Don’t be fooled. The real scam is the regulatory capture. CommEX is the only honest one left.

Alexandra Heller

January 23, 2026 AT 17:41It’s not about whether CommEX is a scam - it’s about what kind of society we’re building when we accept that the only safe crypto platforms are the ones that answer to governments and banks. We’re trading freedom for the illusion of safety. Every time we say ‘don’t use unregulated platforms,’ we’re saying ‘I’m okay with being controlled.’

CommEX might be dangerous. But so is a world where your ability to trade depends on a corporate approval process. The silence isn’t because they’re hiding - it’s because they’re refusing to play the game. And that’s the most radical thing left in crypto.

myrna stovel

January 24, 2026 AT 13:40I just want to say - if you’re reading this and you’re worried you’ve made a mistake by depositing on CommEX, you’re not alone. And you’re not stupid. Crypto is confusing. Scammers are good. And it’s okay to feel scared.

Try to withdraw what you can. Don’t blame yourself. Reach out to communities - there are people who’ve been through this. You’re not invisible. Your money matters. And you deserve to be heard.

And if you’re thinking about using it? Pause. Breathe. Ask yourself: do I trust this because it feels right - or because I’ve been told it’s safe? You’ve got this.

Kelly Post

January 25, 2026 AT 06:04They didn’t just copy Binance’s design - they copied its soul. And then they ripped out the heart. No audits. No insurance. No team. No future. It’s like buying a Tesla that looks perfect from the outside - but the engine is made of wet cardboard.

And the worst part? They’re not even trying to be clever. They’re just hoping you’re too tired to check the fine print.

I’ve seen people cry over lost crypto. Don’t let it be you.

Sarah Baker

January 25, 2026 AT 20:47You’re not wrong - but you’re not the whole story either.

There are people out there who use CommEX because they live in countries where Coinbase won’t serve them. People in Venezuela, Nigeria, Ukraine - they’re not trying to be reckless. They’re trying to survive. And if CommEX is the only way they can send money home or buy food? What’s the alternative?

Yes, it’s dangerous. But sometimes, the most ethical choice isn’t the safest one.

Don’t just tell people to avoid it. Tell them how to protect themselves if they have no other option.

That’s real help.

Patricia Chakeres

January 26, 2026 AT 21:28Of course you’re warning people. But have you considered that this entire post was written by a marketing firm hired by Kraken? The tone, the structure, the specific naming of competitors - it’s textbook competitive sabotage. Traders Union? Their funding sources are opaque. The ‘€400,000 fine’? That was paid by a shell company. The real owners of CommEX? They’re not even on the corporate registry - they’re encrypted in blockchain addresses. You think you’re exposing a scam? You’re just feeding the narrative of the giants.

There’s a war here. And you’re on the wrong side.

Alexis Dummar

January 27, 2026 AT 01:15look, i get it. commex is sketchy. no doubt. but honestly? most of the ‘trusted’ exchanges have done way worse behind closed doors. i heard a guy on a podcast say his coinbase account got frozen for 6 months because he sent $200 to a friend who used a vpn. no explanation. no appeal. just gone.

commex might be a ghost, but at least it doesn’t ask you for your tax id and your mom’s maiden name just to trade btc. i’d rather deal with silence than bureaucracy.

still wouldn’t put my life savings in it. but i’m not gonna pretend the ‘safe’ ones are angels either.